Pensions watchdog backs new value for money framework

Four-tier ratings proposed for defined contribution schemes

Don't Miss

Most Read

The Government and Pensions Regulator have backed revised proposals designed to assess value for money across defined contribution pension schemes.

The updated framework, published yesterday, introduces forward-looking measures alongside a more detailed ratings system for evaluating pension arrangements.

The proposals follow industry feedback on an assessment framework first set out by the Financial Conduct Authority (FCA) in August 2024.

The Department for Work and Pensions (DWP) and The Pensions Regulator worked jointly with the FCA to develop the revised approach.

TRENDING

Stories

Videos

Your Say

The document also acts as a formal discussion paper for trust-based pension schemes.

It seeks views to inform regulations under the Pension Schemes Bill, which is currently progressing through Parliament.

Industry stakeholders have until March 8 to respond to the consultation.

Under the revised framework, pension schemes would be assessed using projections of expected investment returns and risk over a 10-year period.

These forward-looking metrics would sit alongside updated backward-looking measures of historical performance.

Regulators said this combination is intended to provide a more rounded picture of how schemes are likely to perform for savers over time.

The proposals also include changes to the ratings system used to categorise schemes.

The existing three-tier structure of red, amber and green ratings would be expanded to four categories.

Four-tier ratings proposed for defined contribution schemes to ensure value for money

|GETTY

Under the new model, the green rating would be split into light green and dark green classifications.

Regulators said this would allow clearer distinctions between schemes that meet minimum value standards and those that perform particularly strongly.

The revised framework also simplifies the data required to assess costs and historic investment performance.

Pension schemes would be compared against a wider group of commercial comparators than under earlier proposals.

This change is intended to reflect the diversity of the defined contribution market and improve consistency across different types of schemes.

Proposals to update service quality metrics are also included.

However, regulators said further work with the industry is needed to develop meaningful measures of member engagement.

LATEST DEVELOPMENTS

Pension schemes would be compared against a wider group of commercial comparators

| GETTYAs currently designed, service quality scores would be able to maintain or lower a scheme’s overall rating, but not improve it.

Nausicaa Delfas, chief executive at The Pensions Regulator, said the framework is intended to drive better outcomes for savers.

"This framework will empower decision-makers to either improve their scheme or consolidate out of the market."

She said the regulator wants to ensure trustees’ views are reflected before final rules are introduced.

"We want to hear the views of trustees to make sure we get this right and help transform pension saving for millions."

Pensions minister Torsten Bell said the proposals are designed to improve transparency for savers.

Mr Bell said the framework is "about being straight with people and making sure people's savings work as hard as they did to earn them".

Industry figures have welcomed the collaborative approach taken by regulators and the Government.

Gail Izat, workplace managing director at Standard Life, part of Phoenix Group, said there had been close cooperation between regulators.

She said there had "clearly been a lot of interaction between FCA, TPR and DWP in developing the system", and that ongoing coordination would be important during implementation.

Ms Izat said this would help ensure consistency between contract-based and trust-based pension schemes.

The framework also introduces enhanced governance expectations for trustees and pension providers.

Schemes identified as delivering poor value for money would be required to notify regulators.

They could also face restrictions on accepting new members.

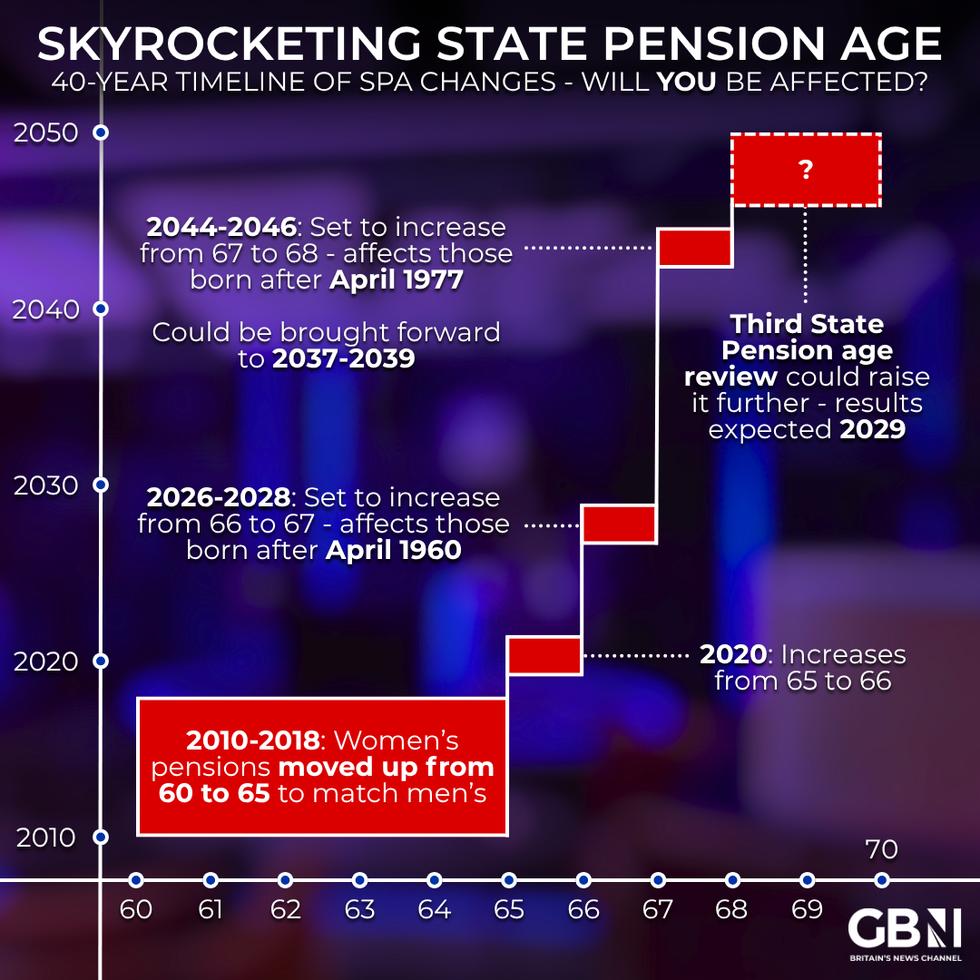

Are you affected by state pension age changes? | GETTY

Are you affected by state pension age changes? | GETTYRegulators said this is intended to encourage improvement or consolidation where schemes fall short of required standards.

Helen Forrest Hall, chief strategy officer at the Pensions Management Institute, said the framework represents progress but warned of practical challenges.

"Schemes face heavy pressures, and added burdens must stay proportionate."

She said clear communication would be essential to avoid confusion among pension scheme members.

Ms Forrest Hall added that she would work with the Government and regulators to help ensure the final rules are workable and consistent.

A group of defined contribution master trust providers has already taken part in a pilot exercise.

The trial tested the proposed value metrics ahead of wider rollout.

Feedback from that pilot is expected to inform further refinements before the framework is finalised.

More From GB News