Inheritance tax raid looms as Rachel Reeves confirms 'biggest Budget fear' for thousands of Britons

Chancellor Rachel Reeves announces changes to wider inheritance tax rules, after controversial measures last year affecting farmers |

GB NEWS

Are you at risk of paying more inheritance tax after the Chancellor's Budget?

Don't Miss

Most Read

Latest

Chancellor Rachel Reeves confirmed the "biggest Budget tax fear" for thousands of households as more Britons are at risk of being "pushed" into paying inheritance tax (IHT).

During yesterday's fiscal statement to the House of Commons, Ms Reeves confirmed the current freeze to personal tax thresholds will be extended three more years until 2031.

As a result of this, more taxpayers will be pulled into higher tax brackets due to the impact of fiscal drag, which occurs when incomes rise during a period of time when thresholds are frozen.

Notably, IHT thresholds will also be impacted by this decision with thousands of estates, including possessions, savings and property, likely to be pulled into the levy's purview.

The Chancellor has confirmed the 'biggest Budget fear' for thousands

|GETTY

Inheritance tax is charged on the estates of individuals who have passed away if their combined assets are valued above £350,000 at a rate of 40 per cent, with pensions set to be made liable for this levy from 2027.

Under this policy, the IHT threshold remains fixed at £325,000, with the residence allowance staying at £175,000 until 2031, extending a freeze that was previously scheduled to end in 2030.

Treasury receipts from inheritance tax soared to an unprecedented £8.2billion during the 2024/25 financial year, according to official figures from HM Revenue and Customs (HMRC).

Sarah Coles, head of personal finance at Hargreaves Lansdown, broke down why more families should prepare for a potential IHT in the years to come with the Chancellor's Budget decisions.

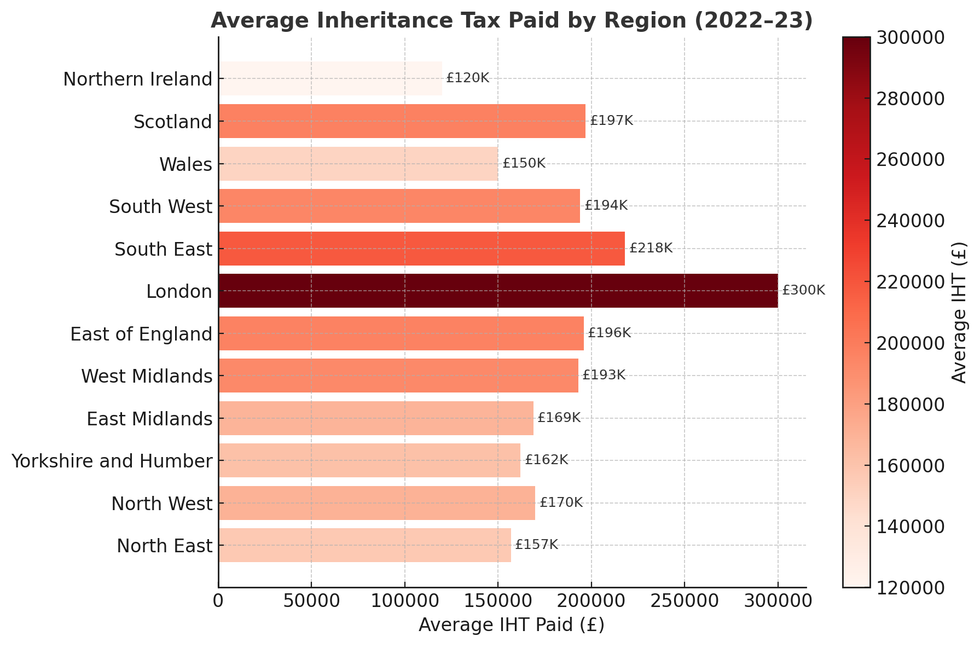

Average Inheritance tax paid by region | CHATGPT/ONS

Average Inheritance tax paid by region | CHATGPT/ONSShe shared: "The nil rate band was introduced in April 2009, while the residence nil rate band hasn't moved since April 2020, so they already both have significantly less value thanks to inflation since."

Rising property prices and investment valuations are driving more estates above these frozen thresholds, subjecting them to the 40 per cent levy, Ms Coles highlighted.

The inheritance tax freeze has sparked particular anxiety amongst older generations, with research revealing that 13 per cent of Baby Boomers identified increased IHT as their "biggest Budget fear".

This figure emerged from a survey of 2,000 individuals conducted by Opinium for Hargreaves Lansdown in October 2025 ahead of the Chancellor confirming her changes to the tax regime.

"Nobody likes the idea of the taxman dipping into your pockets after you've died, so today's news won't be welcome," the savings analyst observed.

"If you’re worried about the impact of these changes, it might make sense to consider whether you can give away any gifts during your lifetime in order to cut your tax bill."

According to Ms Coles, households should consider utilising the £3,000 annual gift allowance and making larger gifts that fall outside estates after seven years.

Furthermore, parents might also consider Junior ISAs, which count as immediate gifts for inheritance tax purposes whilst remaining inaccessible until children reach 18 years old.

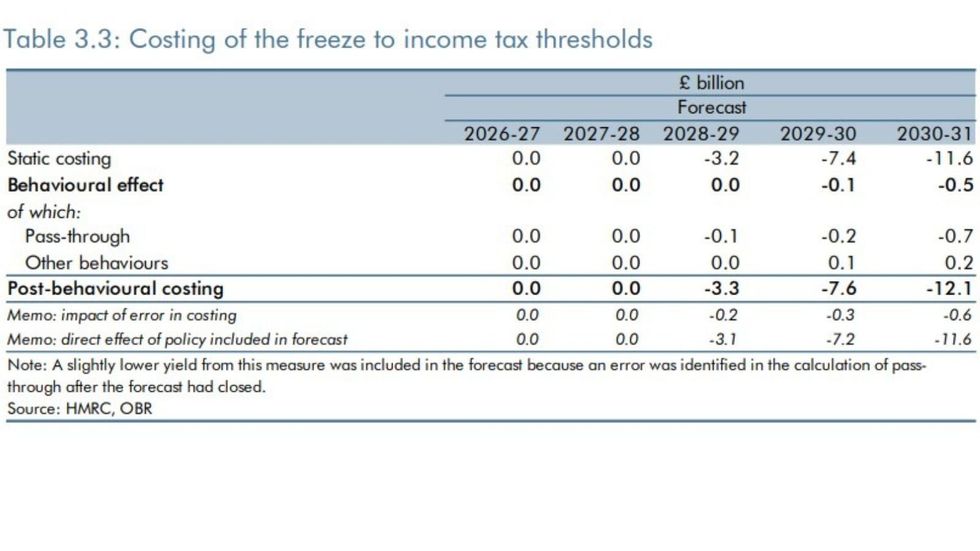

How much money will the income tax threshold freeze bring to the Treasury?

|OBR / HMRC

Mike Ambery, retirement savings director at Standard Life, part of Phoenix Group, stated: "The Government's decision to extend the freeze on income tax thresholds until 2031 represents one of the most significant stealth tax rises in recent years."

The income tax threshold freeze, introduced by former Conservative Chancellor Jeremy Hunt, was initially said to have been implemented as a short-term policy.

"Originally introduced as a temporary measure, the freeze - combined with wage growth and inflation - will steadily push more earners into higher tax bands, reducing take-home pay and increasing the importance of tax-efficient saving," Mr Ambery explained

GB News readers can find out how much they will save or lose a year from the Chancellor's tax reforms by using our free calculator.

More From GB News