Pension hack could create 'savings buffer' for millions of Britons unable to work

Self-employed individuals are being reminded to bolster their savings ahead of retirement or if they are left unable to continue working

Don't Miss

Most Read

Latest

Self-employed Britons are being reminded to take advantage of making pension contributions as tax relief to create a 'savings buffer' for when they are unable to work.

Financial experts have outlined crucial strategies for self-employed individuals to safeguard their finances, given the absence of workplace protections that employed workers take for granted.

Analysts note those working for themselves must navigate their careers without the security of guaranteed paid holidays, rest breaks, statutory sick pay or maternity leave benefits. This lack of a safety net means freelancers and sole traders need to take proactive steps to protect themselves financially.

Specialists have shared guidance covering several key areas, from establishing savings buffers before starting a family to making pension contributions and reserving funds for tax obligations. Opening a dedicated business account and securing income protection insurance also feature prominently in their recommendations.

Self-employed Britons are being reminded to create a 'savings buffer' as soon as possible

| GETTYJamie Alexander, the mortgage director at Romsey-based Alexander Southwell Mortgages, said: "There is zero fallback that employees rely on when you are self-employed. That means you have to build your own, starting with clarity over your finances."

Building a financial cushion remains paramount for those running their own businesses, with experts recommending a reserve covering between three and six months of essential expenses.

Mr Alexander added: "A savings buffer is just as important. I would still recommend three to six months of essential costs, minimum." Setting money aside for tax obligations is equally critical, particularly for those in their first year of trading.

Chloe Mount, the director at Rotherham-based Tunstall Accounting, said: "For most sole traders in the basic rate tax band, a sensible rule of thumb is to set aside around 30 per cent of profits for tax. This helps cover tax and NI and provides a buffer if the bill is higher than expected."

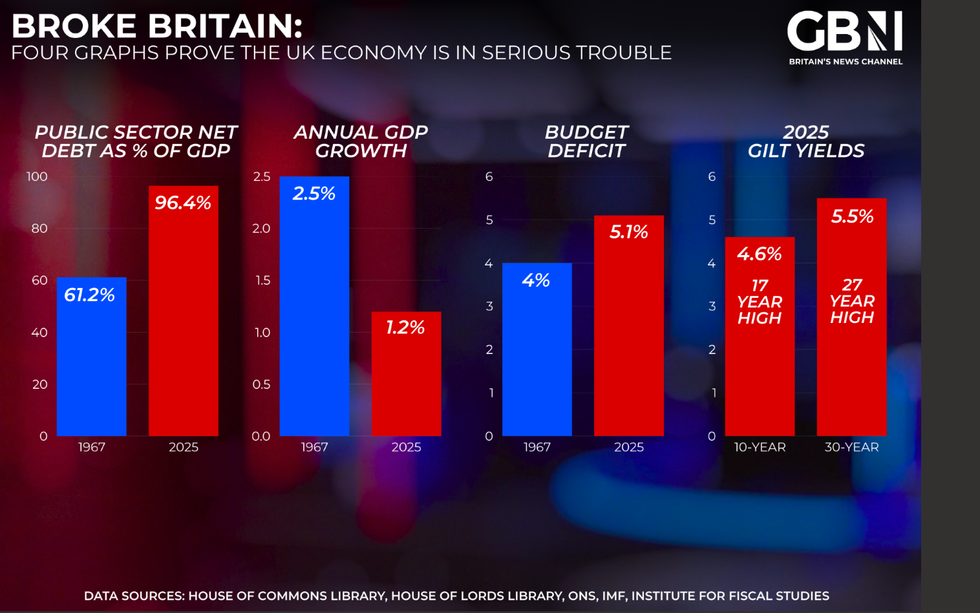

Four graphs prove the UK economy is in serious trouble | GB NEWS

Four graphs prove the UK economy is in serious trouble | GB NEWSShe warned that new business owners face additional pressure, as payments on account can require an extra 50 per cent of the first year's bill to be paid upfront.

Maintaining a clear division between personal and business finances represents one of the most straightforward yet effective measures self-employed workers can adopt.

