State pension alert: Britons could get 'early access' to payments under DWP proposal

Keir Starmer quizzed by Christopher Hope on whether pensioners will receive an apology for his winter fuel allowance cuts. |

GB NEWS

New research is calling on the DWP to reform state pension payments

Don't Miss

Most Read

State pension payments should be paid "early" to certain claimants and a new benefit introduced to help older Britons at risk of poverty, according to a new retirement proposal.

Standard Life's "An intergenerational contract: Policy recommendations for the future of the state pension" report is calling for the Government to consider radical overhaul to the retirement benefit to ensure it remains viable for generations to come.

The report identified a lack of awareness among the British public as to how much the state pension provides and when it is eventually paid.

In order to ensure the state pension "supports those most in need", the firm suggested a series of policy recommendations to the Department for Work and Pensions (DWP).

Britons could get paid "early" under a state pension policy suggestion

| GETTYThe firm stated: "Increase uptake of Pension Credit for those eligible through targeted local level outreach and uprate it in line with the state pension triple lock.

"Introduce bridging benefits through Universal Credit equivalent to Pension Credit for people at risk of poverty one year before their state pension age."

"Allow early access to a pro-rated payment equivalent to state pension for adults of any age with a terminal illness," Standard Life added.

Pension Credit is a benefit payment reserved for older households on low-income, similar to how Universal Credit is awarded to working-age people.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

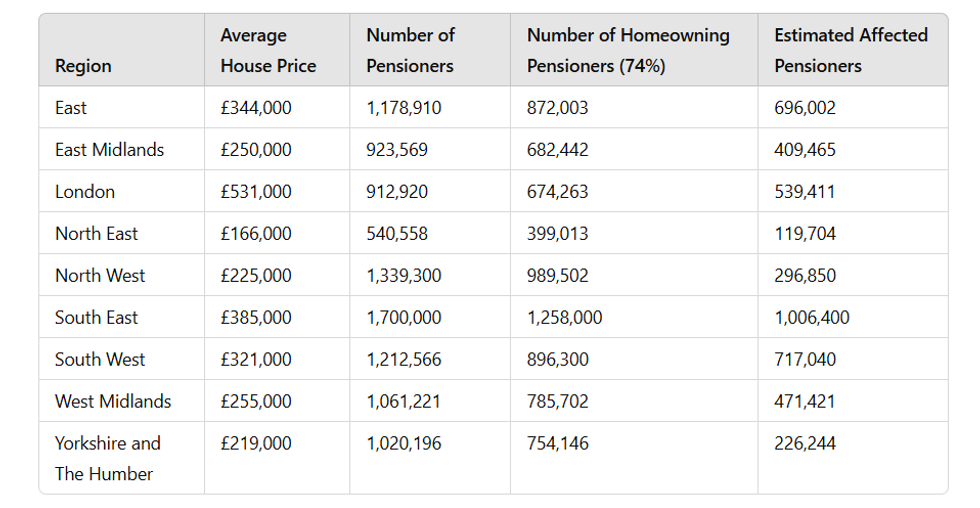

Estimated number of pensioners that would be affected by means testing the state pension on house value, broken down by region | GBN

Estimated number of pensioners that would be affected by means testing the state pension on house value, broken down by region | GBNBased on YouGov polling commissioned by Standard Life, 87 per cent of the public believe the state pension should ensure everyone has a minimum retirement standard.

Some 82 per cent think it is important that the retirement benefit supports older people who are unable to work, with 74 per cent consider it a repayment to those who have paid into the system during their working lives.

The firm's report also stated: "The state pension should remain non-means tested and linked to average life expectancy, but it requires supplemental support in the wider social security system to help people manage changes.

"The next state pension age review should combine both a review of age as well as the uprating system.

"Improve the coverage and effectiveness of Automatic Enrolment to help people to save more for their retirement alongside the state pension system.

"Whenever state pension age increases, invest the equivalent of 20 per cent of the fiscal savings to create opportunities for better work and help those most in need to bridge the transition to higher state pension ages."

LATEST DEVELOPMENTS:

Older Britons are worried about the future of the state pension triple lock | PA

Older Britons are worried about the future of the state pension triple lock | PAAll Britons are entitled to the retirement benefit once they reach the state pension age, which is 66 but will rise to 67 between 2026 and 2028 for claimants.

The state pension age is regularly reviewed depending on a variety of factors, including life expectancy data and the state of the wider economy.

Payments are uprated annually thanks to the triple lock, with pension rates rising by either the rate of inflation, average wages or 2.5 per cent; whichever is highest.

More From GB News