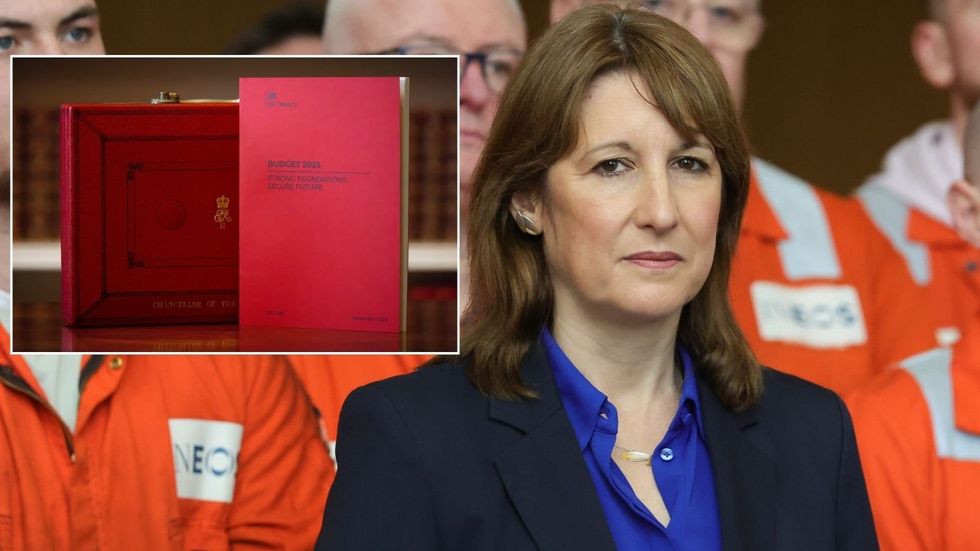

Rachel Reeves's ISA reforms slammed as 'made on the hoof' by industry leaders in explosive meeting

Investment firms have clashed with the Treasury over the ISA reforms

Don't Miss

Most Read

Senior investment industry figures have clashed with Treasury officials over controversial plans to overhaul Individual Savings Accounts (ISAs).

Executives from major financial institutions, including Lloyds Banking Group and Hargreaves Lansdown, attended a meeting with Treasury and HMRC officials on Tuesday to discuss proposals confirmed by the Chancellor in her November Budget.

Attendees warned the reforms were being rushed through without sufficient understanding of how retail investors behave.

Industry figures said the proposals risk discouraging people from investing in British companies rather than boosting domestic markets.

TRENDING

Stories

Videos

Your Say

One source present at the meeting told Sky News: "It became abundantly clear at the meeting today that significant reforms to ISAs are being made on the hoof with little understanding of how retail investors behave or the extent of potential unintended consequences."

Rachel Reeves confirmed in the Budget that changes to ISA rules will take effect from April 2027.

Under the plans, the annual tax-free allowance for cash ISAs will be reduced from £20,000 to £12,000.

The remaining £8,000 of the allowance would be reserved for stocks and shares investments.

Senior investment industry figures clashed with Treasury officials on January 13

|PA/GETTY

The Chancellor has said the reforms are intended to encourage more savers to invest in UK companies and support economic growth.

Treasury officials are also working on a series of so-called anti-circumvention measures designed to prevent savers from avoiding the new limits.

These measures include banning transfers from stocks and shares ISAs back into cash ISAs.

Officials are also considering rules to assess whether certain investments are too cash-like to qualify for the stocks and shares allowance.

Another proposal under discussion would involve charging interest on cash held within investment ISAs.

Industry leaders warned the proposals would significantly increase complexity for savers and providers.

They argued the reforms would disproportionately affect people approaching retirement age who are reducing risk by holding more cash.

Concerns were also raised that taxing cash held within investment ISAs could undermine public confidence in ISAs as a tax-free savings vehicle.

One industry source said the approach risked damaging the long-standing reputation of ISAs among cautious savers.

LATEST DEVELOPMENTS:

Financial experts advise channeling savings over £12,000 into stocks and shares ISAs | GETTY

Financial experts advise channeling savings over £12,000 into stocks and shares ISAs | GETTY Some firms have already withdrawn from a Government promotional campaign linked to the reforms, citing the cost and uncertainty created by the proposals.

Another source at the meeting said HMRC had been placed in a difficult position.

The source said: "HMRC has been put in an invidious position of trying to implement changes that are fundamentally flawed.

"Rather than rushing to do something which risks undermining retail investing, the chancellor should go back to the drawing board."

Despite the criticism, the Government has insisted the reforms are necessary to prevent savers from exploiting the new structure.

A Government spokesman said: "To encourage greater investment in stocks and shares, we’re developing changes to ISA rules which will prevent circumvention of the new lower cash ISA limit."

The spokesman said ministers would publish detailed guidance and continue working with the financial services sector ahead of implementation.

Ms Reeves is looking to encourage investment of cash back into the economy to help boost productivity

| GETTYOfficials argue the reforms are justified by the way ISAs are currently used.

In the 2023-24 tax year, savers invested a record £103billion into ISAs, of which, £70billion was placed into cash ISAs rather than stocks and shares products.

Government figures show this means around two-thirds of ISA savings were held in cash.

Treasury officials believe this trend limits the flow of investment into UK businesses and financial markets.

The Government has confirmed there will be a full consultation process before the reforms are finalised.

Draft legislation is expected to be published well in advance of the April 2027 start date.

Ministers say the consultation will allow firms and savers to respond to the detailed design of the new rules before they are brought before Parliament.

Our Standards: The GB News Editorial Charter

More From GB News