Rachel Reeves under fire over 'double whammy' National Insurance raid as businesses hit by 'stealth tax'

Rachel Reeves announced an increase in Employers’ national insurance contributions in last years budget

|GB NEWS

An analyst has warned that the increase in employers' National Insurance contributions could harm businesses

Don't Miss

Most Read

Businesses face a significant financial burden following changes to employer National Insurance contributions which combine higher rates with substantially reduced payment thresholds.

The point at which employers must begin paying these contributions has dropped dramatically from £9,100 to £5,000 per employee.

This "double whammy" tax raid means companies must now pay National Insurance on a much larger portion of their workers' salaries whilst simultaneously facing an increased contribution rate.

The combined effect creates what Jim Moore, employee relations expert at HR consultants Hamilton Nash, described as a "double-whammy for employers already grappling with wage pressures, higher borrowing costs and energy bills".

The modifications to the Employment Allowance may provide some relief for the smallest businesses.

**Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.**

Reeves remains under fire from economists for increasing employer's National Insurance contributions

|GETTY

However, companies with larger workforces confront substantially higher employment expenses that compound existing financial pressures from multiple directions.

The hospitality industry faces particularly severe consequences from these changes, with establishments operating on extremely narrow profit margins finding the additional costs especially challenging.

"These increases add further strain to already wafer-thin margins in some sectors, especially hospitality," Mr Moore said.

This comes after Kate Shoesmith, deputy chief executive of the Recruitment & Employment Confederation, previously warned: "Hiring in retail and hospitality is down. Employers in these sectors are pausing due to cost pressures and uncertainty around employment law."

Nearly two-fifths of companies employing workers under 21 report that recent National Insurance contribution changes have substantially increased their employment expenses , despite younger employees being technically exempt from these measures.

"This will be a bitter pill for an economy crying out for growth, and a potential nail in the coffin for hospitality businesses already barely able to stay afloat," Mr Moore stated.

"Some employers are already planning redundancies to offset these costs, while others are restructuring to outsource functions or pivoting towards self-employed contractors."

The changes threaten not only expansion plans but the very existence of establishments that have weathered previous economic challenges.

Companies have begun implementing various strategies to manage the increased National Insurance burden, with some already initiating job cuts and redundancies.

Businesses struggle to meet the rising costs

|GETTY

Rather than maintaining traditional employee relationships, firms increasingly favour contractor arrangements that avoid National Insurance obligations entirely.

These adaptations extend beyond simple cost-cutting measures to wholesale operational restructuring.

Businesses that previously relied on direct employment now explore outsourcing entire departments or converting roles to self-employed positions.

Mr Moore outlined that the government is making a mistake in punishing businesses through what he labelled, "stealth tax increases".

LATEST DEVELOPMENTS

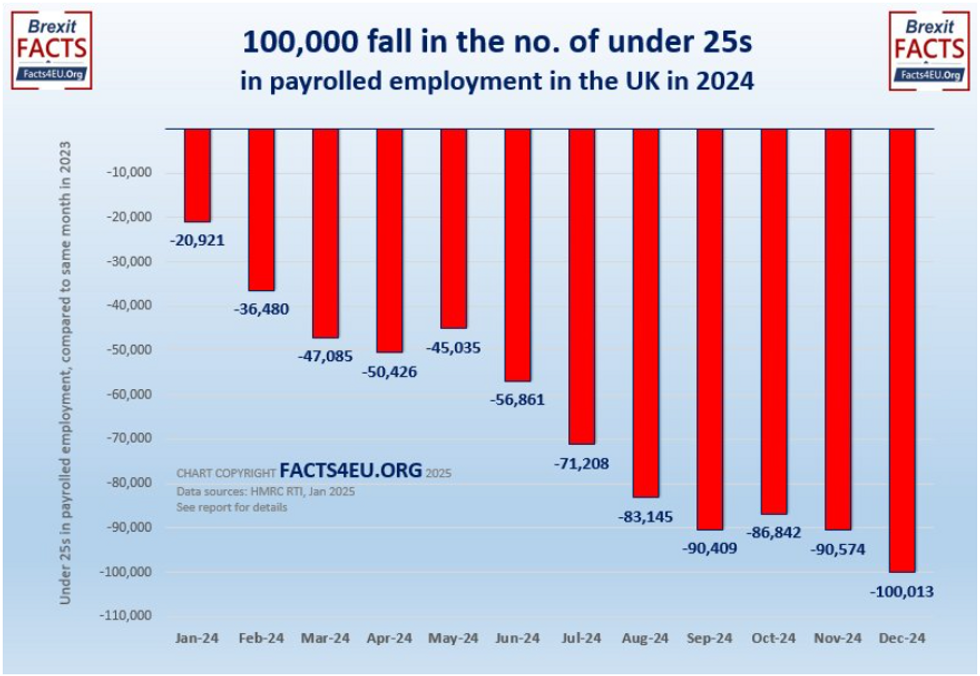

The fall in 16-24 year olds in payrolled employment over the last year | Facts4EU

The fall in 16-24 year olds in payrolled employment over the last year | Facts4EU"If a struggling business increases prices to cover rising costs, but the customer is unwilling or unable to pay more, you just lose customers. Ironically, the price increase therefore causes your revenue to go down, not up - and you go under," he explains.

This comparison highlights how the Government's approach to raising revenue through employment taxes may ultimately reduce the tax base by forcing businesses to shed workers or cease operations.

The broader economic consequences extend beyond individual businesses to threaten overall growth prospects.