Britons urged to 'shop around for best deal' as bank raises savings interest rates - full list of accounts

Ford Money is raising saving rates

|GETTY

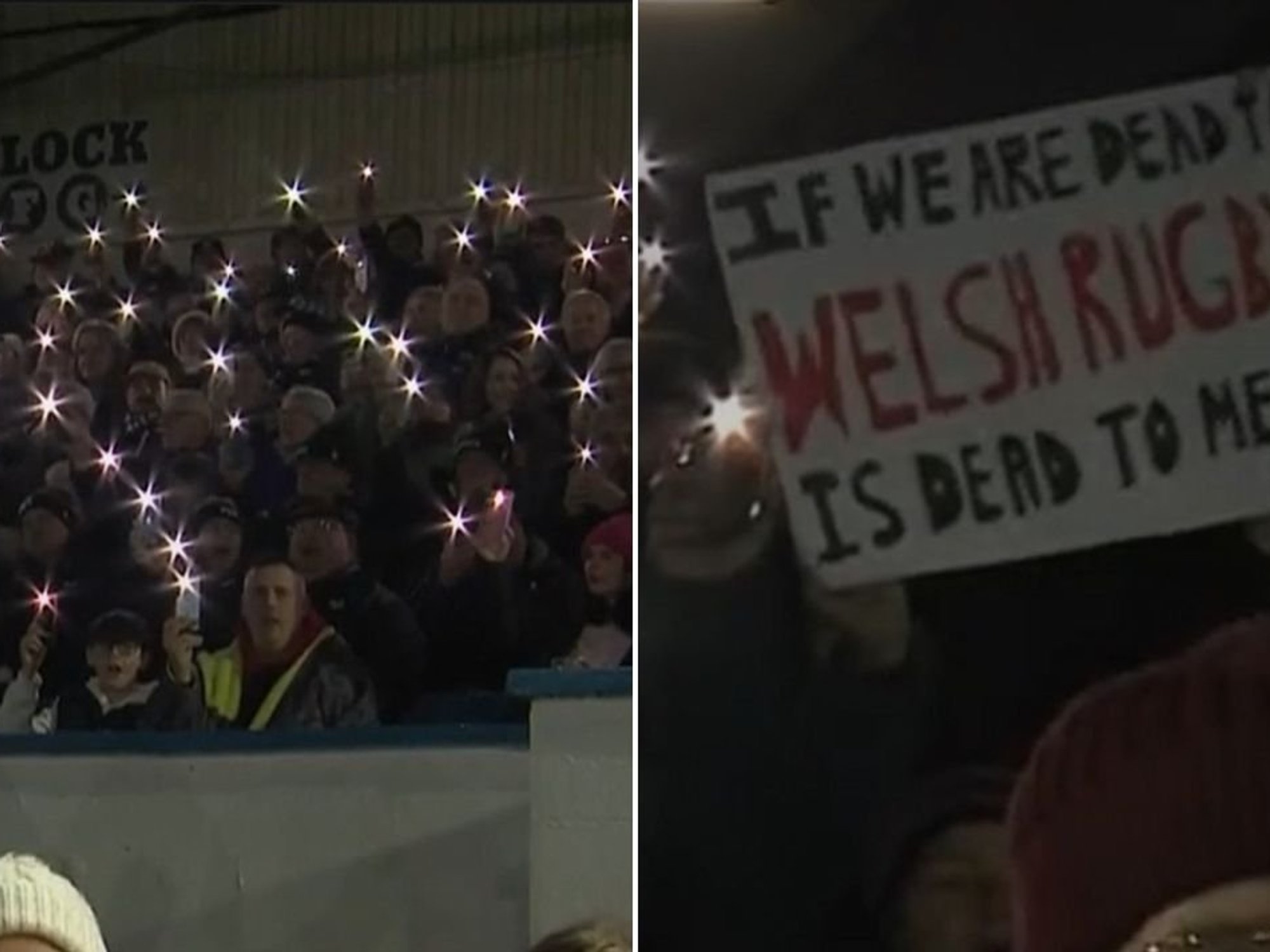

Savings interest rates are on the rise with Ford Money making changes to its line of ISA products

Don't Miss

Most Read

Latest

One of the country's leading digital banks is preparing to raise its savings interest rates in boon for new and exiting customers.

