Pension savings to be targeted in £2bn tax raid under Rachel Reeves's 'backward' Budget

The Chancellor is preparing to unveil her fiscal agenda on November 26's Autumn Budget

Don't Miss

Most Read

Pension savings are understood to be in line for a tax raid in Chancellor Rachel Reeves's upcoming Autumn Budget.

Ms Reeves is preparing to extract an additional £2billion from retirement funds by imposing restrictions on salary sacrifice pension arrangements, as part of efforts to address a substantial gap in Government finances.

The Chancellor intends to establish a £2,000 annual limit for these schemes, with National Insurance contributions becoming payable on amounts exceeding this threshold.

These measures form part of the Treasury's strategy to generate revenue for a financial shortfall reaching as much as £30billion, partly attributed to anticipated productivity revisions by the Office for Budget Responsibility (OBR).

The Chancellor is understood to be considering changes to salary sacrifice which could see pension savings targeted in a £2billion tax raid

|GETTY

The proposal has emerged ahead of this month's Budget announcement in reporting from The Financial Times.

Under the proposed changes, contributions exceeding £2,000 annually would attract National Insurance at standard rates - eight per cent for earnings below £50,270 and two per cent for income above that level.

The restrictions would also affect businesses, which currently avoid paying employer National Insurance contributions at the typical rate 15 per cent on pension contributions made through salary sacrifice arrangements.

Ahead of the November 26 fiscal statement, the Treasury has been considering various approaches, including complete removal of national insurance exemptions for both employers and employees, though the £2,000 threshold option has been selected as the preferred approach.

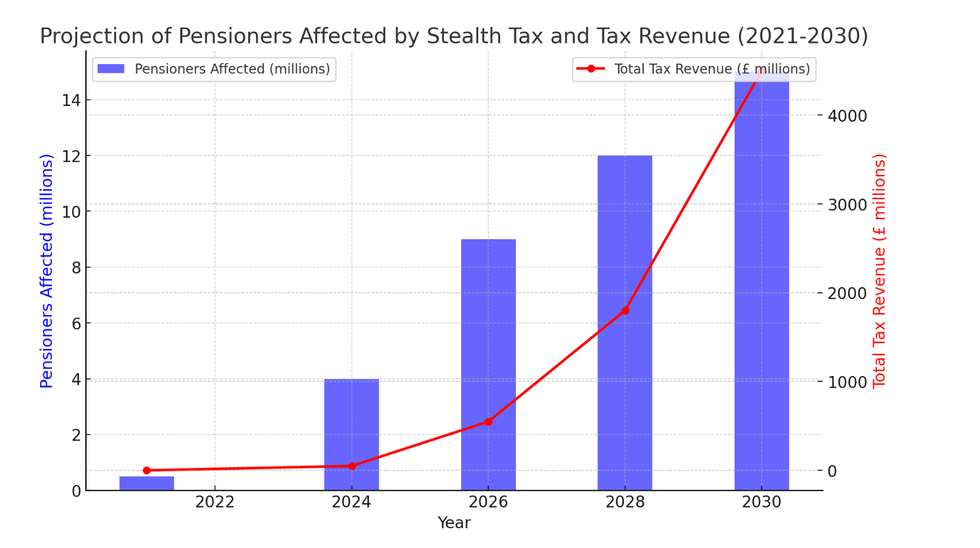

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT

Graph projects the number of retirees facing a stealth tax on their state pensions will rise in the coming years | Chat GPT Pensions expert Steve Webb from consultancy firm LCP cautioned that the proposals would increase financial pressures on businesses and potentially lead to less generous retirement benefits.

"Salary sacrifice is used as a way of reducing the cost to employers of providing decent pensions," Mr Webb shared.

He warned that the changes, combined with previous increases to employer national insurance contributions, could prompt companies to reconsider their pension offerings.

"At a time when millions are not saving enough, this is a backward step," he added.

The reforms have sparked concerns among retirement planning specialists about potential negative impacts on pension provision.

Treasury analysis indicates that workers earning £35,000 who contribute five per cent through salary sacrifice would face no additional charges, while those earning £45,000 making similar contributions would pay £30 more annually, with employers contributing an extra £34.

Higher earners face substantially greater impacts, with accountancy firm RSM calculating that someone earning £125,000 and contributing £25,000 to their pension would pay £460 more in national insurance, whilst their employer would face additional costs of £3,450.

Businesses consulted by HMRC expressed frustration about the administrative complexity and warned the changes could "disincentivise saving into a pension".

The Treasury is on the hunt for fiscal headroom

| GETTYThe reforms would particularly affect those earning between £100,000 and £125,140 who use salary sacrifice to mitigate marginal tax rates exceeding 60 per cent.

Earlier this week, PensionBee's chief business officer Lisa Picardo highlighted salary sacrifice as being an "efficient way to boost pension contributions" and criticised a potential cap.

She shared: "It would disincentivise companies who provide workplace pensions and send the wrong message to millions of basic rate taxpayers trying to save more for their future."

A Treasury spokesperson told GB News: "We do not comment on speculation around changes to tax outside of fiscal events."