Santander slashes mortgage rates in a win for homeowners

Interest rates have soared in recent years with banks like Santander beginning to cut rates in a boon for mortgage holders

Don't Miss

Most Read

Latest

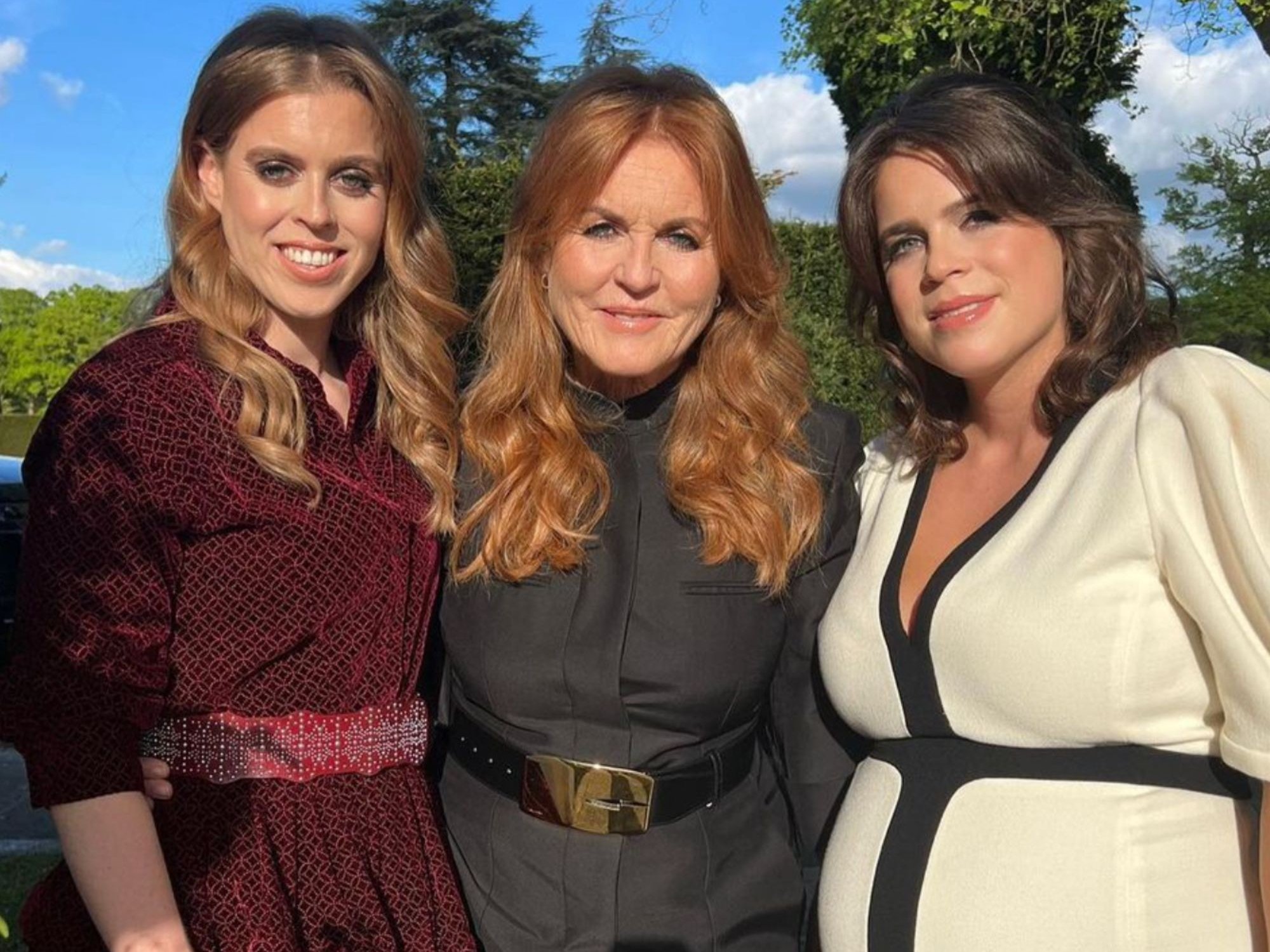

Santander has announced another wave of reductions across its line of mortgage products.

