SHOCK graphs reveal the truth about the terrible taxes coming - and how Rachel Reeves could have avoided them

An exclusive new report debunks the excuses Rachel Reeves will make for the economic pain she's about to inflict

Don't Miss

Most Read

A bombshell new report reveals why the Chancellor will be forced to break her own fiscal promises and announce broad-based tax rises in her upcoming Budget.

It comes days after Rachel Reeves said the Government is “constrained by its promise” after Labour’s general election manifesto pledged not to increase VAT, national insurance or income tax.

She blamed the fiscal mess she inherited from the previous government for the widely-feared tax rises coming down the chute.

However, a new report by Brexit Facts4EU and The Campaign for an Independent Britain (CIBUK), shared exclusively with GB News, suggests it didn't have to be thus, and the dire economic straits Britain finds herself in are largely of Labour's own making.

TRENDING

Stories

Videos

Your Say

The report's co-author Sir John Redwood, cites how the Chancellor failed to mention any spending reductions that could have mitigated the need for broad-based taxes, with the former MP for Wokingham and a former Secretary of State for Wales also noting that there was no mention of how the Chancellor plans to "recoup lost productivity".

He said: “When Rachel Reeves gave her pre-Budget Budget speech she looked like a lonely hostage, made to say she will raise taxes by the socialists who had taken her prisoner. There was no word about spending reductions despite the obvious waste. There was no news on how she will recoup lost productivity, though the poor management of the public sector is ripping off taxpayers on an industrial scale. The money sink that is the HS 2 project, the huge losses of the Bank of England, the needless surrender of Chagos with a dowry for Mauritius are a few examples of needless spending.

“How on earth does she think the public will respond to a second higher-tax, economy-crushing budget?”

Below, a series of charts highlight the scale of Labour's economic mismanagement.

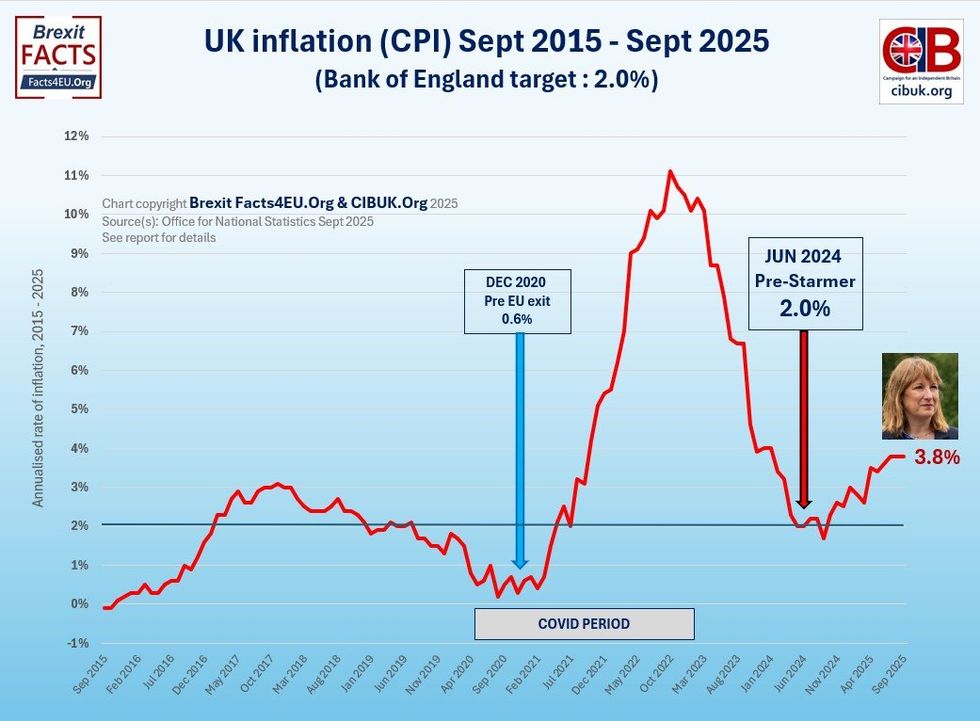

What has happened to inflation, and why? Does it explain Rachel’s threatened tax rises?

A graph demonstrating UK Inflation (CPI) Sept 2015 - Sept 2025

|Brexit Facts4EU and The Campaign for an Independent Britain

“Inflation is already much lower than the double digits seen under the previous government,” Ms Reeves said earlier in the week. She also implied that the UK’s high inflation was somehow due to Brexit on her recent trip to Saudi Arabia. The facts tell a very different story, however.

In 2015, the year before the referendum, inflation was already increasing. This existing upward trend continued until 2017.

