Households could save more than £1,700 thanks to credit card debt hack as borrowers urged to 'shop around'

'The bond markets are applying what they call the moron premium to the UK economy.' |

GB NEWS

Many borrowers turn to balance transfers to bring down their card card bill

Don't Miss

Most Read

Britons saddled with credit card debt could be in line for savings boost worth more than £1,700, according to new analysis from TotallyMoney.

Bank customers have been forced to contend with hiked repayment costs and fees as a result of the Bank of England's decision to hike the base rate in its fight against inflation.

Analysts are citing the impact of balance transfer as an option to reduce costs for borrowers with one lender offering Britons the opportunity to stop paying interest for 35 months.

The balance transfer credit card sector is experiencing fierce competition as banks extend their interest-free periods to unprecedented lengths. Barclays has emerged as the market leader with a 35-month offer, marking the longest deal available since 2022.

Households could slash their credit card bill thanks to balance transfer

|GETTY

Five major lenders are close behind with 34-month terms, including financial institutions such as HSBC, MBNA, NatWest, Tesco Bank and Virgin Money. This represents a significant shift from twelve months ago when the maximum available period stood at just 28 months.

These extended offers allow customers to shift existing credit card debt to a new provider without incurring interest charges until August 2028 for the Barclays deal.

Borrowers typically pay a one-off fee between two per cent and four per cent of the transferred amount .The surge in competitive offerings arrives as households prepare for increased winter expenses.

Research from TotallyMoney reveals that 47.8 per cent of credit card holders currently pay interest on their balances each month. These customers could potentially qualify for balance transfer deals that would eliminate interest charges for nearly three years.

How much is your credit card bill?

| PACustomers who secure Barclays' market-leading 35-month offer could save £1,775 on an average balance. Those opting for the 34-month deals available from the five competing banks would see savings of £1,728.

The mechanism is straightforward: customers transfer their existing debt to a new card that charges zero interest for the promotional period.

This space enables borrowers to focus on reducing their principal debt rather than servicing interest payments, potentially saving hundreds or thousands of pounds over the term.

TotallyMoney's chief executive Alastair Douglas has outlined five essential strategies for borrowers seeking to secure these deals.

"Before you start your search, check that the information on your credit is correct and up to date," Mr Douglas advises.

He recommends using free services like CredAbility and TotallyMoney to review credit reports and dispute any errors.

His second tip calls for borrowers to carry out comprehensive market research when looking for balance transfer options.

"Always shop around - and that means going direct to banks and checking different comparison sites," he states.

LATEST DEVELOPMENTS:

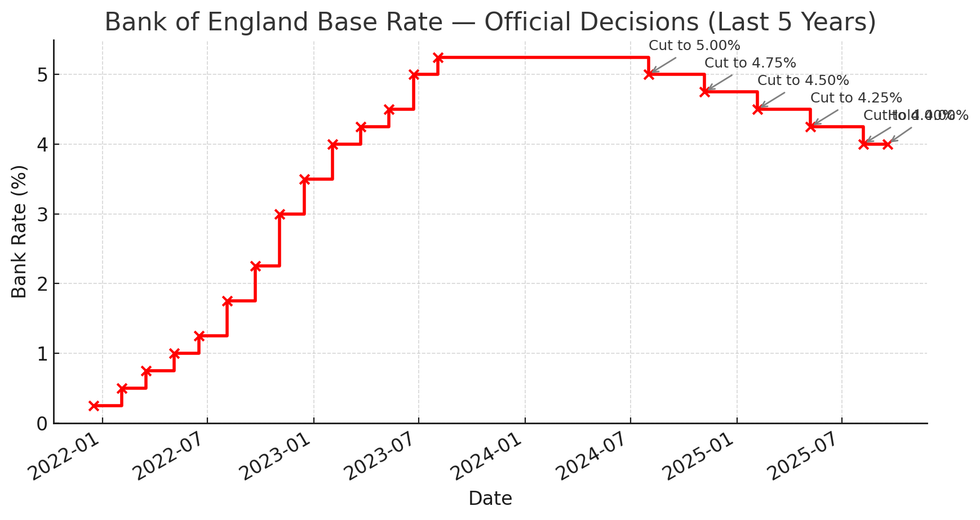

How has the base rate changed in recent years? | CHAT GPT

How has the base rate changed in recent years? | CHAT GPT Mr Douglas also highlights the importance of seeking pre-approved offers with guaranteed terms to avoid unexpected changes to rates or credit limits.

He stresses creating a structured repayment schedule with fixed monthly payments via direct debit.

Finally, he warns against using balance transfer cards for new purchases or cash withdrawals, as these transactions typically incur immediate interest charges and fees.

The Bank of England's Monetary Policy Committee (MPC) will next meet to discuss the base rate, which will determine the cost of borrowing, on November 6, 2025.

More From GB News