Rachel Reeves slammed for failing to deliver pension certainty for savers

Ministers confirm no guarantee on tax-free pension withdrawals or relief

Don't Miss

Most Read

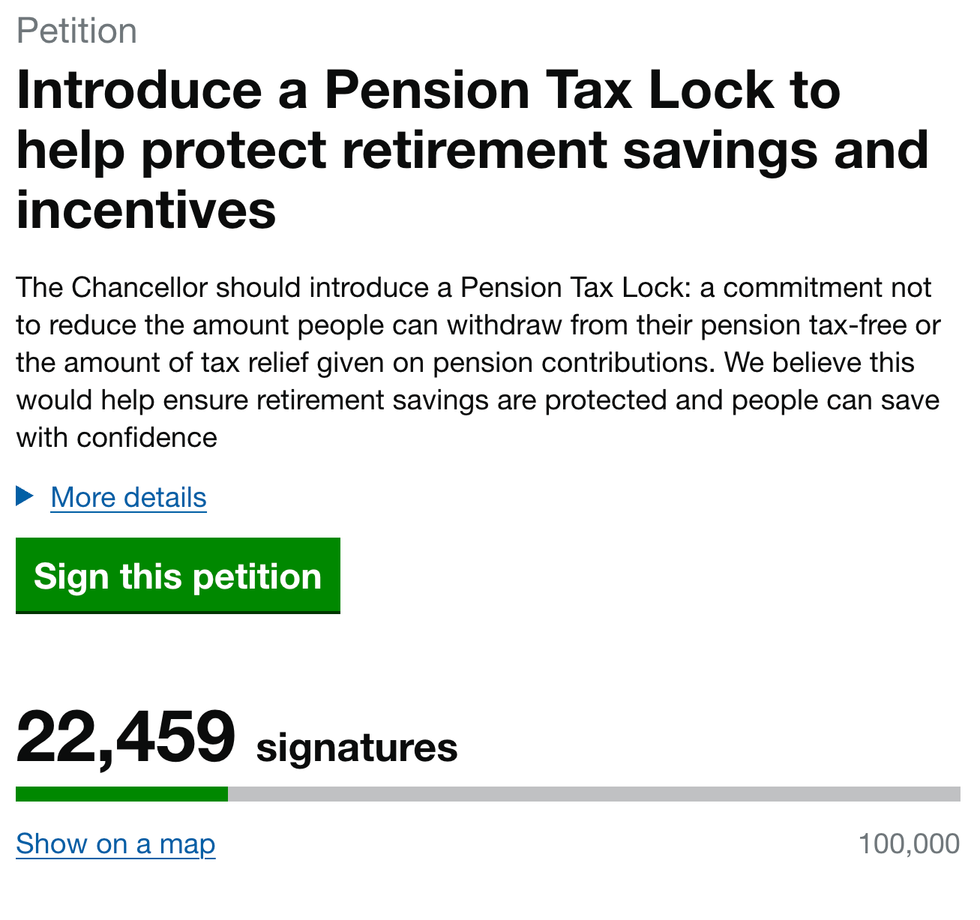

The Treasury has confirmed it will not introduce a Pension Tax Lock, despite a public petition attracting more than 22,000 signatures calling for the measure.

A revised Government response, published on December 10 and released publicly today, states that ministers do not intend to commit to protecting pension tax rules from future change.

In the fallout, AJ Bell criticised Rachel Reeves for "failing to deliver much-needed certainty for pension savers".

The petition called on the Labour Chancellor to guarantee tax-free pension withdrawals would not be reduced and tax relief on pension contributions would not be cut.

TRENDING

Stories

Videos

Your Say

In its updated response, the Treasury said it keeps all tax matters under review as part of the annual Budget process and in the context of the public finances.

The clarification followed criticism from MPs on the Commons Petitions Committee.

In November, the committee rejected the Treasury’s initial response, saying it failed to directly address the core request for a Pension Tax Lock.

The committee subsequently asked ministers to issue a clearer and more direct answer.

Treasury confirms no Pension Tax Lock despite petition with over 22,000 signatures

|GETTY

The revised statement confirms the Government does not plan to introduce such a guarantee.

The petition was registered on October 1 and argued a Pension Tax Lock would cost the Exchequer nothing while providing savers with greater certainty when planning for retirement.

Supporters of the proposal said it would help boost confidence in long-term pension saving by ending speculation about future tax changes.

The Treasury’s original response, issued on October 22, declined to comment on possible tax changes or speculation ahead of future Budgets.

LATEST DEVELOPMENTS:

Petition to introduce a pension tax lock to help protect retirement savings and incentives

|GOV.UK

On November 5, the Petitions Committee said the response did not adequately address the request and required a revised answer.

The updated response confirmed pension taxation would continue to be reviewed through Budget decisions rather than fixed by a long-term commitment.

Tom Selby, director of public policy at AJ Bell, said the decision leaves pension savers without certainty.

"Despite two bites at the cherry, after fellow MPs rejected the Treasury's first attempt to dodge the question, Rachel Reeves has comprehensively failed to deliver much-needed certainty for pension savers by rejecting calls to commit to a Pension Tax Lock."

He said the Government’s position contrasted with its stated aim of encouraging pension saving.

"The government says it wants to encourage pension saving and insists it understands the need for promoting confidence in pension saving," he added.

The decision not to introduce a lock leaves speculation about future pension tax changes unresolved.

Mr Selby said this uncertainty could persist until the next general election.

"Having overseen one of the leakiest Budgets in living memory, the government must be well aware it has created the conditions for speculation."

He said successive Budgets could continue to prompt rumours about changes to pension tax incentives, and that this could influence how and when people access their pensions.

The Treasury said pensions tax relief remains one of the most expensive personal tax reliefs and totalled £78billion in the 2023/24 tax year.

Under current rules, pension savers can usually withdraw up to 25 per cent of their pension pot tax-free.

This is capped at £268,275 for most individuals.

Rachel Reeves unveiled the salary sacrifice changes in the Autumn Budget | GB NEWS

Rachel Reeves unveiled the salary sacrifice changes in the Autumn Budget | GB NEWS At the Autumn Budget, ministers announced changes to salary sacrifice arrangements for pension contributions.

Under those plans, National Insurance exemptions on pension contributions will be capped at £2,000 a year from April 2029.

The Treasury said it is conducting a two-phase review of the pensions system.

This includes work by the Pensions Commission, chaired by Baroness Jeannie Drake, alongside Sir Ian Cheshire and Professor Nick Pearce.

The Government said the review is intended to strengthen retirement outcomes and improve confidence in pension saving.

Despite the Treasury’s position, Mr Selby said savers should focus on long-term planning.

He said decisions about pensions should be based on individual retirement goals rather than speculation about potential tax changes.

The Treasury said it would continue to consider pensions policy as part of wider fiscal decision-making.

Our Standards: The GB News Editorial Charter

More From GB News