Pound FALLS against US dollar and FTSE 100 in red as Rachel Reeves tax rises 'inevitable'

GB NEWS

Analysts are sounding the alarm over growing debt burden in the UK, US and Europe as the Chancellor's fiscal headroom continues to shrink

Don't Miss

Most Read

The British pound is currently slipping against the US dollar amid ongoing concerns about borrowing costs, with the currency on track for its worst day in almost three months.

This morning, the UK's 30-year gilt yield jumped to 5.672 per cent in early trading, over the previous 27-year high set in April, adding further pressure to Chancellor Rachel Reeves ahead of this year's Autumn Budget

Sterling has dropped more than one per cent against the greenback with the currency being famously sensitive to movements in sentiment towards the bond market.

So far, the pound has lost nearly 1.5 per cent and fallen to around $1.34. If this trends continues, this would represent the largest one-day fall since mid-June.

The British pound has fallen against the dollar amid a recent spike in borrowing costs

|GETTY / TRADING VIEW

In response to gilt yields, the FTSE 100 opened at loss of 0.3 per cent. This is in line with movements in European markets, with Germany's DAX and Italy's MIB both slipping upon open.

As trading opened, the FTSE 100 index went down 40 points, or -0.43 per cent, at 9156 points. This is a notable drop from the record high of 9,357 points set last month.

Among the fallers were UK-focus stocks, including retailers such as Marks & Spencer, which slipped 3.6 per cent and housebuilders Taylor Wimpey, falling 3.4 per cent.

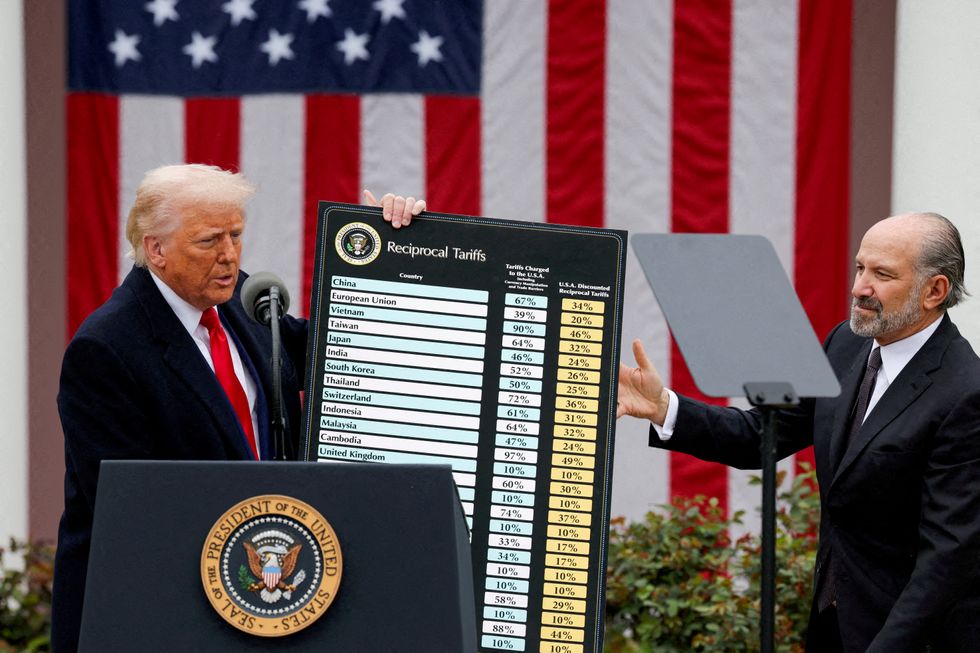

Outside of bond market concerns, traders are likely to be concerned around the ongoing volatility resulting from US President Donald Trump's sweeping tariff agenda, which has impacted most countries' economies.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

