State pension warning: Labour told 'it is time to means test' payments as DWP benefit's future at risk

Good Morning Britain guests clash in debate on pensioner support |

GB NEWS

Concerns remain over the long-term financial viability of the state pension in its current form

Don't Miss

Most Read

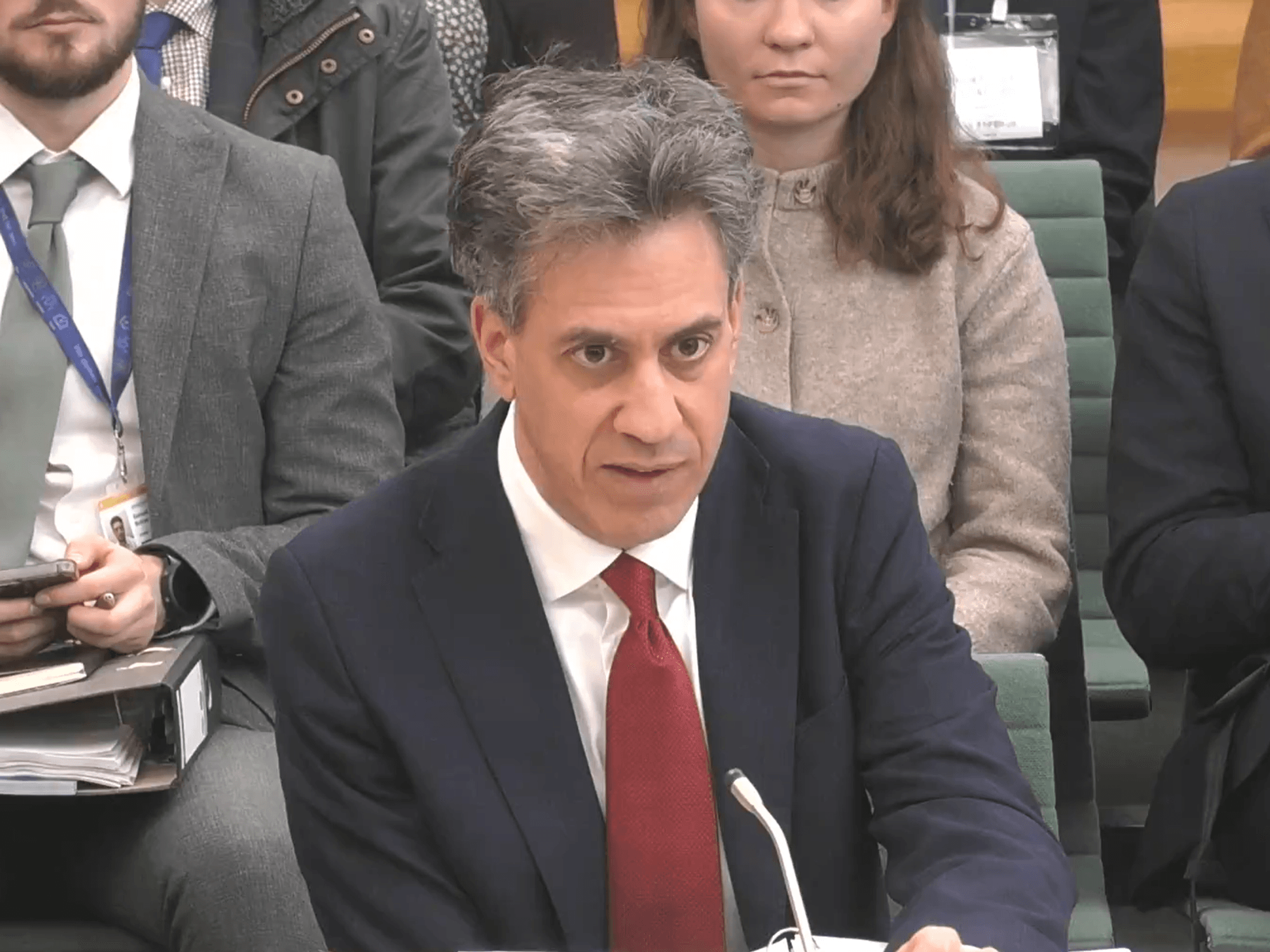

The Labour Government is being urged to consider means-testing the state pension as the retirement benefit's annual cost looks set t £170billion within five years.

Finance experts from Mouthy Money argue at universal pension payments have become financially unsustainable, with benefit expenditure for older Britons projected to reach £169.4billion by 2029/30.

The state pension currently represents 46 per cent of the Department for Work and Pensions' (DWP) total benefits expenditure, consuming £124.1billion annually.

This trajectory would mark a 143 per cent rise in pension costs since 2010/11, equivalent to yearly growth exceeding seven per cent over two decades.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

State pension payments could be means-tested under a proposal being put forward by finance experts

|GETTY

The platform contends that wealthy recipients should no longer receive automatic payments regardless of their financial circumstances.

Recent Government data reveals that 49 per cent of British pensioners aged over 65 possess net wealth of at least £500,000, according to the Office for National Statistics (ONS)' household wealth survey.

More than a fifth of this age group hold assets exceeding £1million, raising questions about universal benefit eligibility.

