State pensioners can get freebies and discounts worth over £7,000 this August

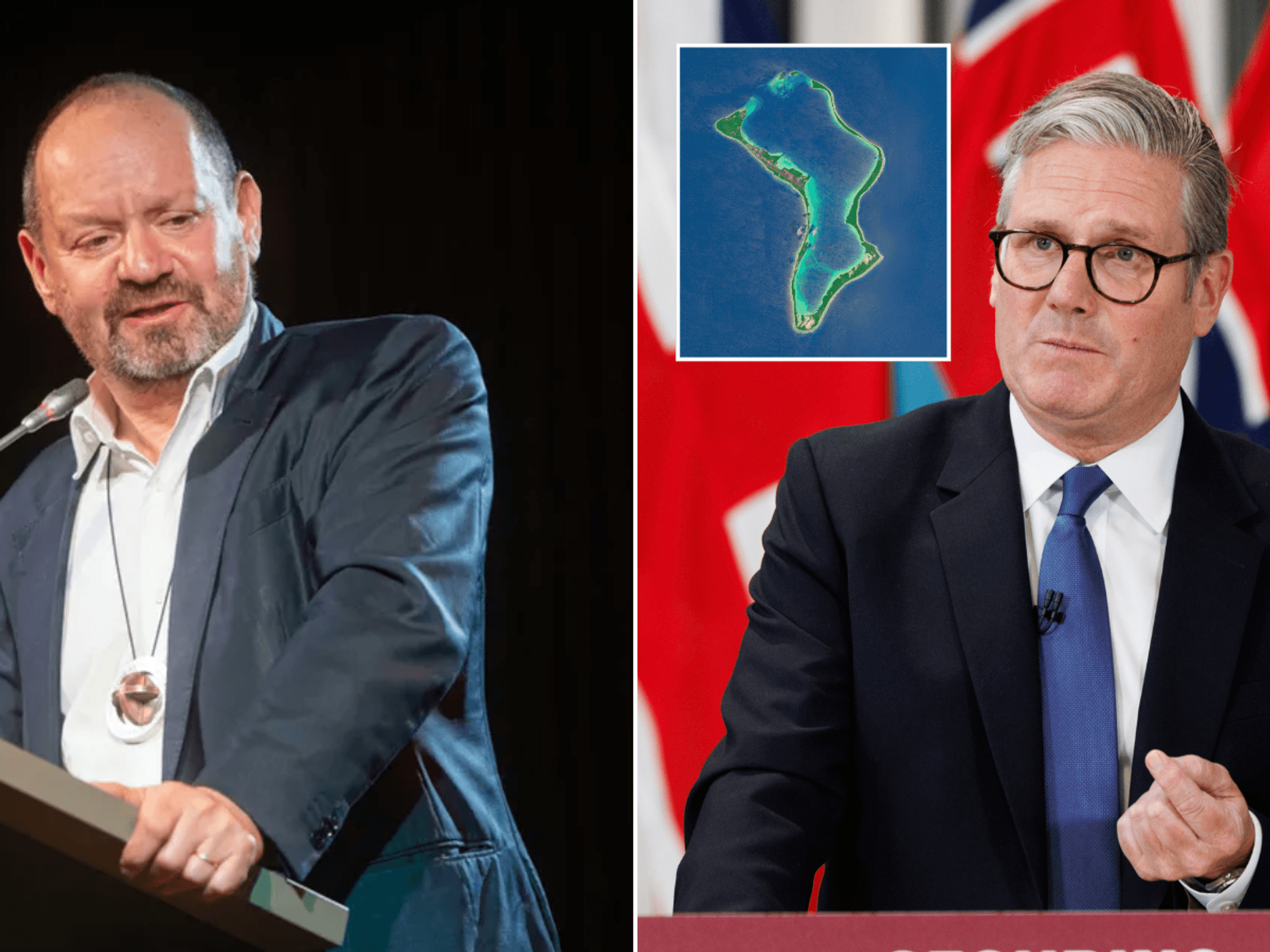

Keir Starmer quizzed by Christopher Hope on whether pensioners will receive an apology for his winter fuel allowance cuts. |

GBNEWS

Many retirees are missing out on big savings in unclaimed help with everyday costs

Don't Miss

Most Read

Latest

UK state pensioners could access benefits and discounts worth over £7,000 a year, according to support available through Government schemes and concessions this August.

