Savings alert: Britons could earn £600 a year boost if they 'say no' to common habit

Reform UK Spokesperson Ann Widdecombe reacts to GB News' analysis revealing that the UK economy is currently in a worse position than in the 1970s |

GB NEWS

New analysis is shining a light on how households can make serious savings

Don't Miss

Most Read

Latest

Britons could make significant savings of nearly £600 annually if they cut down on non-essential activities, new research has found.

Adults are forking out approximately £600 each year attending social gatherings they would rather avoid, according to fresh findings from savings app Spring.

The research uncovered that individuals typically spend £591 annually on obligatory social commitments they feel compelled to accept.

This study, which surveyed 2,000 adults, discovered that workplace functions, group dining experiences, festive celebrations, nuptials and birthday gatherings rank amongst the most common unwelcome social commitments.

Britons can make significant savings by cutting down on spending

|GETTY

Nearly two-thirds of participants reported experiencing pressure to agree to expensive social arrangements, creating significant financial strain for many households across the UK.

Work-related meals and drinks topped the list at 25 per cent, followed by group restaurant outings at 21 per cent.

Christmas festivities accounted for 19 per cent of unwanted commitments, whilst weddings and birthday celebrations represented 18 per cent and 17 per cent respectively.

Nearly half of those surveyed confessed to raiding their savings accounts to fund these obligations, withdrawing an average of £260 for a single event.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Britons are looking to boost their savings | GETTY

Britons are looking to boost their savings | GETTYThe impact on personal finances proved substantial, with 43 per cent of those who touched their savings subsequently reducing their own spending.

More than a third never replenished their savings accounts, whilst 29 per cent missed financial targets they had been pursuing.

The consequences reach far beyond immediate finances, with one in five respondents reporting that social spending obligations prevented them from purchasing property.

Travel plans suffered for 36 per cent, whilst 13 per cent postponed starting a family and 12 per cent delayed marriage.

MEMBERSHIP:

- POLL OF THE DAY: Would shutting all migrant hotels put an end to the protests? VOTE NOW

- Reform 48 hours away from locking horns with Labour in two key battlegrounds as Rachel Reeves joins the fight

- MAPPED: The 'sanctuary cities' supporting asylum seekers - and how many are Labour-run - do YOU live in one?

- I was hit by 'anti-racist' campaigners at a migrant protest, but the hate-filled mob won't silence

- GB News - Sophie ReaperTrump just took a sledgehammer to the Kremlin and exposed Starmer's hand. This changes everything - Lee Cohen

Millennials face particularly severe impacts. The research shows 42 per cent have postponed holidays, while 27 per cent have delayed property purchases and 25 per cent have deferred career breaks.

By comparison, merely eight per cent of Generation X and five per cent of Baby Boomers reported delaying home ownership, with even smaller percentages postponing career breaks at three per cent and five per cent, respectively.

LATEST DEVELOPMENTS:

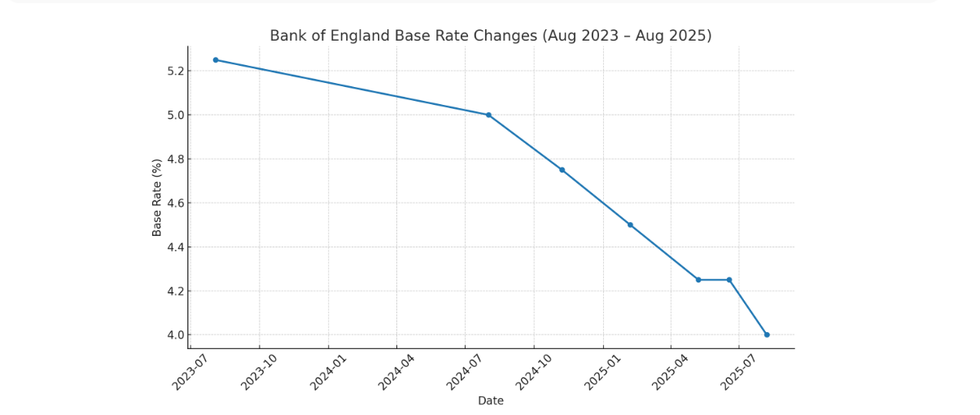

How has the UK base rate changed over the last two years? | CHAT GPT

How has the UK base rate changed over the last two years? | CHAT GPT Derek Sprawling, Head of Money at Spring, stated: "At Spring, we believe everyone should feel empowered to prioritise their own financial goals without guilt, especially with so many respondents highlighting the challenges it posed to their savings.

"Whether it's saving for a home, a family, or to go travelling, it's important that people feel confident saying no when spending doesn't align with their priorities."

Spring's research aimed to highlight the financial pressures surrounding social commitments.

The company provides a 4.30 per cent annual equivalent rate on accessible savings through its app, which connects to existing bank accounts without imposing charges or withdrawal restrictions.

More From GB News