Pension warning: Retirees face 'frustrating' 24-day wait for savings payments over Christmas

A pension warning has been issued to millions of savers

Don't Miss

Most Read

Latest

Analysts are sounding the alarm that pensioners face an up to 24-day wait for pension savings over the Christmas season which could result in "real frustration for savers" in the weeks ahead.

My Pension Expert has issued an urgent warning to Britons that millions of savers face significant delays when transferring their pension pots during the festive period this year.

According to analysis from the firm's Retirement Fairness Index, the time required to complete transfers jumps considerably in December, reaching 24 days compared to an annual average of just 18.

This near-week-long extension means most people initiating transfers now will not see their funds move until January at the earliest; potentially impacting how much older households can spend ahead of Christmas Day.

New research is shining light on pension savings transfer delays

|GETTY

The advisory firm cautions that countless savers risk being left in uncertainty throughout the Christmas period, unaware that the system experiences its greatest slowdowns precisely when financial reliability matters most.

On top of this, My Pension Expert's data revealed that some retirement savings transfers face extreme delays, with the longest recorded case taking 244 days – more than eight months.

Should similar delays occur now, affected savers might not see their pensions transferred until August 2026. Those with modest savings face disproportionate waiting times.

Transfers involving pots worth less than £40,000 average 20.4 days to complete, while those between £40,000 and £80,000 take approximately 18.5 days in comparison.

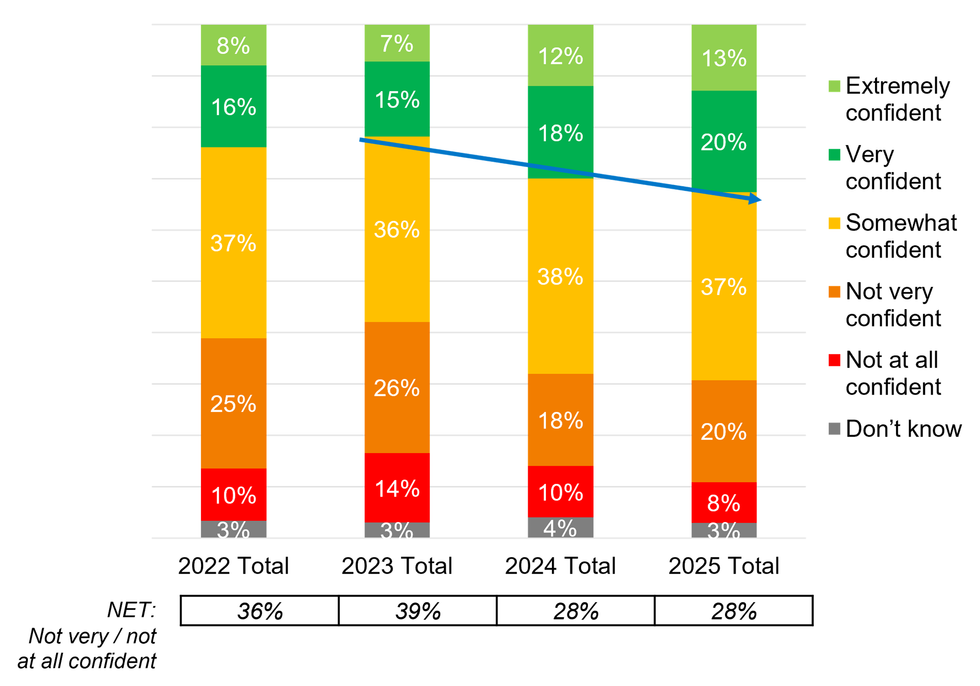

How confident are Britons about their pension savings? | AEGON

How confident are Britons about their pension savings? | AEGON Workplace pension holders experience the most significant delays, with transfers from these schemes averaging 25.7 days – substantially longer than the overall mean.

Lily Megson-Harvey, the policy director at My Pension Expert, broke down what older Britons should expect if they attempt to complete a pension savings transfer in the coming days.

She explained: "December puts real pressure on household budgets and it is often a moment when people want clarity over their pension. However, our data shows that transfer times are highest during the Christmas period, which we know can be a real frustration for savers.

"Anyone planning a move or withdrawal should speak to their provider and give themselves as much time as possible over this period. Greater transparency and accountability from providers would go a long way to easing these pressures and giving people confidence that their pension is being handled fairly.

"What matters is that people feel supported to make decisions with confidence. Access to clear information and affordable advice can also make a huge difference, helping savers stay in control and plan ahead even when the system is under strain.”

Last week, the Financial Conduct Authority (FCA) confirmed plans were underway to improve Britain's pension transfer regime with a new consultation into the process being launched.

The financial services regulator plans to introduce transfer timelines and formal recognition of digital signatures to remove unnecessary friction, reduce harmful delays, and ensure consumers can move their pensions quickly and securely.

Lisa Picardo, chief business officer UK at PensionBee, commented: "The FCA’s proposals to enforce a consistent 10 working day response time and to mandate the acceptance of digital signatures are long-overdue steps that help modernise the industry and ensure customers no longer suffer from outdated, paper-based processes.

Pension savers are waiting weeks for pot transfers to be completed

| GETTY"The industry has been plagued by excessively slow transfer times, inconsistent practices, and providers that routinely reject perfectly valid digital signatures. These reforms set a clear and enforceable expectation: consumers should be able to move their pensions efficiently, securely and without unnecessary friction.

"With mandated 10-day response times, ceding firms will need to build operational efficiency into their processes, reducing the pervasive delays that undermine consumer trust and cause harm.

"And with the widespread adoption of digital signatures, the dreaded ‘wet signature’ - a long-standing cause of transfer stagnation - finally looks set to become a thing of the past."

More From GB News