This total includes a mix of direct financial help and everyday savings aimed at those who have reached retirement age.

The range of support spans income top-ups, healthcare exemptions, free travel, tax relief, and savings on household bills. Yet many pensioners remain unaware of just how much help they could be entitled to.

These benefits include long-established support programmes and lesser-known discounts that could significantly ease the pressure on household budgets.

Pension Credit – Worth up to £3,900 a year

The most valuable support comes from Pension Credit, a means-tested benefit available to pensioners on low incomes. According to the Department for Work and Pensions, average recipients receive around £3,900 per year.

Pension Credit is separate from the state pension and must be applied for independently. It includes two parts, Guarantee Credit and Savings Credit. Both parts come with different eligibility rules. It can boost weekly income from £218.15 to as much as £332.95.

Partners of those receiving Pension Credit may also qualify for linked support. Despite its value, many eligible pensioners have yet to claim, missing out on thousands of pounds each year.

Pension Credit can be claimed by phone, online or by post | ALAMY

Pension Credit can be claimed by phone, online or by post | ALAMYFree NHS Prescriptions - Save up to £115 per year

Everyone aged 60 and over qualifies for free prescriptions across the UK. This can save up to £115 a year for those who regularly need medication.

Free NHS Sight Tests - Worth £25 per test

Pensioners aged 60 and over are entitled to free NHS eye tests. Patients simply need to inform the optician of their age when booking.

Free NHS Dental Care - Save at least £26.50

Pensioners who receive Pension Credit qualify for free dental check-ups and other NHS treatments. A standard exam costs £26.50, with further savings possible for those needing additional care

Travel Discounts on Bus

Free bus travel across the UK is available to those who have reached state pension age, offering significant savings for regular users.

In London, residents aged 60 and over enjoy free travel on buses, tubes and other transport within the capital through TfL. Welsh residents can also access free bus passes from age 60.

A comprehensive package of benefits and discounts worth thousands of pounds is available alongside the state pension

| GETTYNational Insurance Exemption - Save up to £1,851 per year

Employees and self-employed individuals stop paying National Insurance once they reach state pension age. This automatically saves up to £1,851 per year depending on income level.

Free TV Licence (Over-75s on Pension Credit) - Save £174.50

Pensioners aged 75 and over who receive Pension Credit are eligible for a free TV licence. The licence covers all residents in the household.

Attendance Allowance - Save up to £434 a month

Attendance Allowance for pensioners in the UK can be either £3,842.80 or £5,740.80 per year, depending on the level of care needed. The higher rate is £110.40 per week, and the lower rate is £73.90 per week. Those with severe disabilities that require regular assistance day and night could claim the higher amount. There are a total of 56 categories of conditions which could make someone eligible.

Council Tax Discounts - Save up to £2,171

Housing support offers substantial financial relief for pensioners. Pensioners may be eligible for a council tax reduction by up to 100 percent. For households in certain council tax bands, this could mean an annual saving of up to £2,280.

Applications for a council tax reduction must be made through the local council, which can be accessed via the Government’s website.

Many retirees are missing out on big savings in unclaimed help with everyday costs

| GETTYThe Senior Railcard - £96

This provides additional travel savings for those aged 60 and over, offering one-third off train fares throughout Great Britain. Rail users save an average of £96 annually with the card, which costs £30 for one year or £70 for three years. Most cardholders recover the cost within just three journeys, according to railcard providers.

Discounted Broadband - Save up to £142.92 per year

Pension Credit recipients can access social broadband tariffs from £14.99 a month, compared to standard rates of around £26.90. This equates to an annual saving of approximately £142.92.

Leisure and Travel Discounts - Varies by activity

Pensioners benefit from discounted entry at National Trust and English Heritage sites, cheaper cinema and museum tickets during off-peak hours, and 10 per cent off Interrail passes for European rail travel.

These concessions help support an active social life on a limited budget.

More From GB News