State pension disaster as retirees fall £5,000 short of 'minimum income standard' despite triple lock hike

The state pension will rise in April but will it be enough?

|PA/GETTY

The triple lock guarantees the state pension will rise every year but doubts have been raised about whether payments are enough for pensioners

Don't Miss

Most Read

Latest

Retirees who are reliant on the state pension have been dealt a devastating blow as their payments are expected to fall short of the "minimum income standard" despite the pending triple lock hike.

Research from the Joseph Rowntree Foundation (JRF) claims that a single pensioner will need to have an income of £17,200 in order to pay for the most basic needs in society.

As it stands, the full new state pension is sitting at £11,502 annually but this is guaranteed to be raised thanks to the Government's triple lock promise.

Under this pledge, payments are increased by either the rate of inflation, average earnings or 2.5 per cent; whichever is higher.

Tomorrow (September 10), the Government will announce how much state pensions will go up.

It is understood that leaked Treasury documents show payments will be hiked by £400 a year for those who receive the full, new amount.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The think tank's research revealed how much pensioners need to have to live

| PADespite this boost, state pensioners heavily reliant on the retirement benefit are going to have to contend with a shortfall of potentially thousands of pounds.

If the triple lock £400 rise is implemented, the full new state pension will exceed £12,000 which is around £5,000 short of the "minimum income standard".

Furthermore, JRF claims couple pensioners would need £27,800, or £13,900 each, for a "socially acceptable standard of living".

A separate analysis from financial services firm Just Group suggests that retirees will need a private pension worth £78,600 to plug the gap between the current "full" state pension and the minimum income standard.

This would need to be achieved by the time they reach the current state pension age of 66.

Furthermore, it would be enough to purchase an annuity guaranteed to be worth £5,689 annually until they pass away.

The Foundation's "minimum income standard" is calculated to determine how much cash Britons require to "meet material needs like food, clothes and shelter without struggle".

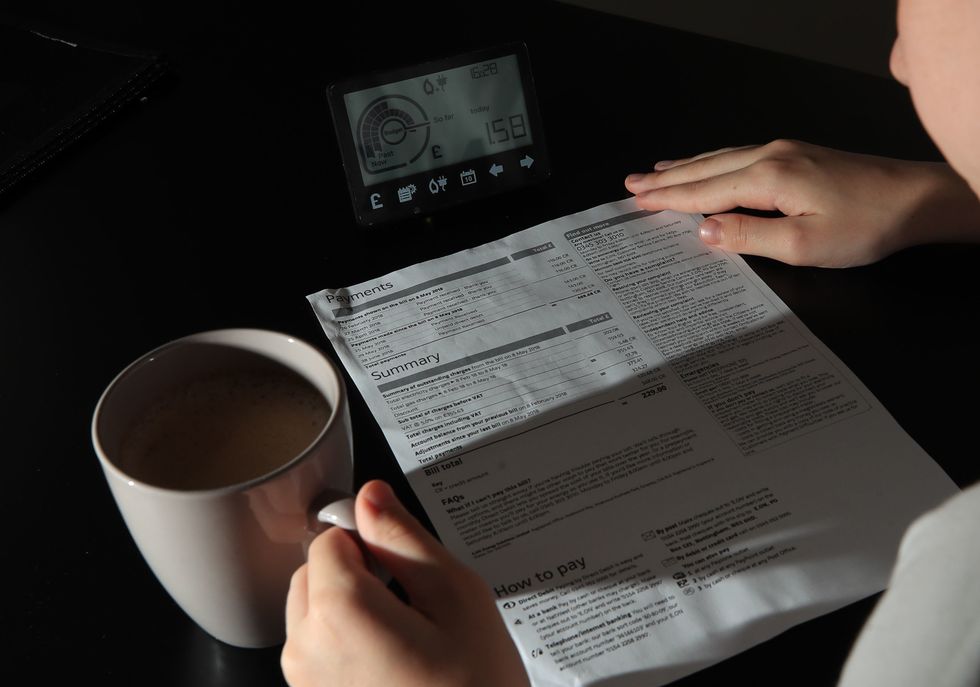

Many pensioners are already expected to be hit hard by the cost of living this winter following Labour's decision to means-test energy bill support.

Last month, Chancellor Rachel Reeves confirmed eligibility for the Winter Fuel Payment, which is worth up to £300, will be linked to Pension Credit.

Speaking to The Telegraph, Just Group's Stephen Lowe described the "minimum income standard" as being essential for pensioners who want a life of "dignity".

LATEST DEVELOPMENTS:

Pensioners are finding themselves with not enough saved for retirement | GETTY

Pensioners are finding themselves with not enough saved for retirement | GETTY He explained: "Even assuming pensioners are receiving the full state pension – which we know many are not – they will still need to find thousands of pounds a year of extra income to bridge the gap.

"It demonstrates the importance of building up additional sources of income throughout a working career, whether that is through the pension system, using property as a reservoir of wealth or accumulating additional savings and investments."

GB News has contacted the Treasury for comment.