State pension age in the UK to be 'one of highest' in the democratic world as future increases under fire

The state pension age is expected to rise from 66 to 67 in the next few years

Don't Miss

Most Read

The state pension age in the UK is set to be "one of the highest" out of countries associated to the Organisation for Economic Co-operation and Development (OECD), experts warn.

A major pensions organisation has urged ministers to link any future retirement age rises to improvements in the nation's health, whilst providing a decade's warning before implementation.

The recommendations form part of Pensions UK's response to the Government's ongoing retirement age assessment, with some analysts suggesting ministers should raise the threshold to as high as 70.

Notably, the organisation advocates for an "evidence-based approach grounded in transparency and public engagement" when evaluating potential modifications to retirement age thresholds or benefit adjustment mechanisms.

The state pension age in Britain will be 'one of the highest' in the democratic world, experts warn

|GETTY

Their proposals emphasise that any upward revision must depend on genuine gains in healthy life expectancy across the population.

The submission also stresses the importance of maintaining simplicity through a unified retirement age threshold to prevent saver confusion.

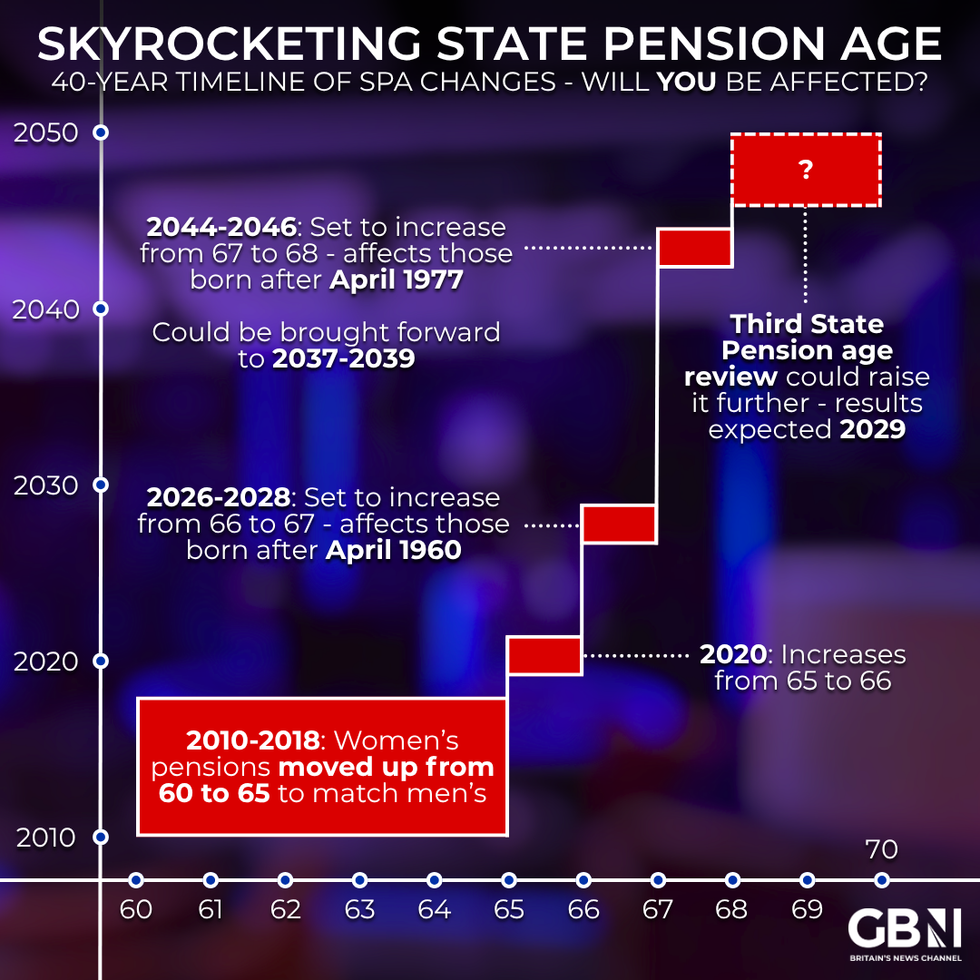

Currently. the state pension age sits at 66 years old, with legislation already in place to raise this threshold to 67 by April 2028.

Ministers commissioned an independent assessment in July 2025 to examine whether the nation's retirement age remains appropriate, taking into account recent mortality data and budgetary constraints.

According to Pensions UK, Britain is set to have among the most elevated retirement thresholds in the OECD once the 67-year benchmark takes effect in 2028.

Skyrocketing state pension age - will you be affected? | GB News

Skyrocketing state pension age - will you be affected? | GB NewsThe organisation highlights troubling health trends that could undermine fairness in retirement policy.

Health-adjusted life expectancy has decreased for both genders since the 2017-2019 period, with marked variations between England, Scotland and Wales.

Substantial gaps persist in longevity outcomes based on geography, employment type and earnings levels. Manual workers, residents of disadvantaged communities and ethnic minorities face particularly stark disparities.

