Pension tax alert: Retirees could be slapped with extra £2,500 year HMRC bill in Rachel Reeves's Budget

The Chancellor is due to give her Autumn Budget statement on November 25

Don't Miss

Most Read

Latest

Chancellor Rachel Reeves is rumoured to be considering a hike to income tax in next month's Autumn Budget; a move that could see pensioners pay an extra £2,500 a year to HM Revenue and Customs (HMRC).

New analysis has broken down how Britain's wealthiest retirees would be impacted if a two per cent increase to income tax rates is announced on November 26's fiscal statement.

Such a move would impact nearly nine million pensioners receiving state benefits and potentially violate the Labour Party's election commitments from last year.

The proposal forms part of wider considerations to generate £6billion through simultaneous adjustments to income tax and National Insurance contributions, with the latter potentially falling by an equivalent amount.

Pensioners could pay an extra £2,500 in tax under rumoured plans

|GETTY

Government figures obtained through Freedom of Information (FoI) requests indicate that 8.8 million state pension recipients would face higher tax obligations under the scheme.

Among these, approximately 124,000 individuals who currently pay the 45 per cent additional rate on earnings above £125,140 would be particularly affected.

The proposal under serious consideration involves reducing National Insurance contributions by two percentage points while simultaneously increasing income tax by the same margin.

This approach, initially suggested by the Resolution Foundation last month, would generate an estimated £6billion in revenue whilst specifically targeting groups who are exempt from National Insurance payments, including retirees and property landlords.

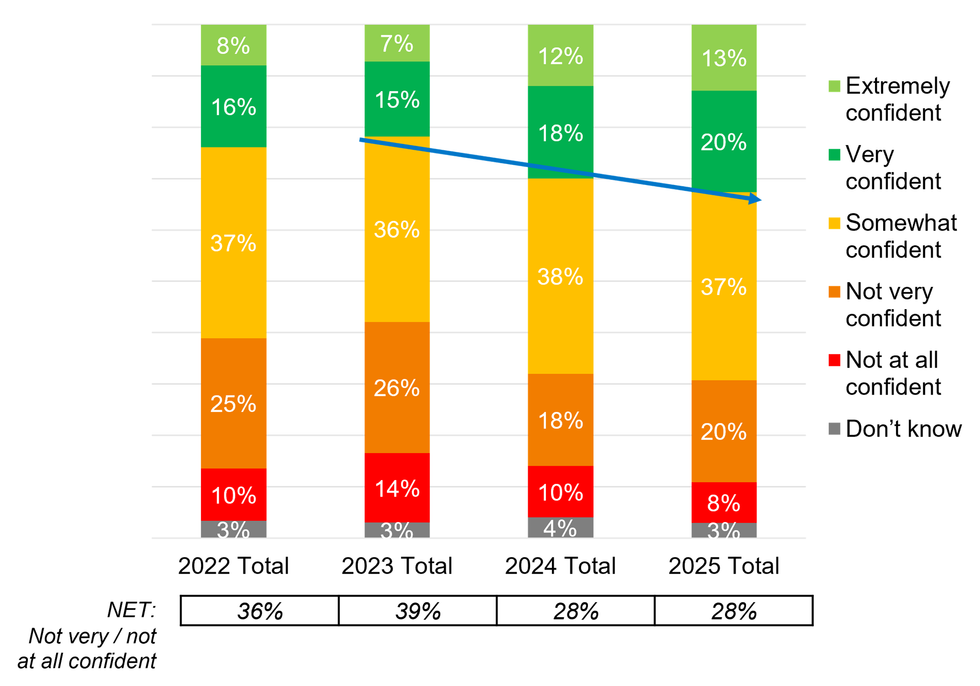

How confident are Britons about their pension savings? | AEGON

How confident are Britons about their pension savings? | AEGON Wealth management specialist Adam Cole from Quilter noted that fiscal drag continues to push increasing numbers of retirees into elevated tax brackets, potentially intensifying financial pressure on prosperous pensioners through the upcoming Budget.

Former Chancellor Jeremy Hunt under the Conservative Government froze tax thresholds which are set to remain in place until April 2028.

Critics have slammed this move as a stealth tax rate with Britons finding themselves in higher brackets due to rising interest rates or incomes.

Mr Cole suggested that despite Labour's manifesto commitment against raising primary income tax rates for workers, this approach might prove "more palatable" than implementing complex adjustments across multiple taxes or introducing indirect fiscal changes.

David Luxton, representing pensioner advocacy group Later Life Ambitions, condemned the potential increase as "grossly unfair" to retired individuals.

He argued: "Many in later life live on a fixed income, and this kind of broad increase fails to recognise that pensioners often face rising costs.

"It effectively penalises people with an extra charge for ageing."

Keir Starmer declined to exclude the possibility of income tax increases during Wednesday's session of Prime Minister's Questions, despite his party's electoral promises.

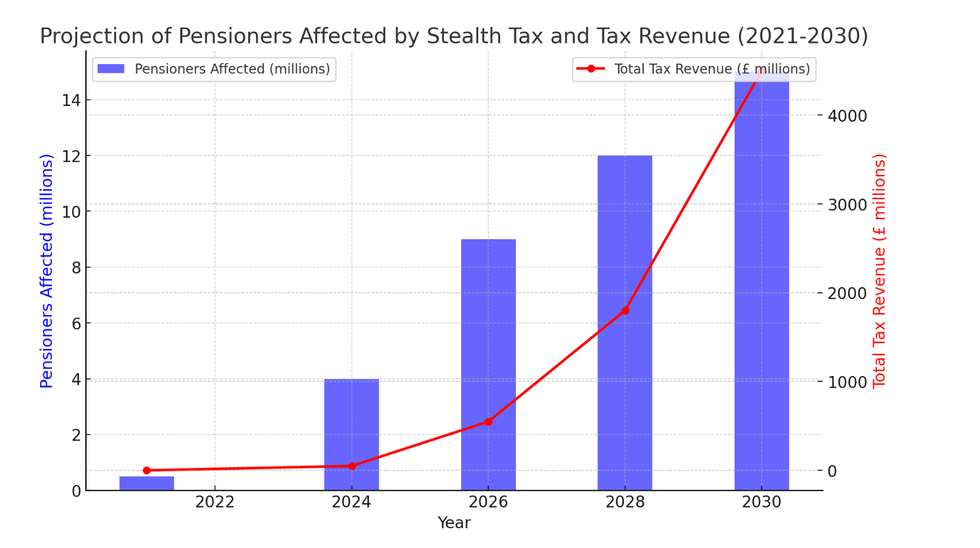

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT This development coincides with fresh data revealing that retirees have recovered £48.5 million in excessive tax deductions from their pension withdrawals during the July to September period alone.

Mr Luxton further emphasised that retired individuals have fulfilled their obligations through decades of employment and tax contributions.

He stated: "Pensioners have paid their dues through a lifetime of work and taxation.

Asking them to shoulder yet another rise, when many already pay the highest rate, is unjust. Those who've contributed the most shouldn't be punished again simply for having saved responsibly."