Rachel Reeves must face 'blunt truth' over pension tax raid: 'Not good state of affairs!'

Rachel Reeves tells Christopher Hope whether she will apologise to pensioners after humiliating winter fuel U-turn |

GB NEWS

The Chancellor must avoid increasing the tax burden on private retirement savings, according to former pensions Guy Opperman

Don't Miss

Most Read

Chancellor Rachel Reeves is being urged to remember a "blunt truth" before considering a tax on pension savings by a former Conservative Government minister.

Former pensions minister Guy Opperman MP cautioned the Treasury over a potential tax raid on retirement pots in an attempt to generate more revenue

Speaking at The Investing and Savings Alliance's (TISA) Retirement Conference earlier this week, Opperman praised many of Labour's policy decisions in regards to pensions; including the move to megafunds.

The ex-Conservative minister noted that significant legislation drafter in the Pensions Bill, which is set to voted on in Parliament, is continuation of work conducted by the Tories.

A former pensions minister is calling on Rachel Reeves to avoid taxing pensions

|GETTY

However, concerns have been raised over a stealth tax rise on pensions being implemented in the Chancellor's upcoming Autumn Budget.

It would follow the £40billion increase in taxes, which saw the rate paid in National Insurance contributions by employers hiked and pension pots being made liable for inheritance tax (IHT).

Speaking exclusively to GB News, Opperman sounded the alarm that any future tax rise on pensions would be counterintuitive to the legislation being proposed in the Government's bill.

A tax raid is expected to pay for the Government's Spending Review, which saw Labour pledge more funding in the health sector, infrastructure and AI.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

"The blunt truth is you want people to be saving into a private pension. If you're any Government, that is a good thing," Opperman explained.

"Hopefully that is invested, in part, for the good of the country. The problem is if you keep taking away pensioner benefits in the private sector and you keep taxing them or reducing tax breaks, people will do that less or less.

"Then you really get into complications. The nature of tax policy is you're trying to pluck the goose without it realising.

"Now, the difficulty without that is, if you keep going back to the same well, namely pensions, and private sector pensions, eventually people are going, 'Why am I bothering with this?' And that's not a good state of affairs."

He added: "The factual reality is, the national insurance contributions hikes on business means it's going to be almost impossible to put further taxes or burdens by where automatic enrolment increases on local businesses.

"That's a big deal because, on the one hand, Treasury had taken tax. Great for them. It's a killer for jobs but that's a separate issue. The problem is that it will restrict and stifle improvements in private pensions."

LATEST DEVELOPMENTS:

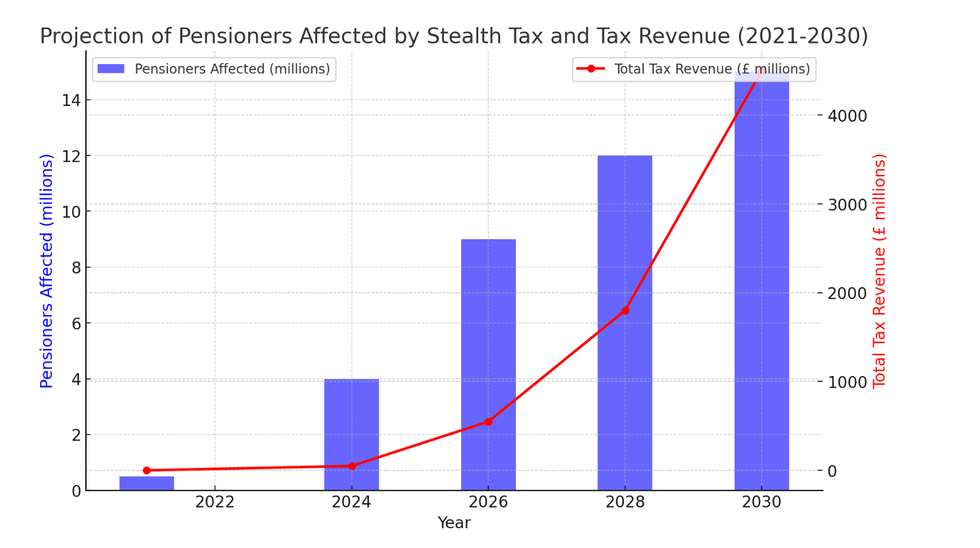

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT How could pensions be taxed more?

While no tax change policies have been confirmed, analysts warn the tax-free lump sum on pensions or reliefs on the contributions of higher earners could be on the chopping block.

As it stands, pension savers are able to withdraw up to 25 per cent of their retirement pots tax-free at the age of 55; up to a maximum of £268,275.

Furthermore, British workers are able to save up to £60,000 annually tax-free, resulting in relief of 20 per cent for basic-rate taxpayers and 40 per cent or 45 per cent for those in the higher and additional income tax brackets.

Pension experts are also concerned over reductions in the annual allowance or the return of the lifetime allowance while salary sacrifice could also be abolished.

More From GB News