Savings crisis as bank customers risk losing more than £500 after 'falling into account trap'

Savers urged to be careful of tax on savings interest |

GB NEWS

Savers have enjoyed a period of high interest accounts in recent years, but not everyone is taking advantage of these deals

Don't Miss

Most Read

Analysts are warning that bank customers are at risk of losing more than £500 due to leaving their cash in low-interest savings accounts.

More than half of UK savers are losing money by keeping their savings in current accounts that pay sub-par interest, according to new research.

A survey of 2,000 people has found that 56 per cent of savers hold at least some of their money in zero-interest current accounts.

This widespread practice has resulted in over £297billion sitting in accounts earning no interest at all, representing a 20 per cent increase from the previous year.

Research suggests British savers are losing out

|GETTY

The findings, from research conducted by Opinium for Hargreaves Lansdown in April 2025, highlight a significant financial blind spot affecting millions of British savers.

Research shows younger people are particularly prone to this habit, with 67 per cent of those aged 18-34 keeping savings in current accounts.

Men are slightly more likely than women to do so, at 58 per cent compared to 54 per cent. Among higher rate taxpayers, 81 per cent keep money in current accounts, whilst 83 per cent of investors follow the same pattern.

The survey identified three primary reasons for this behaviour. Nearly half (46 per cent ) say they want funds readily available for emergencies.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Savers are losing money to interest rate cuts and inflation | GETTY

Savers are losing money to interest rate cuts and inflation | GETTYOthers cite inertia, with 15 per cent claiming it's not worth the hassle to move money, 14 per cent preferring everything in one place, and 13 per cent simply not getting around to switching.

Sarah Coles, head of personal finance at Hargreaves Lansdown, warns that savers have "fallen into the current account trap" and are "paying a big price for a misguided sense of comfort".

She identifies two major risks of this practice. Firstly, the temptation to overspend is significant.

"You don't have to transfer cash from another account in order to spend it, you just spend as normal, and find yourself eating away at your savings," Coles explains.

Previous research by Hargreaves Lansdown found that one in five people spend their current account savings without intending to do so.

The second major risk is inflation's erosive effect on purchasing power, according to Coles.

LATEST DEVELOPMENTS:

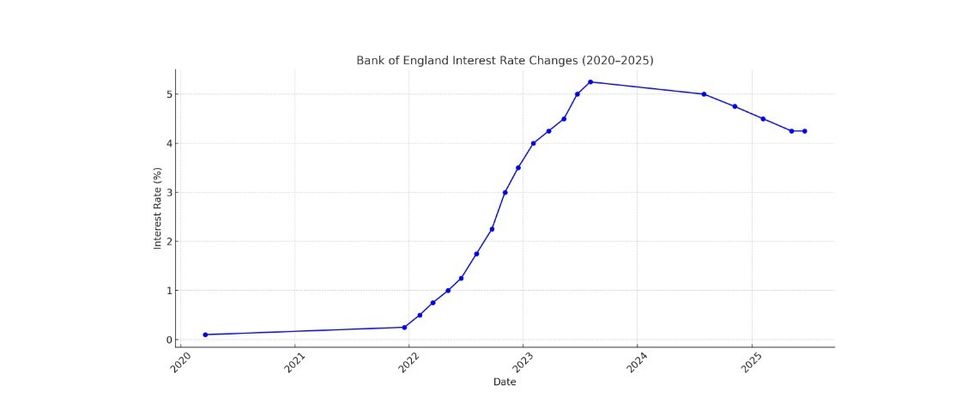

The Bank of England has made changes to interest rates in recent years | GETTY

The Bank of England has made changes to interest rates in recent years | GETTY With the average household holding £3,365 in current accounts, and assuming 3.5 per cent inflation, savers would lose £114 of spending power within a year.

Those with £10,180 in current accounts would see £344 of purchasing power vanish annually. Over five years, someone with £3,365 could lose £532 in real terms.

Coles notes that many savers do not realise they could earn 4.5 per cent or more through online banks or savings platforms.

She suggests these platforms offer a solution, allowing savers to switch between competitive deals without additional paperwork whilst monitoring everything in one place.

More From GB News