State pension WIN for millions after payment 'reform' but retirees still 'have been underpaid'

Good Morning Britain guests clash in debate on pensioner support |

GB NEWS

Concerns have been raised about the state pension gender disparity between men and women

Don't Miss

Most Read

Latest

Millions of state pensioners have been handed a win after recent payment "reform" but many retirees still have been "underpaid", according to recent analysis.

Fresh figures reveal the state pension gender disparity has dramatically decreased to merely £1.80 weekly amongst those who've begun claiming recently.

Finance specialists indicate this narrowing differential demonstrates meaningful progress towards establishing equitable retirement provisions.

The reformed system, which took effect for individuals reaching retirement age following April 6, 2016, addressed historical disadvantages that frequently left women with reduced entitlements.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

The state pension gender gap has narrowed, according to recent research

| GETTYPreviously, employment interruptions and caregiving duties significantly impacted women's pension accumulation.

Data obtained through a Freedom of Information (FoI) request by former Liberal Democrat pensions minister Sir Steve Webb reveals newly retired males currently receive £209.95 weekly whilst females obtain £208.15.

Webb, presently a partner at consultancy firm LCP, expressed satisfaction with these findings.

"I am delighted to see that when it comes to the state pension, the battle against the gender pension gap is nearly won for those retiring today," he stated.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

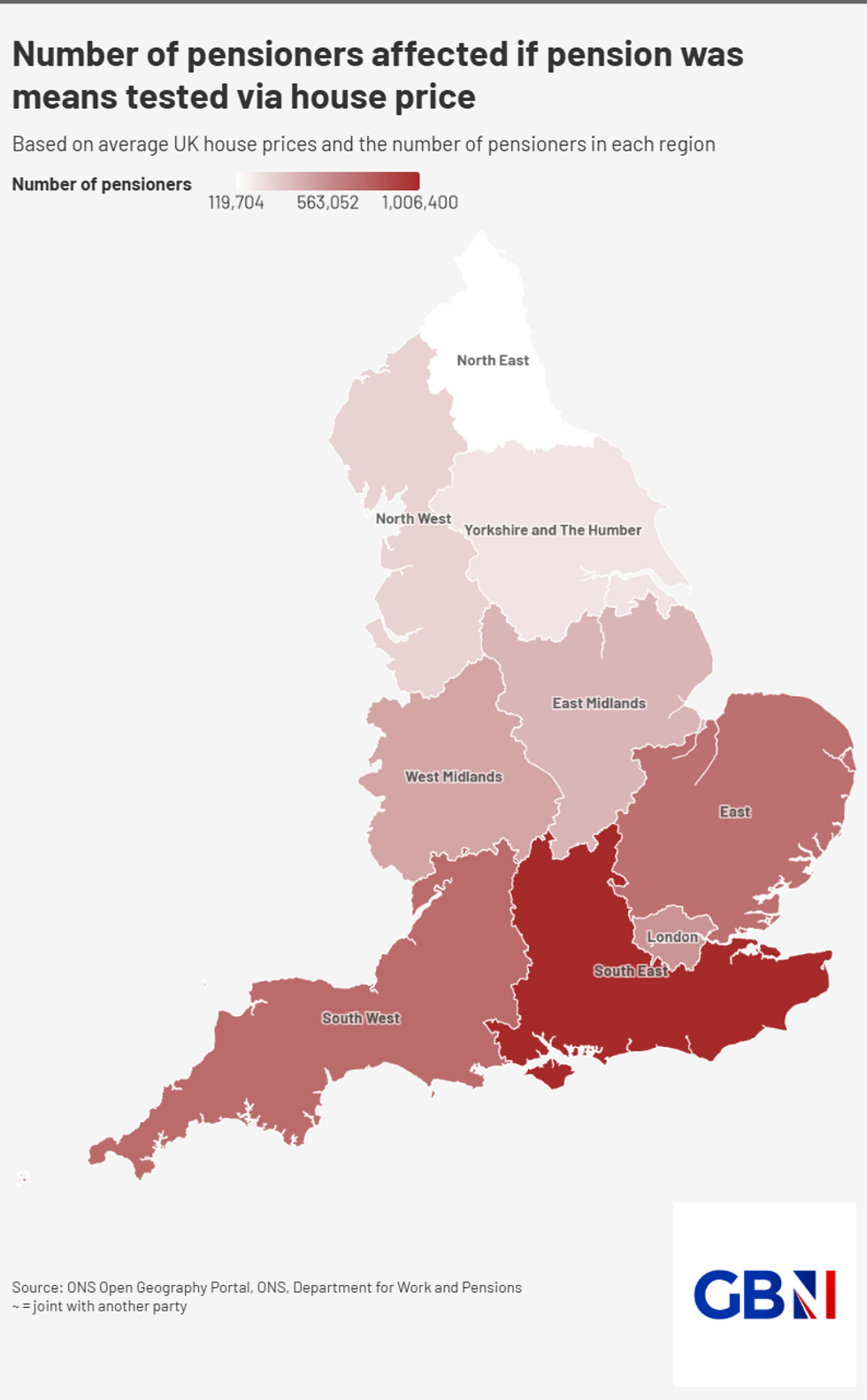

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBN"When there is so much negative news about gaps between men and women when it comes to pensions, these figures show that things can be changed, provided that there is the political will to do so."

Despite these improvements, significant disparities persist for females who entered retirement prior to the 2016 overhaul.

Webb emphasised his commitment to advocating for equitable treatment of this demographic, particularly addressing administrative mistakes resulting in prolonged underpayments.

"There are, however, far too many women who have already retired who are living on reduced pensions, and I will continue to campaign for them to be treated fairly, including by rooting out all of the errors which have led to so many being underpaid for so long," he explained.

Helen Morrissey from Hargreaves Lansdown stressed that comprehensive changes remain necessary.

"We need wider reform to address the reasons why women have to leave the workplace or have gaps in their pension saving by making sure they are able to access good quality and affordable childcare as well as more flexibility in the workplace," she noted.

LATEST DEVELOPMENTS:

Older Britons are worried about the future of the state pension triple lock | PA

Older Britons are worried about the future of the state pension triple lock | PARecently, questions have been raised about the triple lock's long-term viability continue to intensify as expenditure surpasses initial projections.

Under this payment uprate mechanism, state pensions rise every year in line by either the highest of inflation, average wages of 2.5 per cent.

Claire Trott from St. James's Place acknowledged the mechanism's fiscal burden has grown beyond anticipated levels.

"The long-term affordability of the Triple Lock has been questioned for some time and understandably so," Trott stated. "With people living longer and the Triple Lock delivering higher increases more frequently than originally anticipated, the cost has exceeded expectations and is only set to rise further."

More From GB News