State pensions could be paid THREE YEARS EARLIER under proposal in DWP overhaul

As it stands, Britons are able to access the full, new state pension once they turn 66

Don't Miss

Most Read

Latest

State pension payments should be paid three years earlier than the official retirement age under a new policy proposal, a leading financial services firm has claimed.

Aegon has called on the Labour Government to permit employees to access their payments as much as three years before the state pension age, albeit with lower annual payments.

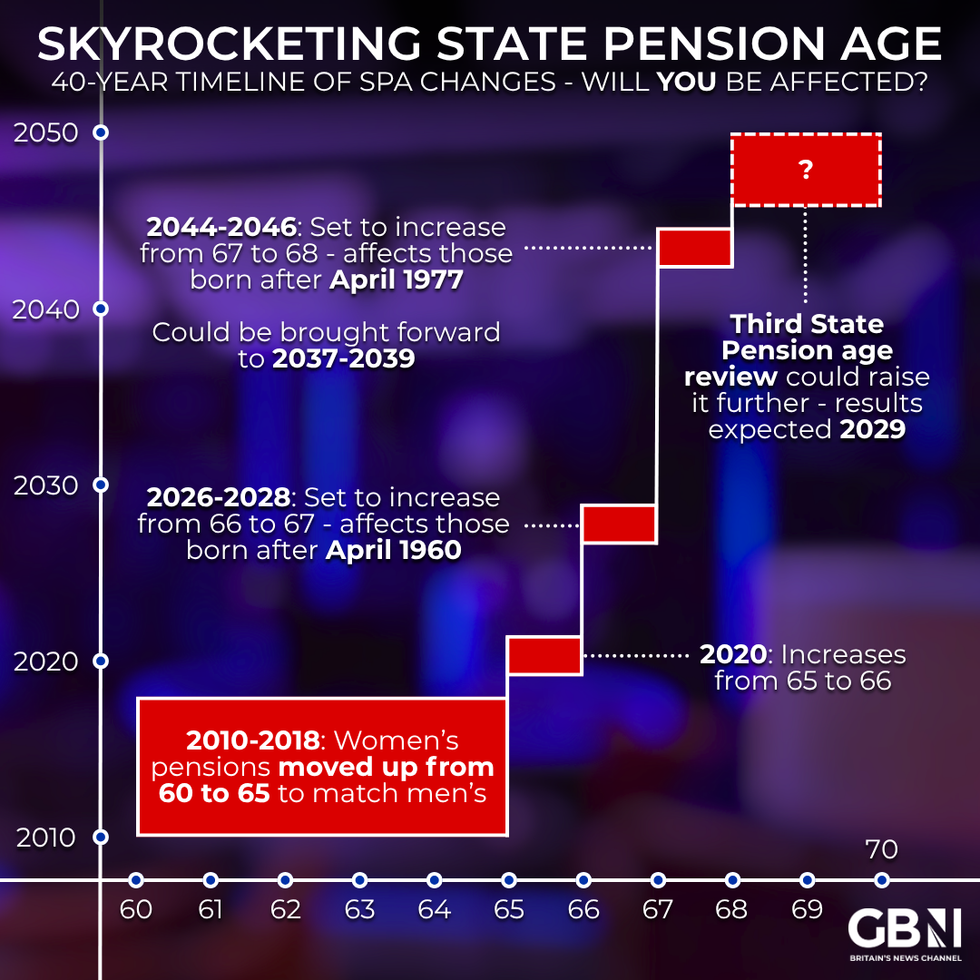

This recommendation from the organisation comes as ministers conduct a comprehensive assessment of the statutory retirement age, which could see it increase at a faster pace than previously planned.

The proposal emerges against a backdrop of mounting pressure on the Treasury, with the state pension's triple lock mechanism facing scrutiny due to its substantial financial burden on public spending.

State pension payments should be paid three years earlier, according to a pension provider

|GETTY

The company argues this approach would provide enhanced financial adaptability for those approaching retirement whilst helping to mitigate disparities arising from varying life expectancies across different demographics.

As it stands, the statutory state pension age is set to increase from 66 to 67 starting next year, with further rises planned to reach 68 by 2046.

These scheduled increases form part of the Government's strategy to manage the growing expense of state pension provision as the population ages.

Currently, the triple lock mechanism, which ensures state pension increases match the highest of inflation, earnings growth or 2.5 per cent, will boost the full new state pension by 4.8 per cent to £12,547.60 annually from April.

What has the impact of the state pension triple lock been on the public's finances | OBR

What has the impact of the state pension triple lock been on the public's finances | OBR Chancellor Rachel Reeves faces mounting calls to abandon this expensive commitment, with the Office for Budget Responsibility (OBR) projecting its cost will hit £15.5billion by 2030.

Steven Cameron, pensions director at Aegon, highlighted that rising retirement ages increasingly force people from employment due to declining health, demanding physical work or caring duties for ageing relatives.

He noted: "We're already seeing increasing numbers of over-50s exiting the workforce due to ill health."

Mr Cameron further warned: "A continually rising fixed state pension age risks becoming divisive and misaligned with the flexibility of today's private pensions landscape."

He emphasised that retirement age increases disproportionately affect those with shorter life expectancies, typically lower earners.

"Having to wait a year when you may only have five years of life ahead is a much bigger cut than if you've got 30 years or more to go," Mr Cameron added.

However, Steve Webb, who served as pensions minister and now works at Lane Clark & Peacock consultancy, strongly criticised the early access proposal as "bad policy".

He cautioned: "The UK state pension remains very low by international standards, and even the full pension is not enough to meet estimates of the income needed in retirement to fund a decent minimum standard of living."

LATEST DEVELOPMENTS:

Skyrocketing state pension age - will you be affected? | GB News

Skyrocketing state pension age - will you be affected? | GB NewsMr Webb warned that allowing early access with permanent reductions could result in "large numbers of people in retirement living below the poverty line".

Multiple pension providers and financial services firms have offered policy suggestions to the Government amid its ongoing State Pension Age Review.

This consultation is scheduled to be complete by 2029 under the current timeline outlined by ministers.

According to the Department for Work and Pensions (DWP), the review will look at what the timetable should be for rises in he state pension in future decades and ministers cannot pre-empt the outcome of the review.