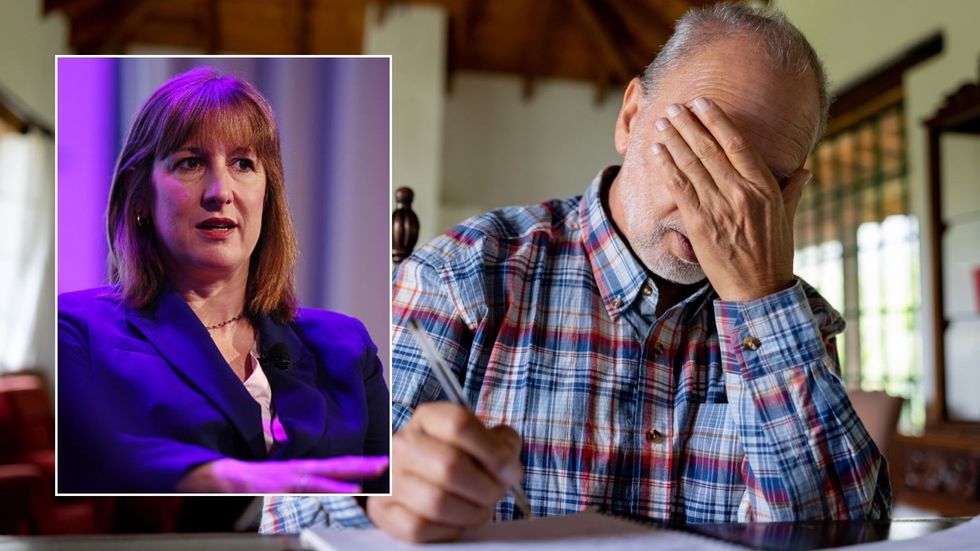

Hiring plans fall to record lows as Rachel Reeves' tax raid fears grip UK employers

Labour's history of economic woes and recessions |

GBNEWS

Businesses scale back recruitment to record lows outside pandemic amid tax fears

Don't Miss

Most Read

Britain’s job market has taken a sharp hit, with hiring dropping to record lows.

Businesses are being squeezed by rising National Insurance costs and growing economic worries ahead of the autumn Budget.

New data shows employer confidence in recruitment is now close to the lowest levels since the pandemic. Only one in four companies expect to add staff in the next three months.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

The steep drop reflects growing concern among businesses facing major payroll cost hikes from recent tax changes.

Several industry surveys show the same gloomy trend, with private sector hiring plans at their weakest since records began in 2016, apart from the pandemic.

Rising employment costs, global uncertainty, and expected regulatory shifts have led many firms to freeze recruitment.

The latest KPMG and REC jobs report gave a reading of 40.0 for permanent staff appointments in July, slightly up from June’s 39.1. Any score below 50 indicates a slowdown, confirming another month of falling recruitment across the UK.

Jon Holt, group chief executive and UK senior partner at KPMG, stated: "The labour market cooled in July as chief execs held back from increasing their recruitment budgets."

He added: "Economic uncertainty, the complexities of AI adoption and global headwinds are all weighing on business planning."

The survey revealed that recruiters consistently identified diminished economic confidence and rising payroll expenses as primary drivers behind the recruitment slowdown.

Rachel Reeves's National Insurance hike is being blamed for the recent job figures | GETTY

Rachel Reeves's National Insurance hike is being blamed for the recent job figures | GETTY Whilst engineering maintained relatively stable employment levels, the data highlighted persistent declines in retail and hospitality hiring.

The CIPD's comprehensive survey of 2,000 companies revealed that merely 57 per cent of private sector organisations intended to recruit personnel within the next three months, representing the lowest figure since the survey's inception in 2016, apart from pandemic lockdowns.

This marks a substantial decline from 65 per cent recorded in autumn 2024, when 34 per cent planned recruitment during the pandemic's peak.

A separate CIPD metric, calculating the difference between firms planning expansion versus those reducing staff, reached near-record lows at nine percentage points in July.

James Cockett, senior labour market economist at the CIPD, observed that business confidence was "faltering further under rising employment costs," with particular impact on sectors traditionally providing crucial early career opportunities.

Economists have also warned that recent tax changes could limit business growth and affect jobs | GETTY

Economists have also warned that recent tax changes could limit business growth and affect jobs | GETTY The retail and hospitality industries have borne the brunt of the recruitment freeze, with vacancies in these sectors declining steeply during July as cost pressures intensified.

Kate Shoesmith, deputy chief executive of the Recruitment & Employment Confederation, warned: "Hiring in retail and hospitality is down. Employers in these sectors are pausing due to cost pressures and uncertainty around employment law."

Nearly two-fifths of companies employing workers under 21 report that recent National Insurance contribution changes have substantially increased their employment expenses, despite younger employees being technically exempt from these measures.

The BDO audit firm's survey corroborated these findings, noting that tax and minimum wage rises had already constrained labour budgets, with firms "preparing for further cost exposure ahead of the Autumn Statement."

Starting salary inflation decelerated for the second consecutive month, reaching its lowest point since March 2021, according to the KPMG and REC data.

Figures suggest there could be potential rises in unemployment rates

| GB NEWSThis wage growth slowdown coincides with Bank of England projections indicating further moderation in pay increases throughout the year, alongside potential rises in unemployment rates.

Jon Holt from KPMG noted that "Many firms will continue to pause major investment decisions until there is greater clarity in the autumn."

Kate Shoesmith, REC deputy chief executive, commented: "With starting salaries and temporary pay rising only modestly, it was right to cut interest rates last week."

She emphasised: "More action like this, to stabilise the business cost-base, is what will support growth and boost the jobs market this year."

More From GB News