State pension tax allowance proposal REJECTED by Treasury: ‘Untargeted and costly’

Government says proposal would benefit wealthier retirees as petitions over frozen thresholds grow

Don't Miss

Most Read

Latest

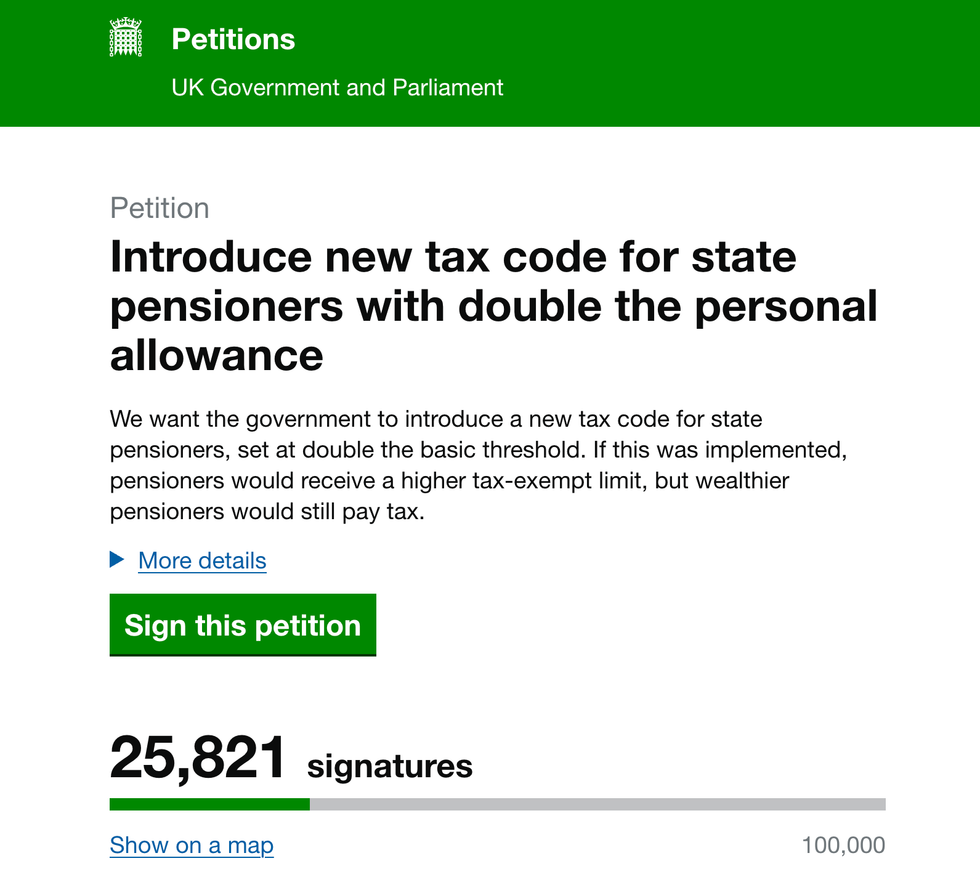

The Treasury has rejected a parliamentary petition signed by 25,000 people calling for pensioners to receive a doubled personal tax allowance.

This proposal sought to create a dedicated tax code for state pensioners but was dismissed by the Government as "untargeted and costly".

Chancellor Rachel Reeves has not offered any new measures that would shield low-income retirees from entering the tax system in the coming years.

In a written response published on September 1, the Treasury said: "The Government is committed to a fair tax system but doubling the personal allowance for pensioners would be untargeted and costly".

TRENDING

Stories

Videos

Your Say

The department said the proposal would provide the largest benefit to higher-income pensioners rather than supporting those on the lowest incomes. The controversy centres on the Chancellor’s decision last month to extend the freeze on the £12,570 income tax threshold until 2031.

Because of this freeze, recipients of the full new state pension will become taxable from 2027 as the triple lock increases their income above the threshold. The triple lock raises the state pension each year by the highest of inflation, average earnings growth or 2.5 per cent.

Next April, this will increase the full new state pension from £230.25 to £241.30 weekly, which is equivalent to £12,548 annually.

This figure remains slightly below the current personal allowance, but continued rises under the triple lock are expected to push pensioners into the tax system.

Treasury rejects petition signed by 25,000 seeking doubled personal tax allowance for pensioners

|GETTY

Fiscal drag has kept the basic rate threshold unchanged since 2021, placing more low earners into the tax net each year. The petition was submitted by Timothy Hugh Mason and calls for a tax code that would set the personal allowance for state pensioners at twice the standard threshold.

Supporters argue that such a system would give the greatest relief to retirees with modest pension income while ensuring wealthier pensioners with additional earnings continue to contribute tax.

The petition says: "We think that people with small private or workplace pensions are currently being taxed unfairly."

Mr Mason’s campaign argues that people receiving modest top-ups from private or workplace pensions are facing a tax burden that does not reflect their financial position. The petition says that doubling the allowance would protect vulnerable pensioners while maintaining fairness for those with higher levels of income.

LATEST DEVELOPMENTS

Treasury defended stance citing Government’s triple lock commitment calling it one of the most generous State Pension uprating mechanisms globally

| GETTYThe Treasury defended its position by pointing to the Government’s commitment to the triple lock, which it described as "one of the most generous state pension uprating mechanisms in the world".

The triple lock will provide a 4.8 per cent increase to both the basic and new state pension from April 2026, raising annual income by up to £575.

The Treasury also said that the UK’s personal allowance remains the highest among G7 nations.

Addressing administrative concerns, the Government said it will simplify the process for pensioners receiving only the basic or new state pension without increments.

From 2027-28, these individuals will no longer be required to pay small tax amounts via Simple Assessment if their pension exceeds the personal allowance.

Further guidance on the implementation of this measure will be issued next year.

The Government continues to face pressure over frozen tax thresholds as households seek relief from rising living costs.

A separate petition earlier this year calling for the income tax threshold to increase to £20,000 received 281,792 signatures before closing in the summer.

The petition was met with a response, but not the one participants were hoping for

|Government petitions

That petition led to a Parliamentary debate in which the Treasury estimated the cost of raising the threshold to £20,000 at £50billion.

Another petition launched by Shannon Keene has passed 10,000 signatures and also calls for the tax-free threshold to rise from £12,570 to £20,000.

Ms Keene’s petition says families are struggling with rising rent, mortgage payments, council tax and energy bills.

Her campaign argues that current earnings levels do not sufficiently support average households and that raising the personal allowance would help more people enter and remain in employment.

The petition can be accessed here.

More From GB News