Investor Robert Kiyosaki reveals 'real assets' YOU need to secure financial freedom and 'never work again'

The 'Rich Dad Poor Dad' author's unorthodox approach centres around debt management and investments across a mix of asset classes

Don't Miss

Most Read

Highly regarded business author Robert Kiyosaki has issued an ultimatum to those looking to find financial freedom, saying conventional personal finance is counterproductive.

The bestselling author of "Rich Dad Poor Dad" and property magnate says the traditional path of getting a job, working hard, and staying out of debt is what a "poor person's teacher" would recommend.

Speaking on the School of Hard Knocks podcast, Mr Kiyosaki explained his alternative approach; to master real estate investing and use borrowed money to generate cash flow.

He now owns 15,000 rental properties, which he says each bringing in roughly $200 monthly each.

TRENDING

Stories

Videos

Your Say

The businessman does not believe getting a standard job is the route to financial security.

"Go to school, get a job, pay your taxes, work hard, save money and put your money in a 401(k), that's what every loser does. Loser, loser, loser."

He argues that buying a big house and calling it an asset is misguided when mortgages, insurance, maintenance and taxes drain your wallet.

"Or a Ferrari or a Lamborghini or a Rolls-Royce - and they call it an asset. It's a liability. That's why they're losers."

For Mr Kiyosaki, the distinction is simple: genuine assets put money in your pocket, while liabilities take it out.

Robert Kiyosaki's approach centres around debt management and investments across a mix of asset classes

|GETTY

"True assets" he believes include rental properties generating positive cash flow, dividend-paying stocks, businesses and intellectual property producing royalties.

He's outlined eight key assets that can help people escape the daily grind for good:

Entrepreneurship

Putting sweat equity into building your own business rather than trading time for someone else's money.

Rental properties

Using other people's money to create income streams that don't depend on a nine-to-five.

Paper assets

Stocks, bonds and mutual funds offer another route, letting you tap into established companies' success through disciplined investing.

LATEST DEVELOPMENTS

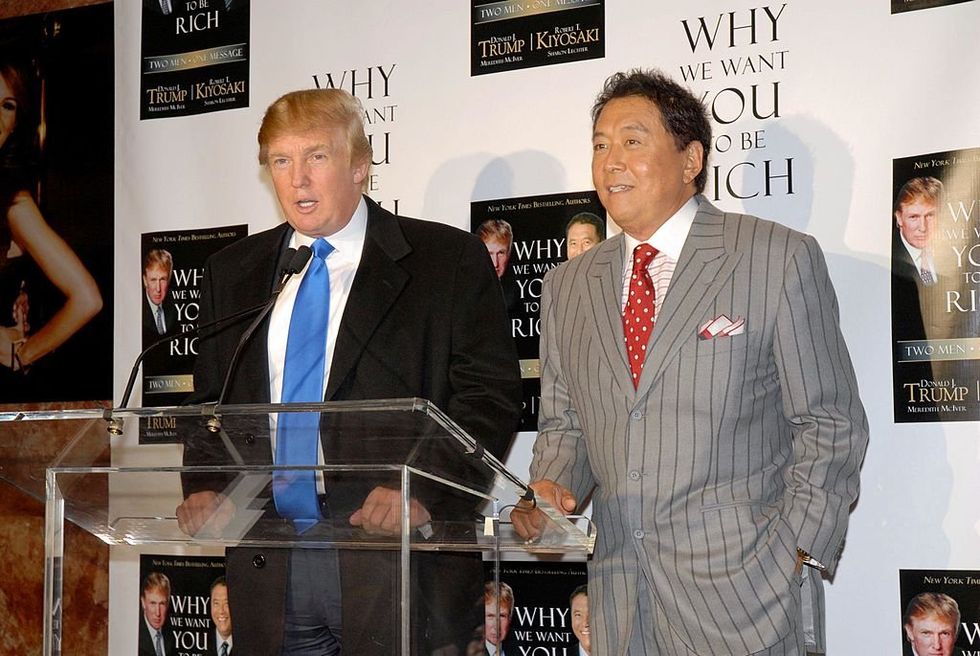

Mr Kiyosaki launched a book with Donald Trump in 2006 titled "Why we want you to be rich"

|GETTY

Commodities

Gold, silver and oil serve as protection against inflation and currency devaluation, holding their value when paper money doesn't.

Time is money

If time is indeed money, it is a finite resource, so utilise it in a way that yields substantial returns.

Self-care

While financial wealth is paramount, Mr Kiyosaki underscores the importance of holistic well-being, particularly physical health.

Safeguarding your financial assets and enjoying a fulfilling life with loved ones is the healthiest choice you can make.

Digitalise your skills

In the digital age, he highlights the accessibility of online platforms as vehicles for wealth creation.

From YouTube channels to e-commerce websites, individuals can leverage their skills and expertise to generate passive income streams.

Network, network, network

The power of networking and personal branding in fostering business success.

Through word-of-mouth referrals and strategic marketing efforts, one can amplify their impact and solidify their position as a trusted authority in their field.

He's a big believer in a strong network

|GETTY

When financial storms hit, wealthy people respond very differently to everyone else, according to Mr Kiyosaki.

Rather than panicking over bad advice or market wobbles, rich people learn to filter out guidance that doesn't work for them – and they never worry about being someone's employee.

They also maintain control over their money by diversifying across multiple investment opportunities, so if one area struggles, they can focus elsewhere.

He noted that tax stress is not a concern for the wealthy. As Mr Kiyosaki explained: "Business owners and investors pay the least in taxes because their income is considered passive income."

Perhaps most importantly, rich people build safety nets that actually grow over time.

In Kiyosaki's words, they "create assets that generate income without them working. In fact, many times these assets grow".

More From GB News