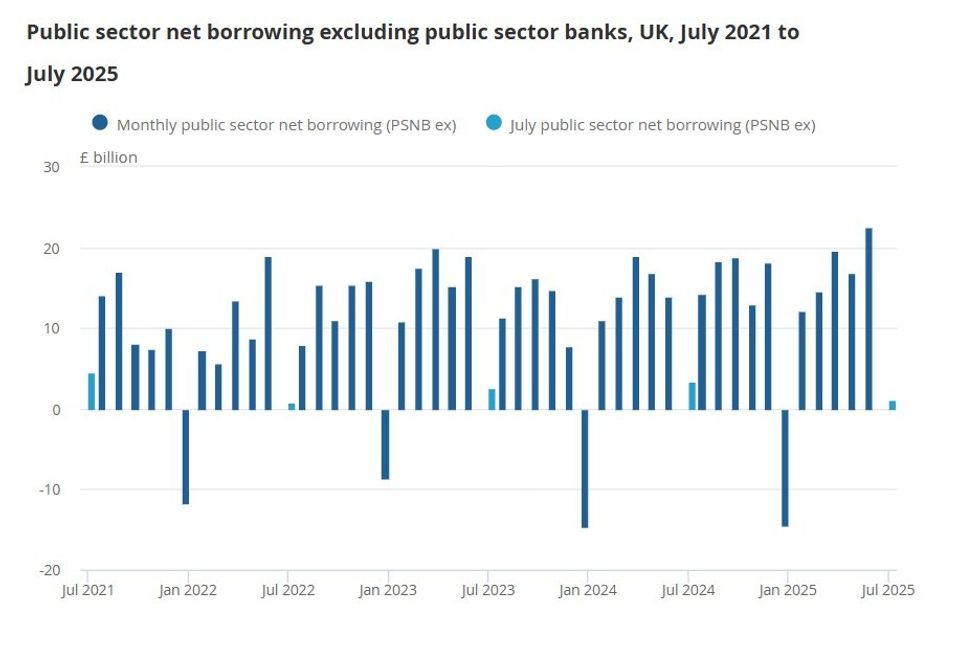

How much did Britain borrow? | ONS

How much did Britain borrow? | ONSOvernight, US Treasury Secretary Scott Bessent shared with reporters that that he believes the Supreme Court will uphold Donald Trump’s taxes on imports coming from other countries.

Last night, a lower court in the US ruled that the Trump administration's way of implementing tariffs is illegal, which could be a major blow to the White House's economic agenda.

Mr Reuters asserted that the President has other options on the table if he is unable to take advantage of a 1977 emergency powers law to impose sweeping tariffs on most trading partners

Analysts have placed blame on US tariffs for sparking widespread market volatility with the taxes commonly being cited as exacerbating the Great Depression in the 1930s.

The legal to-and-fro affects Trump's 'Liberation Day' tariffs on imports from most US trading partners | REUTERS

The legal to-and-fro affects Trump's 'Liberation Day' tariffs on imports from most US trading partners | REUTERSThis latest hurdle for the Labour Government to tackle comes amid a recent reshuffle at Number 10 with Prime Minister Keir Starmer appointing Minouche Shafik, the former Bank of England deputy governor, as his new chief economic adviser.

Earlier this morning, Mohit Kumar, chief economist at investment bank Jefferies International, gave a damning assessment of the British economy's current state.

Mr Kumar said: "Fiscal concerns are being felt in the UK as well with 30 year gilt yields close to the highest level since 1998. The recent economic reshuffle in the government did little to ease investor concerns and is seen as undermining Chacellor Reeves.

"Tax rises are inevitable, but we are reaching a stage where further tax rises could become counterproductive.

LATEST DEVELOPMENTS:

"So far the Government has shied away from difficult decisions on spending cuts which would be required to bring the fiscal picture back in order. We remain negative on the UK long end and continue to favour steepeners along the curve."

Neil Wilson, UK investor strategist at Saxo Markets, added: "The market move was a sign that investors do not have confidence the Treasury will stick to its strict borrowing rules.

"Long-dated gilt yields are now trading close to 27-year highs again with the 30-year above 5.6 per cent.

"30yr yields at their highest in almost three decades is not a good look for the Labour government, and underscores that there is little fiscal or economic credibility left."