UK borrowing costs hit 27-year-high and are now higher than GREECE - fears for mortgage holders

'Rinsing every drop from the British economy!' Rachel Reeves skewered by GB News guest as Chancellor branded 'desperate' |

GB NEWS

The Chancellor is expected to give next fiscal statement sometime in the next few months

Don't Miss

Most Read

Latest

Britain's long-term cost of borrowing has skyrocketed to its highest level in 27 years, placing further pressure on Chancellor Rachel Reeves ahead of her Autumn Budget later this year.

Notably, the country's long-term borrowing costs are now higher than that of Greece, which was infamously pushed into a series of severe spending cuts to bring down its spending.

As well as a concern for traders and the Treasury, Britain's ballooning debt is an additional fear for everyday Britons with mortgage repayments as costs are likely to surge.

Yesterday (September 1), the interest rate attached to the UK's 30-year debt jumped as high as 5.646 per cent, which comes just under the 27-year high of 5.649 per cent seen during trading on April.

Borrowing costs continue to grow in another headache for the Chancellor

|GETTY / CNBC

This morning, the 30-year gilt yield has risen to 5.672 per cent in early trading, over the previous 27-year high set in April. Analysts note this risks removing any potential fiscal headroom needed by the Chancellor in her upcoming statement, which is expected to be announced to Parliament in late October-early November.

In reaction, Deutsche Bank economist Jim Reid said: "Even in orderly markets, we’re seeing a slow-moving vicious circle: rising debt concerns push yields higher, worsening debt dynamics, which in turn push yields higher again."

This move from traders comes after Downing Street's latest reshuffle, which saw Prime Minister Keir Starmer bring Ms Reeves's former deputy Darren Jones on as Chief Secretary.

As well as this, the Prime Minister brought on world-leading economist Minouche Shafik as his new chief economic adviser in Number 10. Mr Jones is replaced as chief Treasury secretary by James Murray, while Daniel Tomlinson has been promoted to a junior Treasury ministerial role.

Bond vigilantes appear to be putting pressure on the Labour after what they consider to be less-than-ideal policy changes, often by ignoring debt auctions or demanding higher rates of return before purchasing Government bonds.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

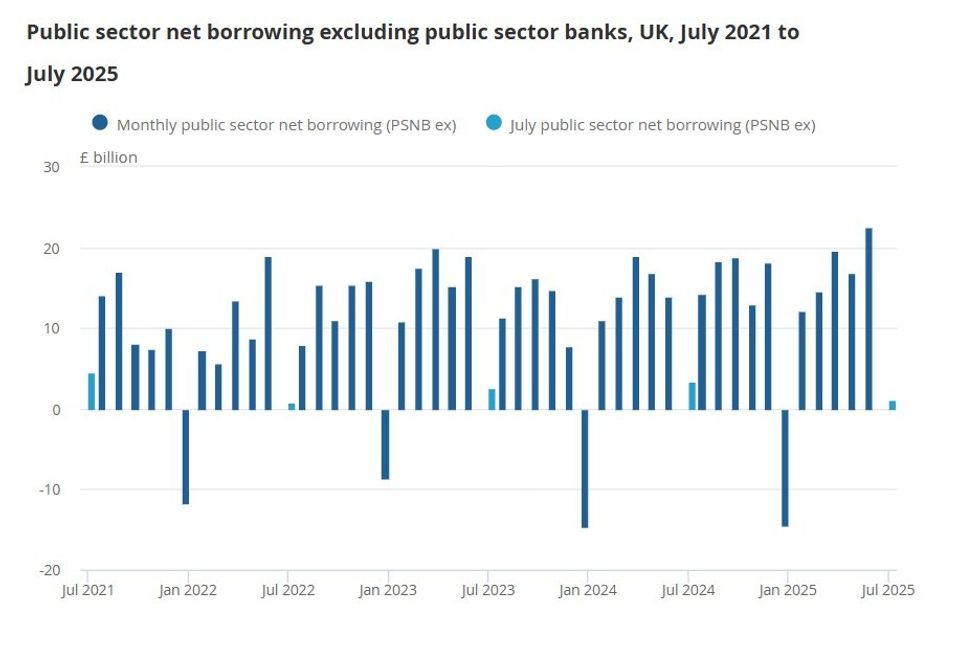

How much did Britain borrow? | ONS

How much did Britain borrow? | ONSGlobally, long-term borrowing costs have been hiked due to widespread fiscal concerns with September already being considered a tough period for the bond markets.

Speaking to clients, Deutsche Bank’s chief UK economist Sanjay Raja said: "At the risk of sounding a little dramatic, the Autumn Budget will be a defining moment for the UK. On our estimates, a fiscal hole worth GBP 20-25bn will need to be filled in November."

Kathleen Brooks, research director at XTB, described August was “dreadful” for UK bonds and highlighted the concerns many investors have ahead of Ms Reeves's fiscal statement.

She added: "This summer’s drip feed of potential tax rises has not gone over well with voters, and Labour has been hemorrhaging support to Reform in recent weeks. Essentially voters don’t want tax rises, while Labour backbenchers don’t want spending cuts, but something will have to give."

In mainland Europe, political turbulence in France has resulted in France's bond yields being pushed higher with concerns the Government could fall in the coming weeks.

Yesterday, French 30-year bond yields hit a multi-year high of nearly 4.5 per cent, widening the gap between the country's borrowing costs and Germany.

Economists from ING told clients: "The spread between French government bonds (OATs) and the German equivalent (Bunds) widened materially on the prospect of a confidence vote, and we still see the balance of risk tilted to further widening.

"The current 10Y spread is at a similar level to that seen in July 2024, when French President Emmanuel Macron called snap elections and OATs sold off significantly in response."

Anxieties among investors have been heightened in recent months following US President Donald Trump's sweeping tariff policies, which have hit both the UK and European Union.

As a result, gold has soared to an all-time high with traders opting to turn to precious metals as a safe haven for their money to avoid what is likely to be a period of high inflation.

LATEST DEVELOPMENTS:

Rachel Reeves's tax changes have proven to be controversial | PA

Rachel Reeves's tax changes have proven to be controversial | PALast week, Tom Stevenson, an investment director of Fidelity International, broke down the dilemma facing the British economy and what Ms Reeves will likely have to address.

He shared: "Meanwhile, over here, the rise in bond yields continues as investors fret about the sustainability of Britain’s government debts and persistent inflation, running at nearly twice the Bank of England’s target.

"The 30-year gilt yield is over 5.5 per cent and the inflation-linked bond is yielding more than at any time since 1998, higher even than after the 2022 mini budget.

"Rising debt servicing costs are just one more factor that will likely influence the Chancellor's decisions as part of the Autumn Budget."

More From GB News