While it was rising, it never reached the level under Ms Reeves, currently sitting at 3.8 per cent, and after 2017 it steadily fell down to 0.6 per cent.

It then rose steeply as Covid measures hit the economy hard, but after a monstrous peak of 11.1 per cent, it fell for 7 consecutive quarters.

Ms Reeves therefore inherited the desired rate of 2.0 per cent in June 2024 - currently (Sept 2025), the rate stands at 3.8 per cent, clearly far above the target.

Simply put, the tax rises cannot be pinned onto Brexit, and inflation has only reached its current high level since she became Chancellor.

If tax rises are due to inflation, then Ms Reeves might want to look at the inflationary effects of her own policies, including the large rise in National Insurance contributions at the last budget.

Everyone is talking about tax rises, but if costs were cut we wouldn’t need tax rises

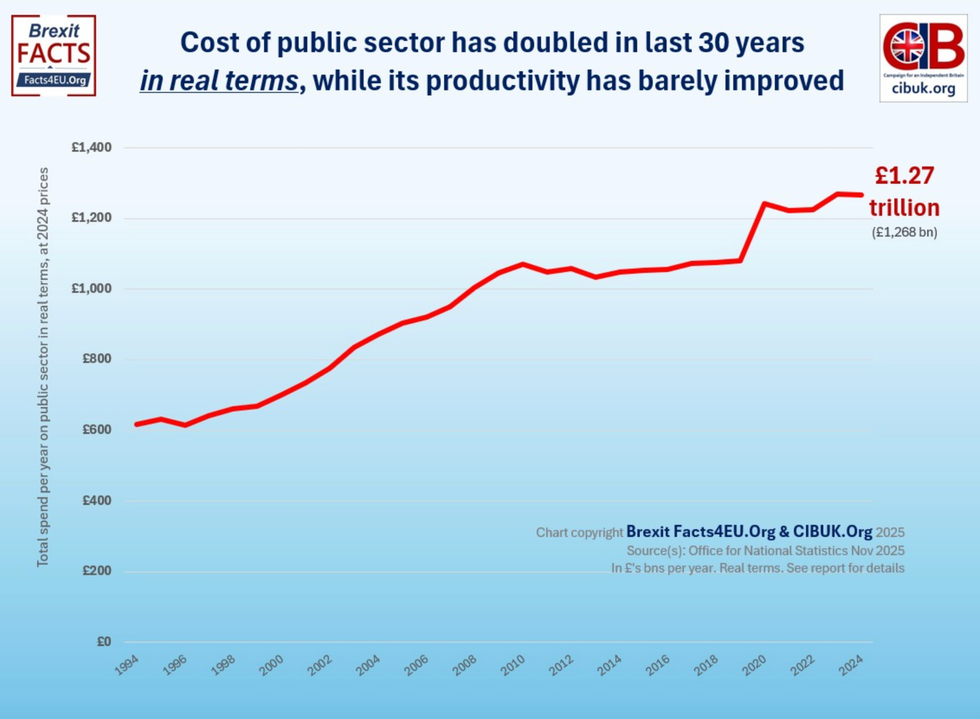

The graph above demonstrates how public sector spending has risen, in real terms, in the last 40 years.

We have heard a lot about the possible taxes which might increase. What we have not heard about, though, are any cost-saving measures as possible ways of avoiding the so-called "black hole" in the country's finances.

If Ms Reeves cut just 2.5 per cent from public sector spending, that could save £33billion per year. This, according to many of the rumours, would cover the so-called "black hole".

According to the Office for Budget Responsibility: "In 2024-25, we expect public spending to amount to £1,278.6billion, which is equivalent to around £45,000 per household, or 44.4 per cent of national income."

So, if you live in an average household, the public sector is costing you “around £45,000 per year”. Despite this seemingly enormous amount per household, representing a total of approximately £1.28 trillion pounds this year, we have yet to hear Ms Reeves talking about where major savings can be made.

