Rachel Reeves plots tax hikes as Britons 'fear' Budget 2025 - full list of FIVE HMRC raids coming your way

The Chancellor is due to give her Autumn Budget on November 26 with tax hikes expected to be a major factor

Don't Miss

Most Read

Chancellor Rachel Reeves is widely expected to break Labour's manifesto promise to not raise income tax in the upcoming Autumn Budget, with a speech set to be delivered later this morning about the issue.

Anxiety about potential income tax increases has emerged as the primary concern ahead of the Budget, with 16% of the public identifying it as their biggest worry, according to a Hargreaves Lansdown.

The apprehension is particularly pronounced among younger demographics and wealthier individuals, affecting 20 per cent of Millennials and 25 per cent of those paying higher rate tax.

Outside of income tax, what other ways could HM Revenue and Customs (HMRC) generate more revenue for the Treasury and who in Britian will be expected to pay the bill.

Rachel Reeves is preparing to raise taxes - what will you have to pay?

|GETTY / PA

Income tax rise on basis rate

Sarah Coles, head of personal finance at Hargreaves Lansdown, said: "An income tax hike is the most feared change in the Budget worrying 16 per cent of people, 20 per cent of Millennials, and 25 per cent of higher rate taxpayers. As the speech creeps ever-closer, the chatter around income tax has intensified."

Treasury modelling from June 2025 indicates that adding a single penny to the basic rate would generate £6.9billion in 2026/7, rising to £8.25billion the following year.

For typical earners, such an increase would prove costly. Those on £35,000 annually would pay an additional £224, whilst someone earning £55,000 would contribute £377 more each year.

The prospect of income tax generating nearly a third of Government revenue makes even modest adjustments potentially lucrative for the Treasury.

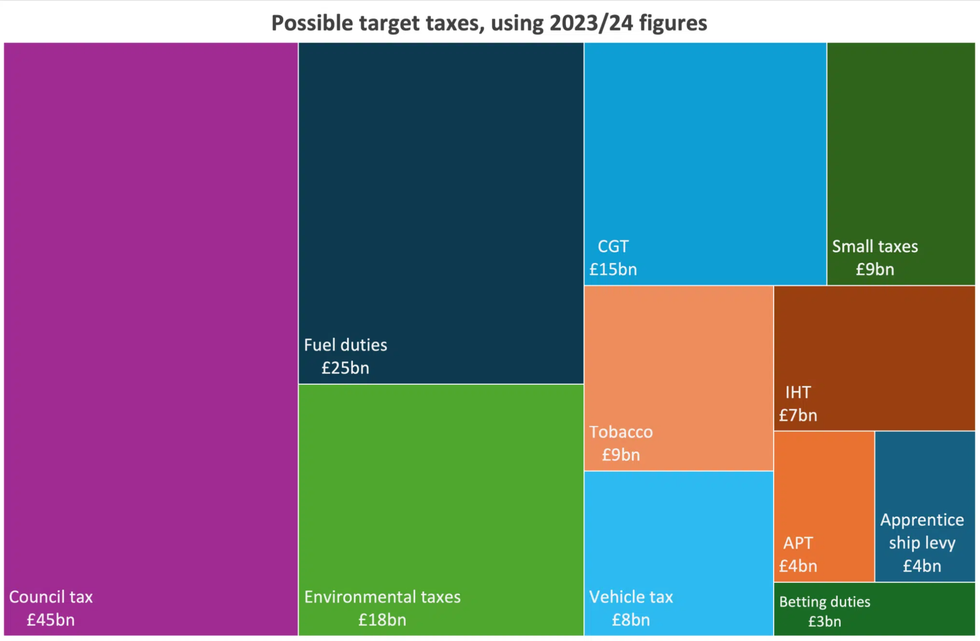

Possible target taxes the Government could use to fill the "£22 billion black hole" in public finances | Tax Policy Associates

Possible target taxes the Government could use to fill the "£22 billion black hole" in public finances | Tax Policy AssociatesIncome tax rise on higher rate

Targeting only higher earners presents a different scenario, with Treasury estimates showing an additional penny on the higher rate would yield £1.6billion in 2026/7, increasing to £2.15billion by 2027/28.

Those earning below £35,000 would remain unaffected, whilst someone on £55,000 would pay £47 more annually.

Reports suggest the Treasury might define working people as those earning under £46,000, potentially allowing higher rate increases without breaching manifesto commitments.

Universal income tax rise

A universal penny increase across all bands would cost a £35,000 earner £224, rising to £424 for those on £55,000, based on Hargreaves Lansdown's research.

Frozen tax allowances

Current arrangements already guarantee rising tax bills, with thresholds frozen until 2028, though speculation suggests this freeze could be extended further.

Should wage growth continue at four per cent, an individual earning £51,000 by April 2028 would face an additional £1,530 in tax payments if bands remain static for two extra years.

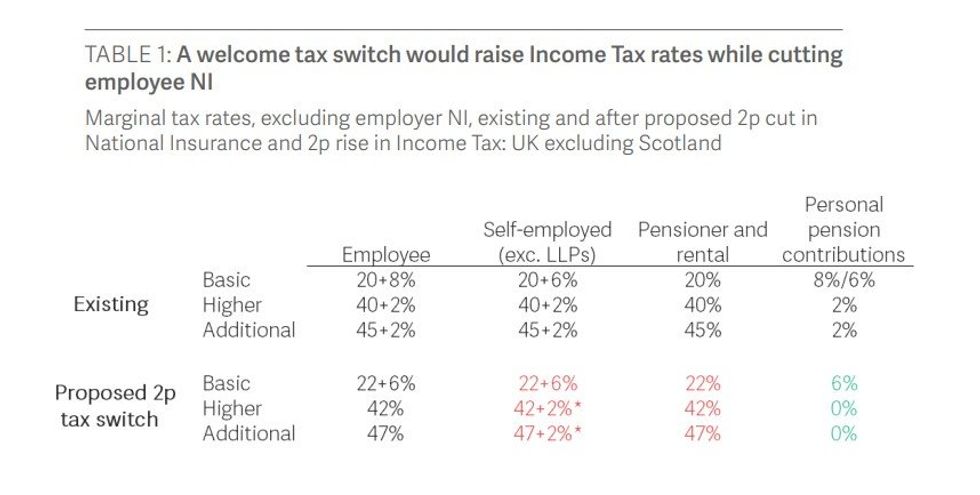

Taking 2p off National Insurance and adding to income tax

The Resolution Foundation has proposed transferring 2p from National Insurance to income tax, potentially raising £6billion whilst technically avoiding impact on working-age employees.

However, this would affect pensioners, landlords and the self-employed, with someone receiving £35,000 in pension income facing an additional £449 annually.

The Government is being called to cut National Insurance, while raising income tax

|RESOLUTION FOUNDATION

How should taxpayers prepare?

Hargreaves Lansdown recommends increasing pension or SIPP contributions offers an effective method for reducing overall taxable income, potentially keeping earners below critical tax thresholds.

This approach not only cuts current tax liability but strengthens retirement provisions, with contributions benefiting from relief at the contributor's highest tax rate.

Cash ISAs provide shelter for savings interest from any elevated tax rates, whilst strategic planning using both cash and stocks and shares ISAs alongside pensions creates flexibility for managing retirement income. Since ISA withdrawals remain tax-free, they offer valuable options for controlling future tax exposure.

Married couples and civil partners can reduce their combined tax burden by transferring income-generating assets to the partner paying lower rates, ensuring both individuals maximise their personal allowances.

More From GB News