Rachel Reeves's cash ISA reforms backed by huge trading platform as saving tool becomes 'too popular'

Trading platform breaks ranks with rivals over proposed allowance cut

Don't Miss

Most Read

Latest

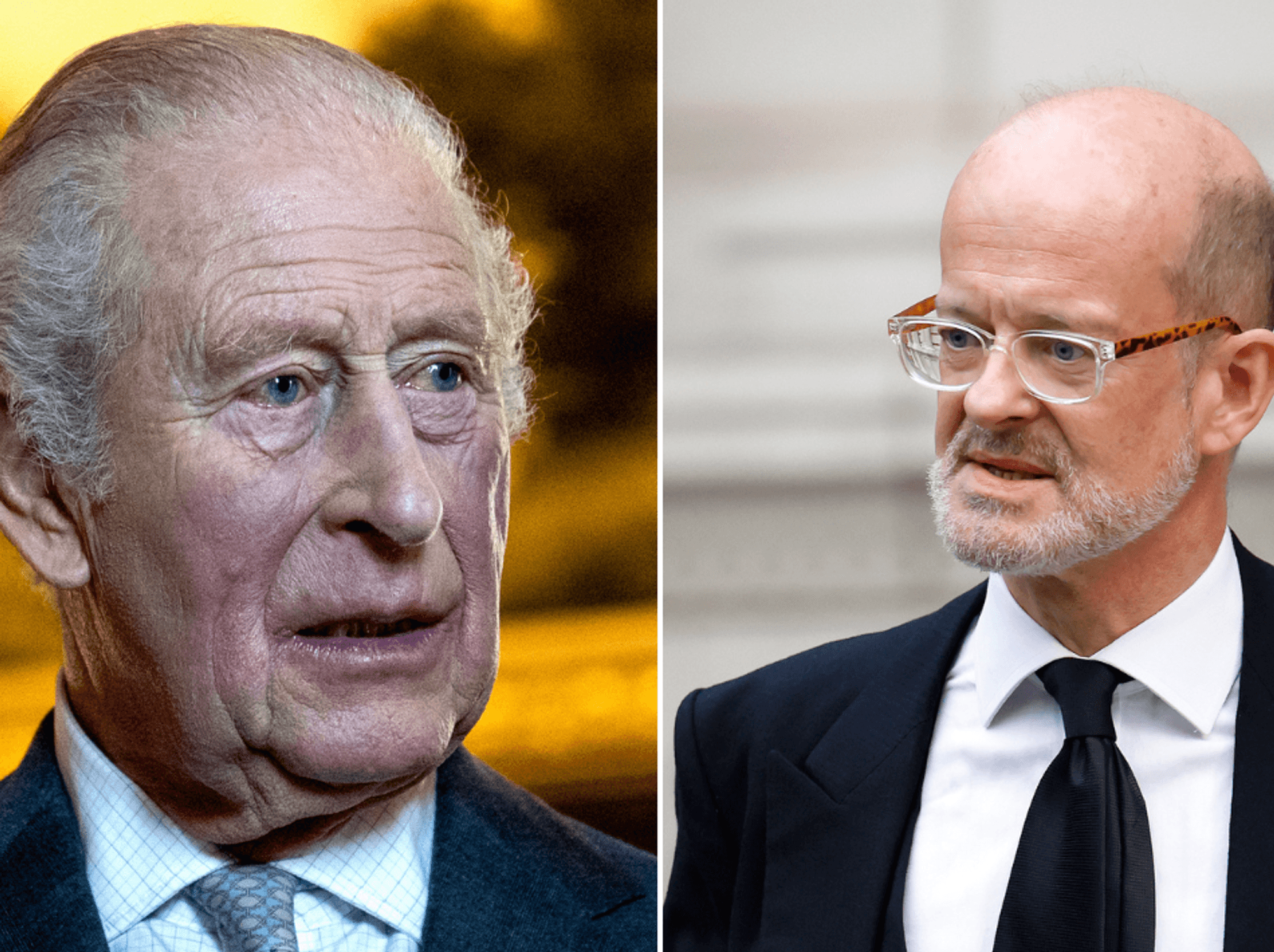

IG Group has publicly backed plans by Chancellor Rachel Reeves to cut the annual cash ISA allowance, putting the firm at odds with much of the financial services industry.

The London-listed trading platform has expressed support for proposals to reduce the cash ISA limit from £20,000 to £12,000.

He argued cash ISAs have “become too popular relative to their economic utility”, saying they have served for too long as the default option for savers despite offering poor long‑term returns.

“Cash ISAs have become too popular relative to their economic utility, serving for too long as the default for savings despite yielding poor long‑term returns and contributing little to productive investment or individual wealth accumulation,” Mr Healy said.

TRENDING

Stories

Videos

Your Say

IG Group, which serves around 900,000 customers across the UK, believes the existing system has failed both individual savers and the wider economy by doing little to channel money into productive activity.

Mr Healy also accused parts of the industry of misrepresenting the Government’s intentions, suggesting some firms are instinctively defending the current structure regardless of whether it works.

IG Group has backed plans by Chancellor Rachel Reeves to cut the annual cash ISA allowance

|GETTY

“There remains a strong instinct to defend existing structures, irrespective of their long‑term efficacy,” he said.

He rejected claims the reforms could trigger a rush into cash ISAs before any changes take effect, arguing such criticism overlooks the purpose of the policy.

“Policy nudges are exactly what is required to shift this equilibrium, and savers are not left without options,” he said, pointing to alternatives such as Premium Bonds.

He also noted older savers would retain the £20,000 allowance under the proposals.

LATEST DEVELOPMENTS

Older savers would retain the £20,000 allowance under the proposals

| GETTYHis intervention came shortly after rival platform AJ Bell attacked the Treasury’s plans, describing them as “doomed to fail” in their aim of encouraging more people to invest for the long term.

The proposals were also discussed at a recent meeting between industry representatives and officials from the Treasury and HMRC, which prompted further criticism from parts of the sector.

Mr Healy dismissed the backlash as evidence of a broader reluctance within the industry to embrace reform.

“This opposition is symbolic of a deeper reluctance within parts of our industry to embrace change, even when the status quo is demonstrably failing most people in the UK as well as the economy,” he said.

ISA reform is still on the cards | GETTY/GBNEWS

ISA reform is still on the cards | GETTY/GBNEWSHe also addressed concerns about proposals to tax uninvested cash held within stocks and shares ISAs — a move critics warn could undermine the appeal of ISAs as tax‑free savings vehicles.

Mr Healy argued that such issues could be resolved through targeted regulation.

“With clear, proportionate rules that distinguish between transactional cash and long‑term idle balances, and with reporting burdens placed on platforms and HMRC rather than on consumers, this problem does not need to be an obstacle,” he said.

The IG Group executive went further by calling for the eventual abolition of cash ISAs altogether, arguing the ISA framework should ultimately be reserved for investments rather than cash savings.

“We reiterate our belief that the ISA wrapper should, over time, be reserved for investments alone,” he said.

Mr Healy urged ministers to maintain their resolve and pursue more ambitious reforms, arguing redirecting tax‑advantaged savings towards long‑term investment would better serve both savers and the wider British economy.

Our Standards: The GB News Editorial Charter

More From GB News