Bank of England boss issues warning about 'dangerous' move from Donald Trump

EJ Antoni warns Bank of England 'should be worried' over exit of gold to US |

GB News

The Governor of the Bank of England has issued a stark caution to parliamentarians regarding attempts to compromise the autonomy of central banking institutions

Don't Miss

Most Read

Latest

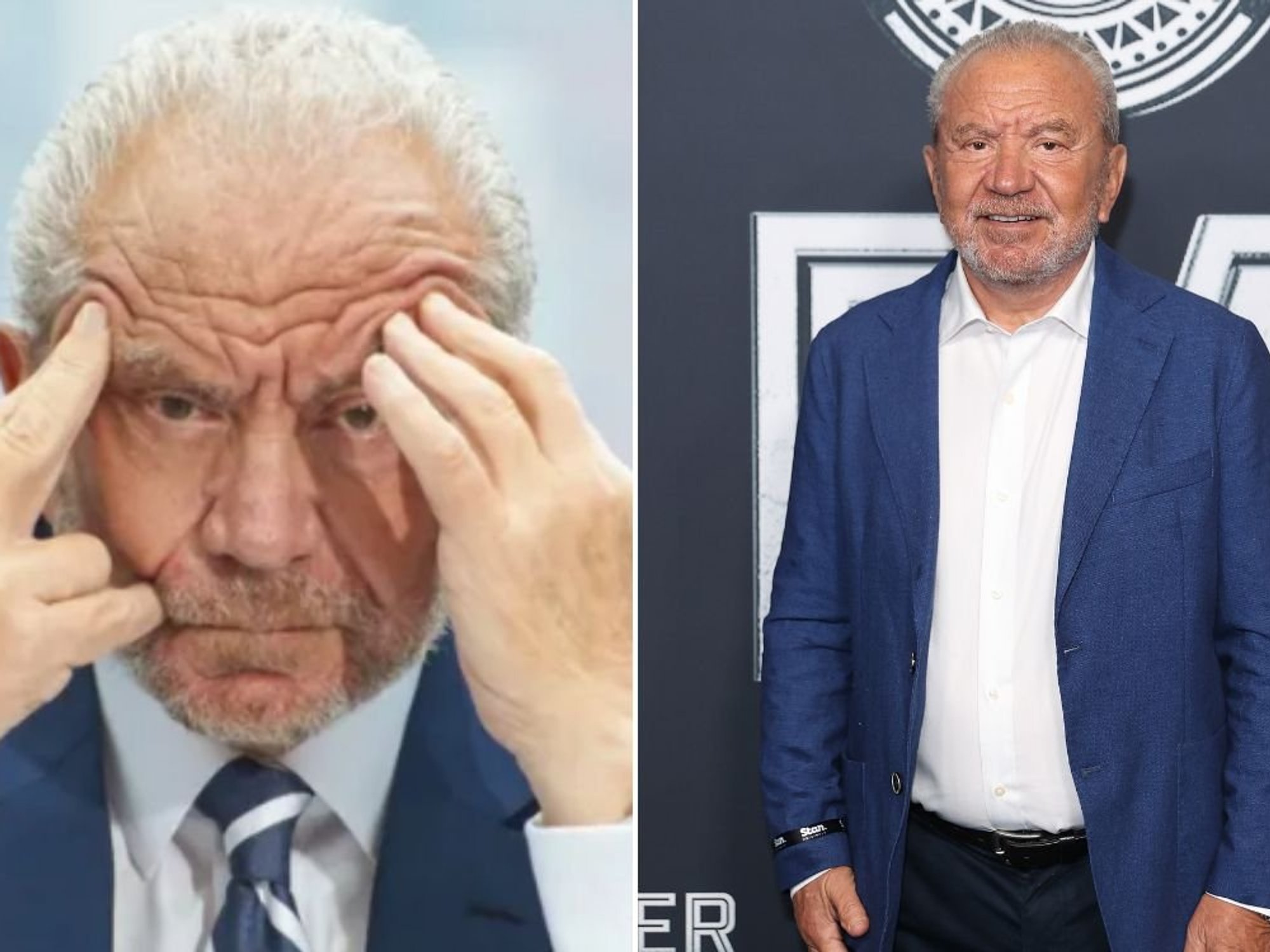

Bank of England governor Andrew Bailey expressed grave concerns to Treasury Committee members on Wednesday about what he termed a "dangerous road to go down".

His warning comes as President Donald Trump seeks to dismiss Lisa Cook from her position as governor at the Federal Reserve.

The American leader has accused Ms Cook of mortgage fraud relating to a property purchase in 2021.

Mr Bailey stressed the gravity of the situation, saying: "This is a very serious situation and I am very concerned because the Federal Reserve is the central bank for the world's strongest economy it has built up a very strong reputation for its independence and for its decision-making."

The President has come under fire from the Bank of England due to his interference with the US Federal Reserve

|PA

The American president's interference extends beyond his efforts to remove Cook from office.

President Trump has persistently pressed the Federal Reserve to slash its benchmark interest rate, despite the central bank maintaining its current stance through five consecutive meetings.

Jerome Powell, who chairs the Fed, has faced repeated demands from the White House for monetary easing. These calls for rate reductions represent a direct challenge to the institution's operational autonomy.

The Federal Reserve, much like Britain's own Bank of England, functions independently from political control. This separation ensures monetary policy decisions remain free from governmental pressure.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Donald Trump has also looks poised to sack the chair of the Federal Reserve as dollar the dropped in June.

| GETTYMr Bailey's testimony to MPs highlighted how such independence forms a cornerstone of sound economic governance.

The threats emerging from Washington represent an unprecedented assault on established central banking principles.

Mr Bailey articulated to the committee how central banks serve as bedrock institutions for economic policy. He explained that "monetary stability and financial stability underpin the foundations of policy" which allow governments to pursue their political objectives effectively.

The Governor warned against those who believe these fundamental principles should be compromised for short-term political gains. "I think what we're now seeing is people saying we should be able to trade off the foundations for those other decisions, and I'm afraid I just think that is a very dangerous road to go down," he told MPs.

Bailey highlighted how independence forms a cornerstone of strong economic governance

| GETTYLATEST DEVELOPMENTS

- State pension age increase 'point of discussion' as DWP launch review into benefit's future

- Rachel Reeves insists Britain is NOT heading for IMF bailout

- Parents forced to delay retirement by up to 10 years as children rely on

Britain's central bank chief emphasised that independent institutions must operate within their prescribed mandates without political interference.

"The job of an independent central bank is to provide those foundations, to take independent decisions to do it, within the remit that we're given that's how it works, that's how it should work," Mr Bailey stated.

The Governor's assessment of the consequences proved unequivocal when questioned by Labour MP John Grady.

When asked whether abandoning central bank independence might lead to "higher prices, higher mortgages and higher cost of borrowing for social housing and businesses," Mr Bailey responded with a single word: "correct."

More From GB News