Pension disaster as Britons MUST have £700k in retirement savings to enjoy comfortable lifestyle

Keir Starmer quizzed by Christopher Hope on whether pensioners will receive an apology for his winter fuel allowance cuts. |

GB NEWS

New research from Fidelity International is breaking down the cost of retirement for future pensioners

Don't Miss

Most Read

Britons need to have £700,000 in pension savings as a starting point in their pot to enjoy a comfortable retirement, according to Fidelity International.

Rising retirement costs and longer life expectancies are prompting UK investors to reassess their financial futures, with new research revealing that 42 per cent plan to increase their retirement savings over the next 12 months.

The figure rises to 46 per cent among those aged 55 and over, Fidelity International's latest study has found. Meanwhile, early retirement aspirations remain strong amongst mid-life workers.

Research found that 22 per cent of those aged 35 to 54 are saving specifically to retire early or reduce their working hours; the highest proportion of any age group.

Britons need to have £700,000 in pension savings by 65 to enjoy a comfortable retirement, research from Fidelity International claims

|GETTY

Alternatively, retirees might purchase an annuity for guaranteed lifetime income, though the amount received varies based on age, health and annuity type.

Fidelity International analysts note that income drawdown offers a viable alternative for those looking for better flexibility.

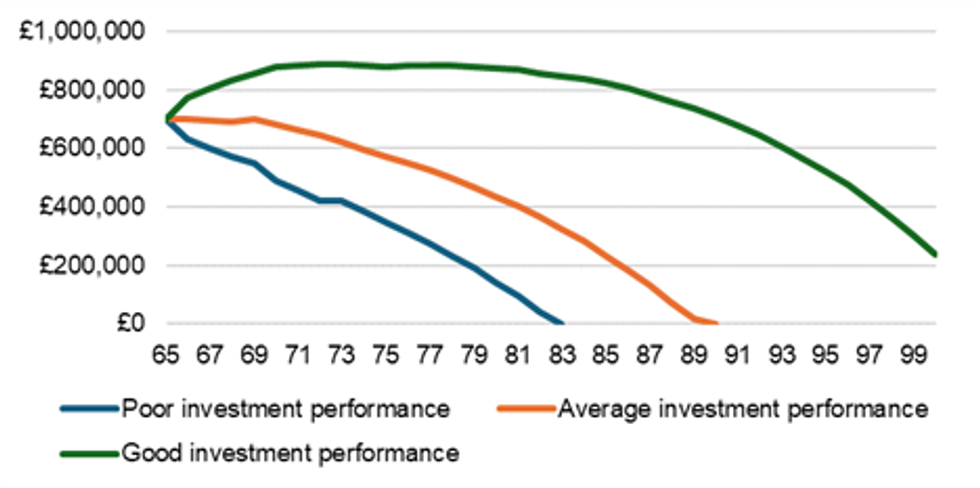

To accrue a gross income to over £52,000 for a single person’s comfortable retirement, Fidelity’s Pension Drawdown Calculator suggests a starting pension pot of around £700,000 at age 65.

Assuming average investment performance, that pot could last until age 90. If returns are stronger, nearly £240,000 could remain at age 100.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

The rising cost of living has dramatically increased the income needed for a comfortable retirement | GETTY

The rising cost of living has dramatically increased the income needed for a comfortable retirement | GETTYHowever, the monthly savings required to accumulate £700,000 by age 65 vary dramatically depending on when contributions begin. According to Fidelity's projections, a 25-year-old would need to save £459 monthly, assuming five per cent annual returns after costs.

However, delaying by a decade means a 35-year-old Britons must contribute £841 monthly to reach this target. Analysts note that the financial burden becomes substantially heavier for those starting later.

A 45-year-old would need to set aside £1,703 monthly - nearly four times the amount required at 25. For those beginning at 55, the monthly requirement soars to £4,508, highlighting the significant advantage of early pension planning.

Ed Monk, an associate Director at Fidelity International, offers practical guidance for those approaching retirement.

LATEST DEVELOPMENTS:

How long £700k could last when taking income of £40,245 a year

|FIDELITY INTERNATIONAL

"Our research figures show that many people are taking positive steps towards improving their retirement prospects - whether that's increasing contributions or planning to retire early. But intention alone isn't enough," he said.

His recommendations include checking State Pension forecasts, particularly with the State Pension age rising to 67 from 2026, and consolidating pension pots to reduce fees.

Those five years from retirement should reassess investment strategies and explore income options through drawdown, annuities or combinations.

Two years before retiring, Monk advises finalising income strategies, reviewing budgets and updating wills and powers of attorney.

More From GB News