From today, the high street lender is slashing select fixed rates for its purchase, remortgage and buy-to-let range.

Furthermore, the bank is launching a new range of buy-to-let two-year tracker mortgage products, up to 75 per cent loan-to-value (LTV).

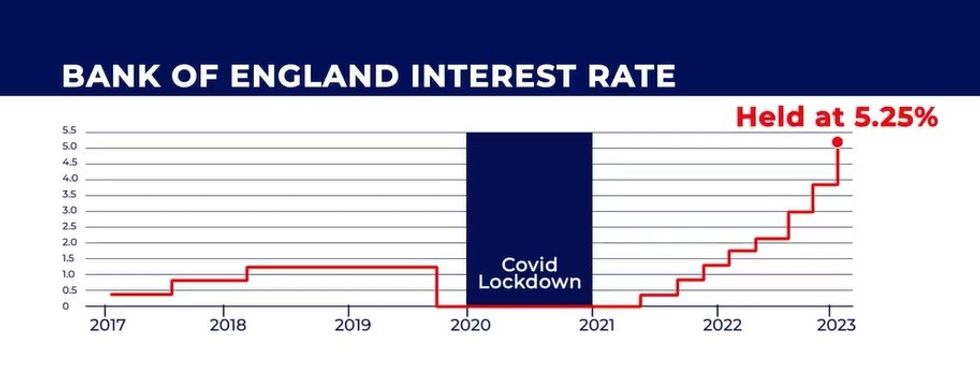

In recent years, mortgage holders have been saddled with soaring repayments costs due to the impact of rising interest rates.

The Bank of England’s Monetary Policy Committee (MPC) has opted to hike the base rate to 5.25 per cent in a bid to ease inflation.

Despite the Consumer Price Index (CPI) rate falling to 3.4 per cent in February 2024, rates have been held at this level since August 2023.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Santander is cutting mortgage rates once again

|GETTY

Some banks and building societies, including Santander, are taking action now to cut rates to entice customers.

A full list of the high street bank’s new interest rates across its range of mortgage products can be found by visiting Santander’s website.

Here are examples of the five-year fixed mortgage rates that have been cut as of today:

- 85 per cent LTV five-year fixed rate residential purchase mortgage with no product fee is now priced at 4.79 per cent, down from 4.89 per cent

- 90 per cent LTV five-year fixed rate residential purchase mortgage with no product fee is now priced at 4.99 per cent, down from 5.23 per cent.

Here is a breakdown of some of the two-year fixed-rate mortgage products which are now on offer from Santander:

- 85 per cent LTV two-year fixed rate residential remortgage with a £999 fee is now priced at 5.58 per cent, down from 5.73 per cent

- 90 per cent LTV two-year fixed rate residential remortgage with a £999 fee is now priced at 5.78 per cent, down from 5.94 per cent.

Following today’s announcement, Santander’s new buy-to-let tracker mortgage range includes the following products:

- 60 per cent LTV two-year tracker rate at 5.60 per cent with a £1,749 remortgage or purchase fee.

- 75 per cent LTV two-year tracker rate at 5.84 per cent with a £1,749 remortgage or purchase fee.

Rachel Springall, finance expert at Moneyfactscompare, outlined why moving to a fixed rate deal could be “cost-of-effective” for mortgage holders.

She explained: “Despite rising fixed rates, the incentive to refinance with a fixed rate mortgage is a sensible option when the average Standard Variable Rate (SVR) is over eight per cent.

LATEST DEVELOPMENTS:

The Bank of England has held the base rate at 5.25 per cent | GB NEWS

The Bank of England has held the base rate at 5.25 per cent | GB NEWS“However, borrowers who will come off a two- or five-year fixed rate this year may be paying between 2.50 per cent and up to three per cent more in interest on their mortgage on average.

“Indeed, in April 2022, the average two-year fixed mortgage rate was 2.86 per cent, and in April 2019 the average five-year fixed mortgage rate was 2.88 per cent.

“Seeking advice is a wise choice to help navigate all the deals available and to work out which one would be the most cost-effective option.”

The next base rate announcement from the Bank of England’s MPC will take place on May 9, 2024.