State pension 'means testing could be introduced' as DWP payment's future in doubt

Economist Neil Record questions Reform UK’s plans to overhaul council pension funds. |

GB NEWS

The OBR has warned the state pension is becoming a growing expense for the Government

Don't Miss

Most Read

State pension payments should be "structurally means-tested" to ensure the retirement system remains economically viable long-term, analysts warn.

Economists are sounding the alarm that the benefit is becoming a growing expense for the taxpayer with the Office for Budget Responsibility (OBR) claiming the triple lock is pushing the cost of the state pension up by £10billion more than initially projected.

Multiple reforms have been proposed to bring down the retirement benefit's cost, including raising the state pension age sooner than expected and overhauling the triple lock.

Under the triple lock, state pension payments rise by either the rate of inflation, average wage growth or 2.5 per cent; whichever is highest.

Analysts are suggesting the state pension should be 'structurally means tested'

|GETTY

Financial consultants are advocating significant changes to the status quo to address mounting pressures on the retirement benefit system.

David Brooks, the head of policy at independent financial services consultancy Broadstone, highlighted how the state pension has transformed from a poverty prevention measure into an almost universal entitlement.

"The state pension is under growing pressure not simply because there are more pensioners, but because their needs are becoming more complex," Mr Brooks wrote for Money Marketing.

He emphasised that retirement income increasingly intersects with healthcare and social support requirements, as extended lifespans create greater probability of expensive long-term care needs amongst elderly citizens.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Mr Brooks outlined several specific policy recommendations to address these challenges.

"One likely reform is the extension of National Insurance contributions to pensioners, including on pension income and earnings," he explained, suggesting that individuals with adequate resources should contribute to public services irrespective of their age.

As it stands, Britons need to have 35 years of National Insurance contributions under their belt to qualify for the full, new state pension.

He also proposed implementing comprehensive means-testing rather than depending on specific benefits such as Pension Credit.

Older Britons are worried about the future of the state pension triple lock | PA

Older Britons are worried about the future of the state pension triple lock | PAMr Brooks noted: "Rather than relying on targeted benefits like Pension Credit, a more integrated form of means testing could be introduced.

"In some European systems, such as those in Scandinavia, pension entitlements are adjusted based on income and assets."

On top of this, analysts are sounding the alarm over the growing tax liability state pensioners face due to the impact of fiscal drag.

In its current trajectory, the state pension is due to exceed the personal allowance within the next two years, which means older Britons will be taxed on their payments alone.

MEMEBRSHIP:

- MAPPED: Where Channel migrants could head next as dozens of asylum hotels to be closed - is YOUR area vulnerable?

- Reform UK braces for six crunch by-election battles as Nigel Farage eyes up breakthroughs across Britain

- It took one phone call to defeat Keir Starmer. Nothing does it quite like a reshuffle rejection - Kelvin MacKenzie

- Our new Home Secretary's record on crime should be in the welcome pack for small boat arrivals - Carole Malone

- POLL OF THE DAY: Was Israel justified in attacking Hamas leaders in Qatar? VOTE NOW

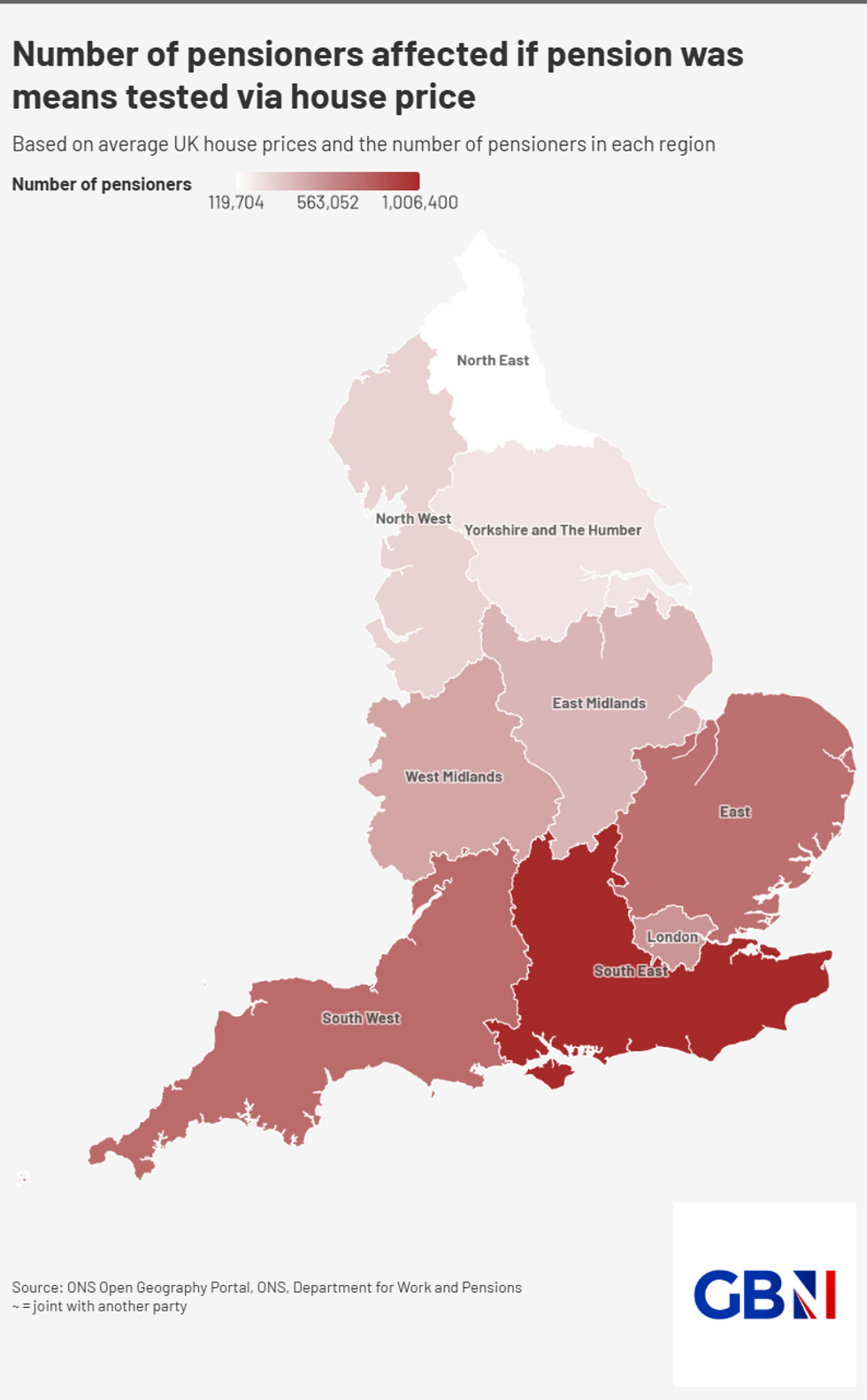

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBNAs such, retirees may soon encounter unforeseen tax liabilities as state pension increases threaten to exceed the income tax threshold within the next few years.

The personal allowance remains fixed at £12,570 through April 2028, whilst pension payments continue rising under the triple lock guarantee.

Even a modest 2.5 per cent annual increase would push the full new state pension to approximately £12,579 by the 2027/28 tax year, surpassing the tax-free threshold by roughly £79.

Chancellor Rachel Reeves is expected to announce further changes to tax and pension policy during her Autumn Budget.

More From GB News