Budget 'worse for savers' as Rachel Reeves launches DOUBLE tax raid on ISAs

Chancellor Rachel Reeves announces Labour will freeze income tax thresholds and equivalent National Insurance thresholds at their current level until 2031 |

GB NEWS

The cash ISA tax-free allowance will be cut to £12,000 with more taxpayers set to cross this threshold due to fiscal drag, analysts warn

Don't Miss

Most Read

Bank customers face a double tax raid on £4.2billion in savings following Chancellor Rachel Reeves's Budget as a result of her looming ISA reforms and the decision to extend the freeze on personal tax threshold until 2031.

Analysts are sounding the alarm over the "salt in the wound" for savers as the cash ISA tax-free allowance will be slashed from £20,000 to £12,000 with more individuals being pulled across this threshold due to fiscal drag.

Recent data reveals that cash ISA account openings surged by 42 per cent last week compared to the previous period the year before, according to financial platform Plum.

National deposits into cash ISAs through banks and building societies jumped 29 per cent month-on-month, reaching £4.2billion, based on HM Revenue and Customs (HMRC) data.

The Chancellor's ISA raid is under fire

|GETTY

This represents a 13 per cent year-on-year increase, despite lower interest rates which have begun to fall in line with recent changes to the UK base rate from the Bank of England.

Victor Trokoudes, Plum's founder and chief executive, suggested that speculation regarding potential reductions to the Cash ISA allowance drove savers to maximise their £20,000 annual limit whilst still available.

"So while Rachel Reeves' intention is to get more people investing, it appears her rhetoric is having the opposite effect for the time being," Mr Trokoudes observed.

The Chancellor has extended the freeze on income tax thresholds for three additional years, maintaining current levels through to 2030-31.

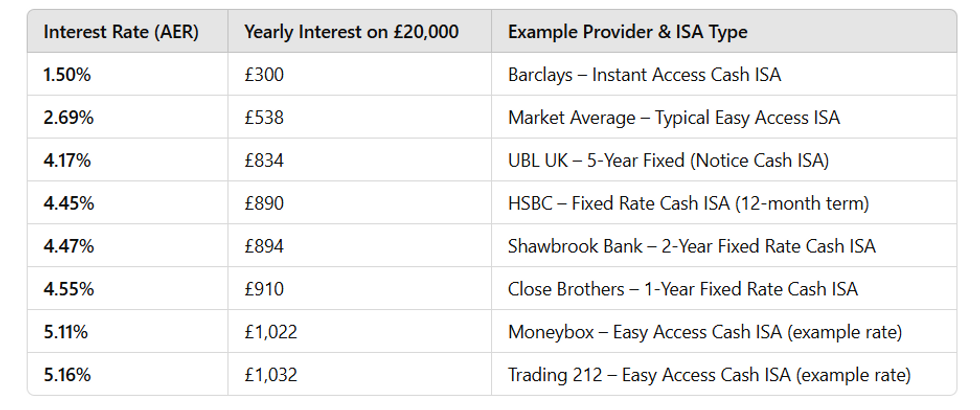

Examples of tax free Isa earnings in the UK if you had £20,000 in the Isa | GBN

Examples of tax free Isa earnings in the UK if you had £20,000 in the Isa | GBNThis prolonged freeze amplifies the impact of fiscal drag, drawing more taxpayers into higher brackets as wages rise with inflation. Savers face additional pressure as the government will impose elevated income tax rates on interest earned outside ISA wrappers.

However, individuals aged 65 and above retain exemption from the new restrictions, preserving their ability to contribute the full £20,000 annual allowance to cash ISAs.

"The ISA reforms are made worse for savers since tax thresholds will be frozen for an additional three years until 2030-31, heightening the effects of fiscal drag, and means more people are now at risk of exceeding their respective savings allowances," Mr Trokoudes noted.

"Additionally, there is salt in the wound after the Government announced that higher rates of income tax will be applied to savings that sit outside of an ISA."