Ms Mount added: "Having a separate business bank account is one of the simplest but most effective steps a self-employed person can take. It keeps finances clear, makes expense tracking far easier, and removes a lot of stress when it comes to preparing tax returns."

A dedicated account provides genuine visibility into earnings and helps determine what can safely be withdrawn, particularly during slower periods.

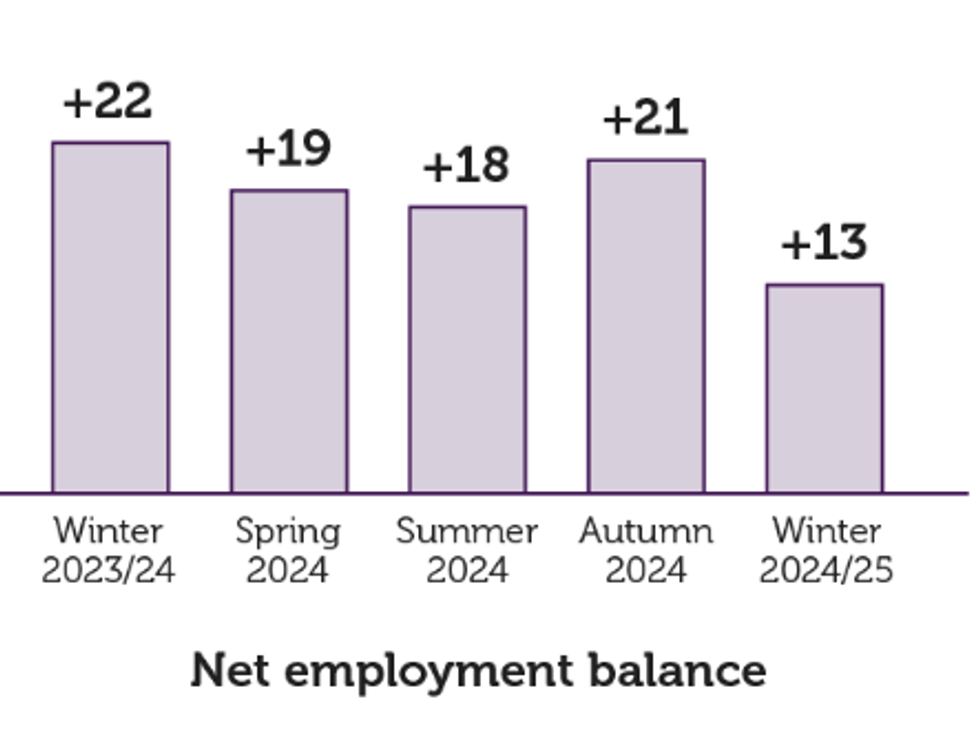

Employment figures | CIPD’s latest Labour Market Outlook

Employment figures | CIPD’s latest Labour Market Outlook Mr Alexander said: "Keeping business and personal money separate is essential. A dedicated business account shows what you truly earn and what you can safely take, reducing stress in quieter months."

He also emphasised the importance of reserving tax funds immediately upon receiving payment, noting that payments on account frequently catch people off guard because the money was never truly theirs to spend.

Protecting income against illness or injury stands as perhaps the most vital consideration for those without employer-provided sick pay.

Austyn Johnson, the founder at Colchester-based Mortgages For Actors, said: "If you are self employed, you are your business. If you don't have income protection in place, you are hugely risking everything that underpins your life. Mortgage, rent, bills, food, and clothes."

Self-employed individuals need to file their tax returns | GETTY

Self-employed individuals need to file their tax returns | GETTYHe stressed that the relatively modest monthly cost of such cover far outweighs the potential consequences of being uninsured.

Lisa Tipton, the director of Financial Planning at Stockton-on-Tees-based New World Financial Group, echoed this sentiment, noting that income protection insurance can provide replacement earnings when illness prevents work.

Securing long-term financial stability through pension contributions should also feature in any self-employed person's planning, according to experts.

Ms Tipton added: "Plan for your future self: pension contributions benefit from tax relief and can help you to build long-term financial security."