Pensions UK cautions that elevating the retirement threshold without accounting for these variations would exacerbate existing inequalities.

The organisation acknowledges the triple lock's significance in safeguarding pensioner purchasing power but warns about its financial trajectory.

Office for Budget Responsibility (OBR) forecasts suggest maintaining current arrangements could push state pension expenditure towards 7.7 per cent of GDP by the early 2070s, compared with approximately five per cent presently.

Pensions UK proposes defining a clear adequacy threshold for state pension provision before potentially shifting towards a more fiscally sustainable adjustment method.

Joe Dabrowski, the deputy director of Policy at Pensions UK, said: "The state pension is the backbone of most people's retirement savings, representing about half of total retirement income.

LATEST DEVELOPMENTS:

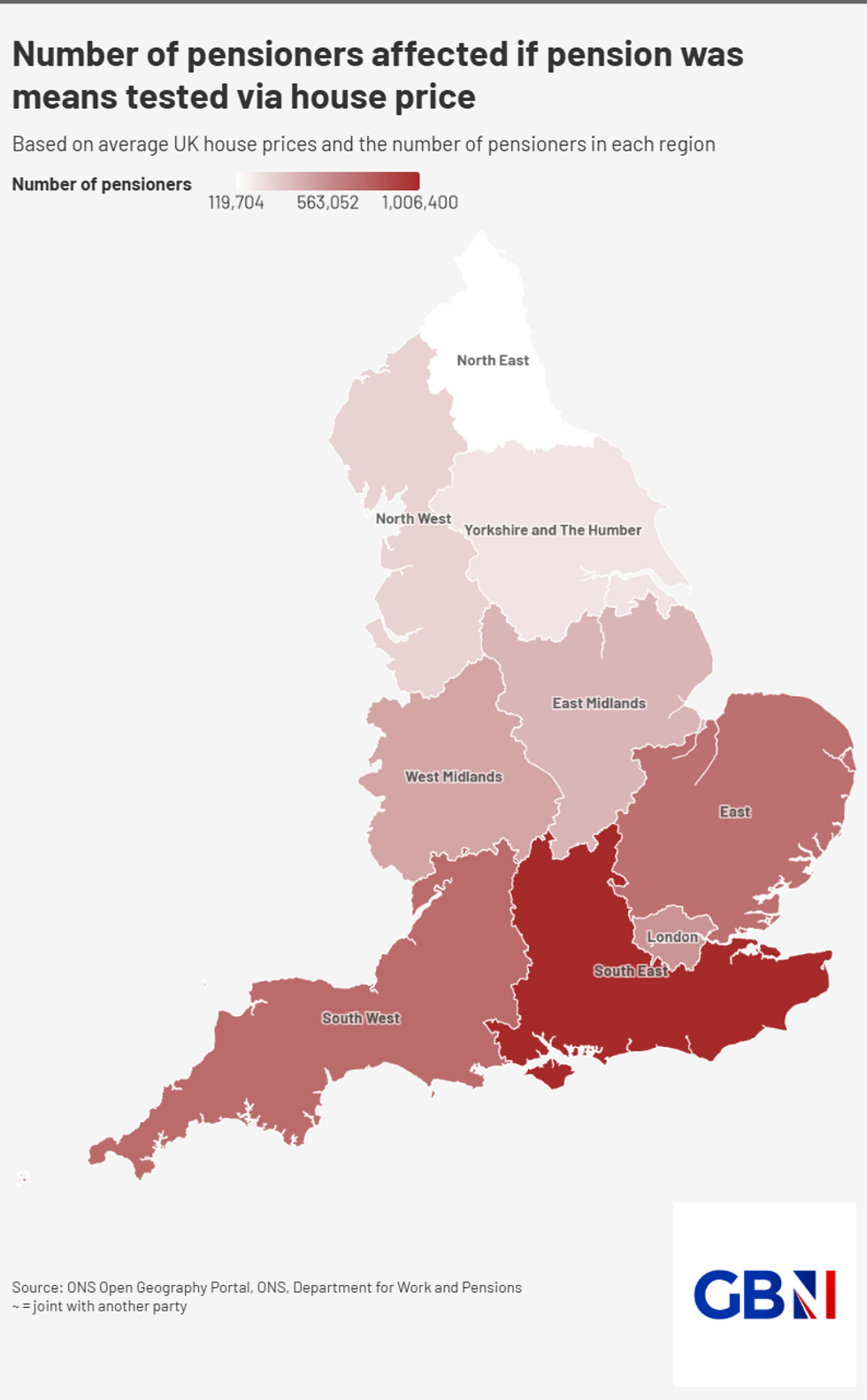

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBN"For those on lower incomes, it is even more important: 13 per cent of retirees get over 90 per cent of their income from the state pension.

"The UK will already have one of the highest state pension ages in the OECD when it reaches 67 for all in 2028.

"Any further increases must be matched by a corresponding improvement in healthy life expectancy so that future retirees enjoy the same number of years in retirement.

"It is also vital that changes to the system are clearly communicated at least 10 years in advance to give people time to plan for the future."

More From GB News