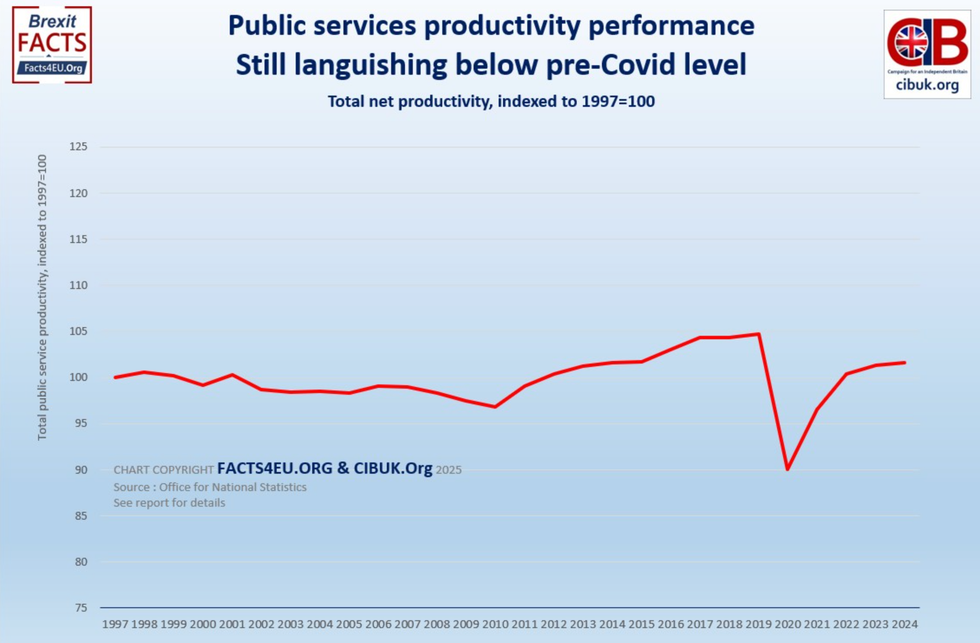

Despite spending doubling, productivity has not been rising

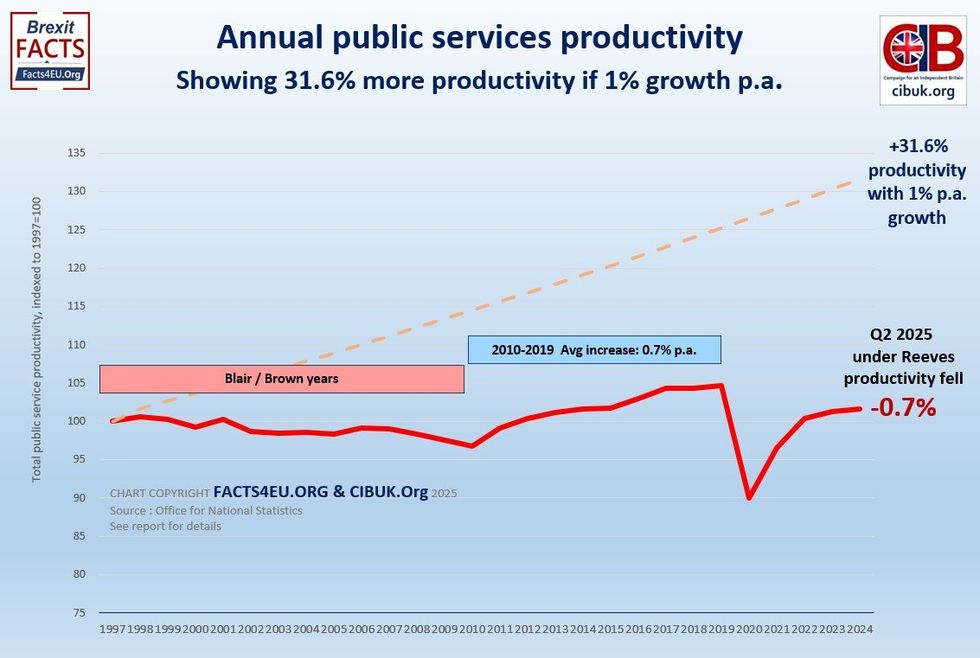

A graph showing the annual public services productivity

|Brexit Facts4EU and The Campaign for an Independent Britain

The above graph shows the official figures for public service productivity from the ONS. This clearly shows a poor performance for many years, but in the years leading up to Covid this had been improving.

The chart crucially shows where we would be if we had had a nominal growth of just 1.0 per cent per year in the productivity of our public services.

All that extra money invested by the British taxpayer, and we have very little to show for it. The dotted line on this chart shows that nearly 32 per cent extra productivity could have been achieved.

Despite this, the Chancellor does not seem interested in talking about cutting costs and increasing productivity; the talk all seems to be about raising taxes.

If the Chancellor should pursue this line and break a firm manifesto promise, there will clearly be electoral consequences. The only conclusion that can be drawn is that she is prevented from cutting costs by her MPs. Given that the alternative is raising taxes again, this is unlikely to go down well.

Unfortunately, the productivity level has not recovered since Covid and growth appears to be tailing off since Labour swept to power.

In the latest quarterly figures released this month, there has been a 0.7 per cent drop in public service productivity under Ms Reeves.

The above graph conveys a sense of this lacklustre performance.

It clearly shows how spending on the public sector has increased dramatically over the last 30 years, while productivity has remained sluggish.

More From GB News