Ford Money has announced plans to rates the rates across its range of ISA products new week.

Here is a full list of the new ISA rates from Ford Money which will be implemented next week:

- Fixed Cash ISA One Year - 4.75 per cent AER

- Fixed Cash ISA Two Year - 4.60 per cent AER

- Flexible Cash ISA - 4.60 per cent AER.

The changes to the bank's fixed cash ISAs will be introduced at 9am on June 25, 2024.

Later in the week, Ford Money will raise the rate of its flexible equivalent on June 28.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Savers have benefited from banks and building societies bolstering rates

| GETTYThe bank has confirmed the interest rates attached to its savings accounts will continue to be the same.

Here is a full list of the savings products currently on offer from Ford Money:

- One- year Fixed Regular Saver - 4.75 per cent AER fixed

- Flexible Saver - 4.60 per cent AER variable

- 1-year Fixed Saver - five per cent AER fixed

- 2-year Fixed Saver - 4.75 per cent AER fixed.

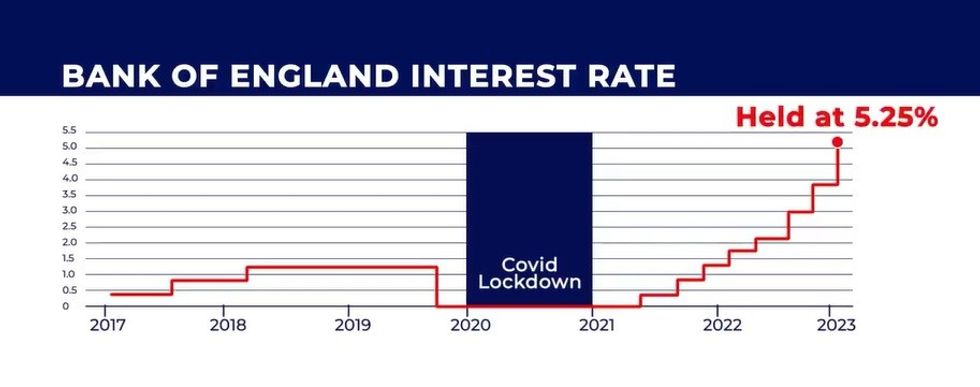

Savers in the UK have benefited greatly from the Bank of England's decision to raise, and eventually hold, the UK's base rate at 5.25 per cent.

The central bank has opted to do this in its ongoing fight to bring the consumer price index (CPI) rate of inflation to two per cent.

Earlier this week, figures from the Office for National Statistics (ONS) revealed that inflation for the 12 months to May reached the Bank's desired target.

Despite this, the Monetary Policy Committee (MPC) voted to keep interest rates at their current level with the base rate having been the same since August 203.

Analysts are betting on the Bank of England cutting rates in the later half of the year.

As such, experts are urging Britons to take advantage of competitive interest rates on savings accounts while they still can.

LATEST DEVELOPMENTS:

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August | GB NEWS

The Bank of England base rate has held interest rates at a 16-year high since it was hiked to 5.25 per cent last August | GB NEWSAndy Mielczarek, the CEO of Chetwood Financial, warned: “Ultimately, it won’t be long before the Bank of England makes the call to cut interest rates, and when they do, many flexible savings offers will have their rates slashed.

"Now is the time to consider investing in longer-term, fixed-rate deals that lock in high interest while at their peak.”

Victor Trokoudes, founder and CEO at smart money app Plum, added "Thanks to high interest rates, it has become a lot easier to mitigate the effect of inflation on savings, with many easy access saving accounts and Cash ISAs delivering returns well in excess of two per cent.

"It’s important to shop around and make sure you are getting the best deal possible to make the most of your savings while rates are high."