Post-Budget analyst from investment platform InvestEngine found that millions of British savers could face higher tax bills under the new cash ISA allowance of £12,000.

Based on the latest HMRC data, there are around 13.3 million cash ISA holders in the UK with 7.1 million paying into their accounts during the 2022/23 financial year. Notably, more than a quarter of this group saved more than £12,000; around two million people.

As such, around 15 per cent of cash ISA holders could soon face tax on their interest if they exceed the personal savings allowance, as any interest-earning additional savings would need to be placed in taxable accounts.

The personal savings allowance is currently £1,000 for basic-rate taxpayers, levied at 20 per cent, and £500 for higher-rate taxpayers, charged at £500, while additional rate taxpayers receive none.

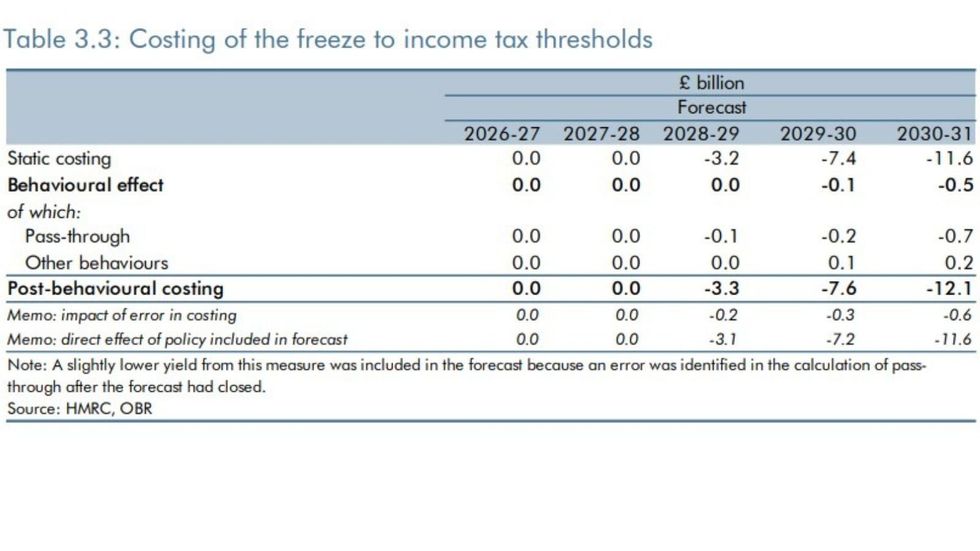

How much money will the income tax threshold freeze bring to the Treasury? | OBR / HMRC

How much money will the income tax threshold freeze bring to the Treasury? | OBR / HMRC Andrew Prosser, the head of Investments at InvestEngine, explained: "Our analysis shows that almost 1.5 million basic-rate taxpayers and just under half a million higher-rate taxpayers deposited more than £12,000 into their cash ISA in the last financial year; now that the allowance has been cut down to £12,000 they will need to find somewhere else for this cash for anything over that amount.

"If they were to put that £8,000 - the difference between £20,000 and the new £12,000 limit - into a 4.5 per cent savings account, after 5 years, a basic-rate taxpayer will have lost around £288 in tax, while a higher-rate taxpayer could lose around £1,080, or £216 a year once their total savings interest exceeds the £500 allowance.”

"Our analysis shows that millions of savers regularly deposit more than £12,000 a year into Cash ISAs. This cut to the allowance could push many into paying unnecessary tax on their savings interest.

"However, while the cut is undoubtedly a blow for those who were planning to save more than £12,000 into a cash ISA, now is a good opportunity for those who have not invested before to consider it as a way of reaching their financial goals. By shifting part of their allowance - anything over £12,000 - into a stocks & shares ISA, savers can preserve the tax benefits of the full £20,000 limit while giving their money a chance to benefit from inflation-beating growth."

More From GB News