The Institute for Fiscal Studies (IFS) has suggested these figures may underestimate pensioner wealth by trillions of pounds, indicating the true financial position of older households could be substantially higher.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

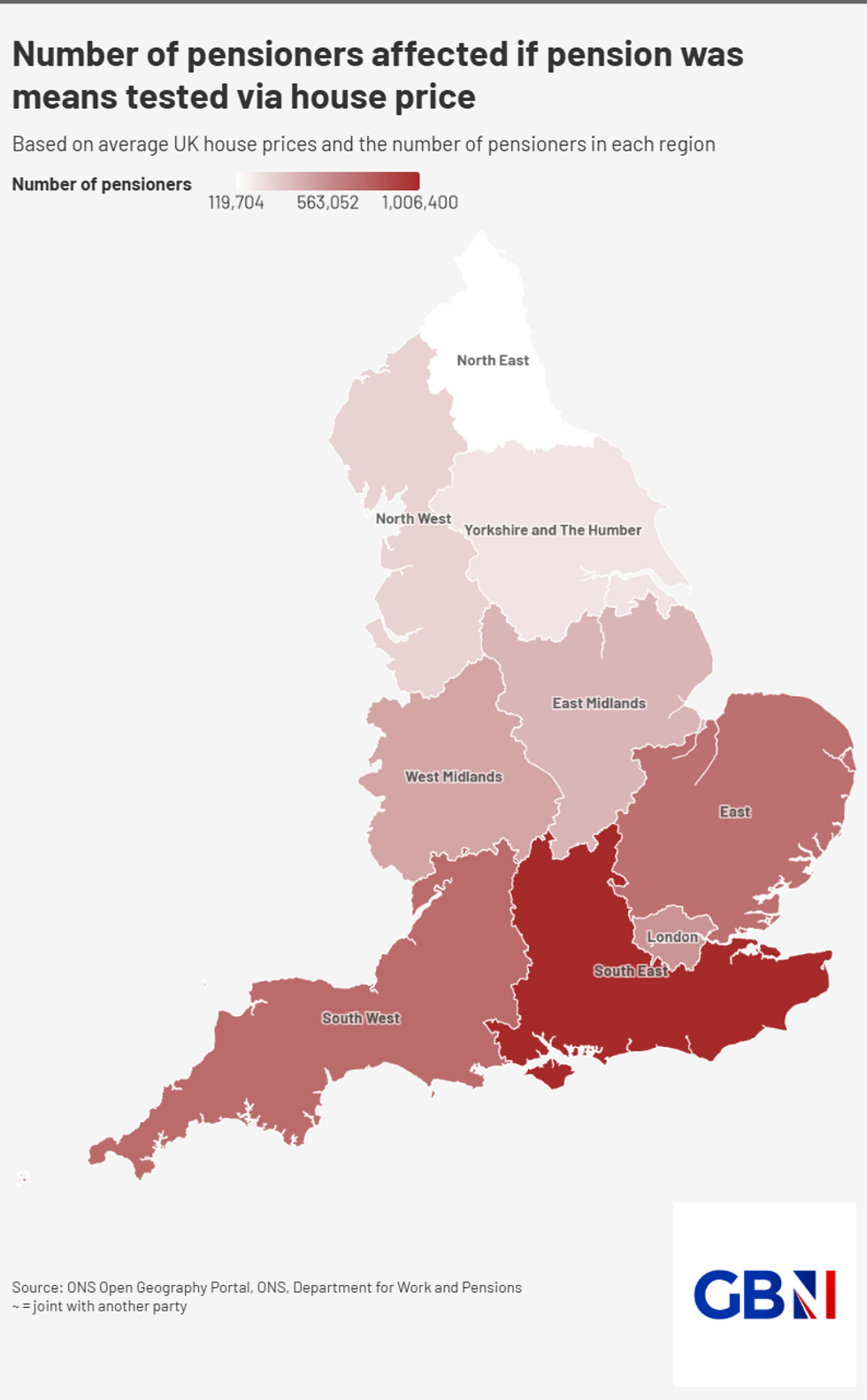

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBNSuch wealth concentration among recipients challenges the rationale for providing state pensions without financial assessment.

Annual state pension payments are set to breach the personal tax threshold from next year, creating an unprecedented situation where lower-income pensioners face taxation on their benefits.

Edmund Greaves, the editor at Mouthy Money, warns: "This means the poorest pensioners with no access to financial advice now face being taxed on their state pension income, while well-off retirees can simply move money around to avoid additional tax liabilities."

Wealthier pensioners can utilise ISAs, private pensions and various tax-efficient vehicles to minimise their obligations, while those dependent solely on state provision will bear the full impact of crossing the personal allowance threshold.

Greaves maintains that wealth assessments offer the sole practical approach to controlling pension expenditure.

He added:: "Instead of distracting arguments such as scrapping the triple lock or more tweaks to state pension age, it is time for the Government to seriously begin considering how it can means test the state pension in order to ensure its budget is put onto a sustainable footing."

LATEST DEVELOPMENTS:

The Department for Work and Pensions administers benefit payments | PA

The Department for Work and Pensions administers benefit payments | PA“Former Governments have taken steps to make the state pension bill cheaper. This has included raising the state pension age, equalising the age between genders and other tweaks to make the bill more affordable.

"But it has always avoided the question of means testing. The state pension level is now at an historic inflection point. For the first time from next year the Government could start to directly claw back a portion of its state pension payments through the income tax system as the annual entitlement finally tips over the personal allowance.

"But while income is subject to direct taxation, the variety of tax-efficient tools available - such as ISAs, pensions and other sources of wealth - means in practice the Government will struggle to claw back significant amounts of State Pension given to wealthy retirees.

"This means the poorest pensioners with no access to financial advice now face being taxed on their state pension income, while well-off retirees can simply move money around to avoid additional tax liabilities.”

More From GB News