Inflation rate hikes 'not a British problem', Bank of England interest rate-setter claims

'The bond markets are applying what they call the moron premium to the UK economy.' |

GB NEWS

The OECD has warned that inflation will continue to be an issue for the UK in the months ahead

Don't Miss

Most Read

A senior Bank of England policymaker has rejected claims that Britain faces distinctive inflationary challenges, advocating for additional reductions in interest rates.

Swati Dhingra, who serves on the central bank's Monetary Policy Committee (MPC), maintains there is no justification for excessive caution when reducing borrowing costs.

Writing in The Times, she challenged the widespread view that UK inflation differs fundamentally from other economies.

"It's become commonplace to assert that inflation in the UK is out of step with other economies, requiring a more careful approach to cutting interest rates as a result," she stated.

A Bank of England policymaker has claimed inflation is not a 'British problem'

|GETTY

“With prices for services and food rising more quickly than in the major eurozone countries, inflation looks like a particularly British problem.”

The MPC member insisted that pressures driving UK inflation would diminish over time and that the factors putting pressure on the consumer price index (CPI) rate “will fade”.

Ms Dhingra specifically addressed concerns about food costs, which have increased more rapidly in Britain than in eurozone nations.

"But it's not clear that this gap reflects anything other than global trends and slightly different supply chains and shopping baskets in the two economies," she wrote.

She argued that variations in inflation between Britain and European neighbours stem from administered prices and international commodity disruptions.

The divergence between the two policymakers highlights growing divisions within the Bank of England about the appropriate pace for monetary easing.

Whilst Ms Dhingra sees scope for accelerated rate reductions, Ms Greene's stance reflects concerns about premature action that could undermine efforts to control inflation.

Recent analysis from the Organisation for Economic Co-operation and Development (OECD) reinforces concerns about Britain's inflation trajectory.

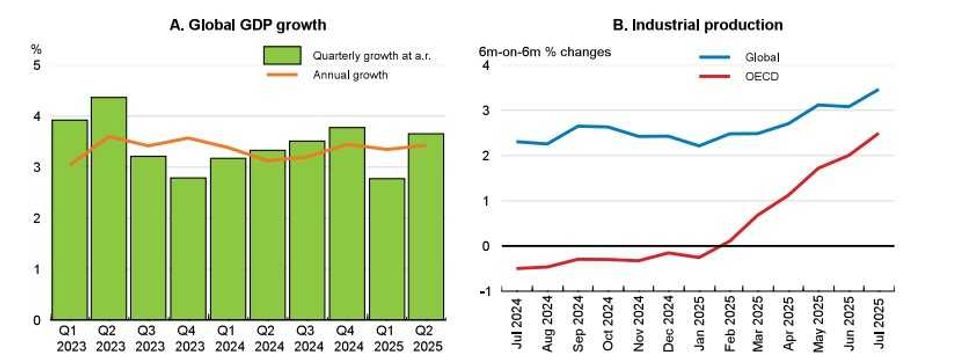

OECD GDP growth data

|OECD

According to the OECD, UK's inflation will reach 3.5 per cent by the end of this year before falling to 2.7 per cent in 2026.

The OECD also says the growth in the UK economy will peak at 1.4 per cent this year before falling to one per cent by next year.

Looking ahead to 2026, the forecasts suggest Britain's inflation will remain elevated, ranking second amongst the G7 countries, with only the United States expected to experience higher price growth.

Shadow Chancellor Mel Stride claimed the OECD's findings underscore "what hard-working families already feel - under Labour, Britain is in a high tax, high inflation, low growth doom loop".

"The UK is now teetering on the edge of stagflation, all driven by Labour's economic mismanagement."

LATEST DEVELOPMENTS:

Rachel Reeves is under pressure to impose tax increases on middle-income households | GETTY

Rachel Reeves is under pressure to impose tax increases on middle-income households | GETTYAccording to the OECD, this slowdown is economic growth is the result of "tighter fiscal stance", suggesting either higher taxes or lower Government spending.

Responding to the OECD's forecast, Ms Reeves said the figures "confirm that the British economy is stronger than forecast - it has been the fastest growing of any G7 economy in the first half of the year".

"But I know there is more to do to build an economy that works for working people – and rewards working people."

More From GB News