Rachel Reeves hit with 'Liz Truss-era' bond market warning as borrowing costs surge

Andrew Pierce issues grave warning to Keir Starmer after ‘throwing Rachel Reeves under a bus’ |

GB NEWS

Analysts are sounding the alarm that Rachel Reeves faces difficult choices in this year's Budget

Don't Miss

Most Read

Chancellor Rachel Reeves has been hit with "Liz Truss-era warning" over her handling of the UK economy from the bond markets ahead of her Autumn Budget statement later this year.

UK Government bonds have experienced their most dramatic sell-off in decades, pushing long-term Britain's borrowing costs to levels unseen since the late 1990s.

Yesterday (September 2), the UK's 30-year gilts climb to 5.68 per cent, marking the highest point since 1998. This sharp increase in yields translates directly into elevated borrowing costs for the Treasury.

While long-term borrowing costs have surged for most other countries, financial markets appear to be sending a signal about their expectations for fiscal discipline from the Chancellor.

Bond markets are sending a 'Liz Truss-style warning' to the Chancellor, analysts claim

|PA

Analysts cite the spectre of former Prime Minister Liz Truss's short-term tenure in Downing Street, which triggered a market crash in the fallout of her mini-Budget.

"The markets are making their view brutally clear," states Nigel Green, chief executive of deVere Group, a major global financial advisory firm.

"The message from the bond market is the same as the one that humiliated Liz Truss: fiscal credibility cannot be fakes."

"Reeves will have no choice but to deliver tough measures—either tax rises, spending cuts, or both—if she wants to prove that Britain's debt can fall in line with her fiscal rules," Green added.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

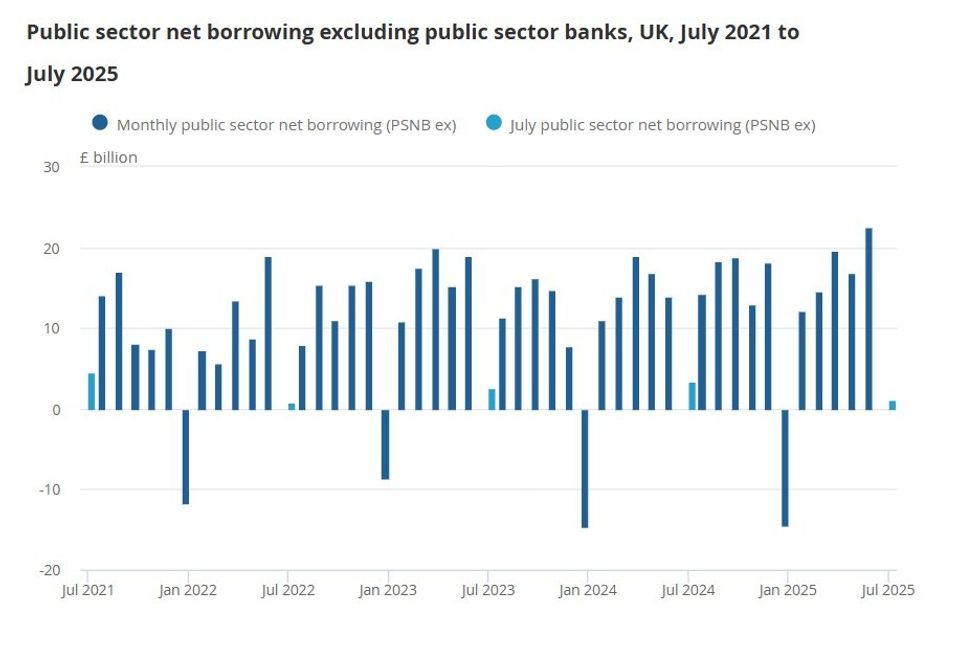

How much did Britain borrow? | ONS

How much did Britain borrow? | ONSAmerican fiscal policy has contributed significantly to global bond market instability, particularly through expansive tax reduction programmes and increased spending commitments that could add substantial amounts to the US deficit.

Long-dated Government bonds have faced selling pressure throughout Europe, whilst America's benchmark 10-year Treasury yield has approached its highest levels in 17 years.

"These pressures are not confined to Britain, but the UK is especially exposed because of its debt profile and its recent history," Mr Green said.

"Investors still have the scars of the Truss-Kwarteng debacle. They will punish any hint of unfunded promises or fiscal sleight of hand.

MEMBERSHIP:

- Nigel Farage 'handed golden opportunity with Britain's migrant crisis - but faces one major challenge'

- REVEALED: The five biggest scandals Reform's Doge unit has uncovered since crowbarring open councils

- While Lucy Connolly languished, a far more sinister plot was underway to capture our courts - Robert Courts

- An unlikely Washington-Rylan Clark tie-up just triggered an extinction-level event for Labour - Lee Cohen

- POLL OF THE DAY: Has the small boats crisis changed how you will vote at the next General Election? VOTE NOW

"Every percentage point higher on long-term borrowing costs drains billions from the Treasury's coffers. That is money that cannot be spent on public services, tax relief, or investment."

Financial markets have witnessed a dramatic flight to safety, with precious metals experiencing exceptional gains. Gold prices reached an unprecedented $3,508 per ounce on Tuesday, whilst silver exceeded $40 for the first time since 2011.

"The rally in gold tells its own story," Mr Green noted.

"Investors are hedging against fiscal irresponsibility, currency weakness, and the erosion of trust in political systems. The parallel moves in bonds and gold highlight the fragility of the global financial environment."

LATEST DEVELOPMENTS:

Long-term borrowing costs are on the rise

| GETTYMs Reeves's commitment to reducing debt as a proportion of gross domestic product (GDP) within five years faces immediate scrutiny from financial markets.

"The credibility of that rule is already in doubt," the chief executive stated. "The bond market is effectively testing whether she has the courage to take politically toxic decisions."

Any reduction in welfare spending would encounter substantial political resistance, whilst tax rises would prove equally contentious for the Labour government. "Without credible action, the UK risks another market revolt," Green cautions.

The upcoming Budget represents more than routine fiscal planning. "Reeves' Budget will not just be a fiscal event. It will be a credibility test in front of global investors," Green concludes. "The bond market has already delivered its warning. If Britain ignores it, the consequences will be swift and severe."

More From GB News