Pension savers told to 'think carefully' as withdrawals surge ahead of HMRC tax raid: 'Can't be reversed!'

Economist Neil Record questions Reform UK’s plans to overhaul council pension funds. |

GB NEWS

The Chancellor confirmed pension pots would be come liable for inheritance tax during last year's Autumn Budget

Don't Miss

Most Read

Pension savers withdrew a significant amount of tax-free cash last month ahead of a HM Revenue and Customs (HMRC) raid, with interactive investor recording a 61 per cent jump in withdrawals compared to August 2024.

The rush reflects mounting anxiety that Chancellor Rachel Reeves might reduce the current 25 per cent tax-free allowance in this year's Autumn Budget on November 26.

Pensions minister Torsten Bell has declined to dismiss speculation about potential pension reforms, with the Treasury prepping to make retirement savings liable inheritance tax (IHT) in April 2027.

Under existing rules, savers can withdraw a quarter of their pension pot tax-free, up to a maximum of £268,275.

Britons are making pension withdrawals ahead of further changes to the tax regime

|GETTY

Despite these concerns, retirement analysts are cautioning against rushed decisions to withdraw pension funds.

Craig Rickman, the personal finance editor at interactive investor, warned that "once you've drawn your pension tax-free cash the decision can't be reversed, and taking the lot in one hit might not be the best course of action".

He urged savers to "think carefully before reacting to speculation and make choices with their long-term future in mind, taking expert advice where necessary".

The platform's analysis suggests withdrawal increases stem partly from growth in their self-invested personal pension customer base.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

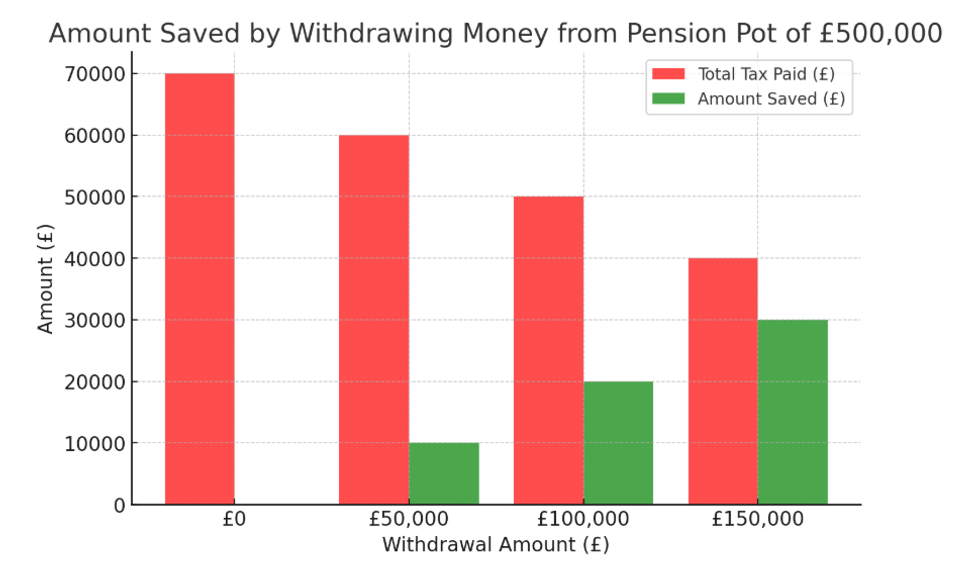

How much you could save by withdrawing money from your pension | GBN

How much you could save by withdrawing money from your pension | GBNThe inheritance tax changes unveiled in last year's Budget have significantly influenced withdrawal patterns, according to interactive investor.

From April 2027, retirement savings will fall within inheritance tax scope, ending their current exemption from death duties.

Financial Conduct Authority (FCA) data reveals that tax-free pension withdrawals reached over £18billion in the year ending March 2025, a sharp rise from £11.25 billion the previous year.

Two prominent pension specialists, Tom McPhail and Stephen Lowe from Just Group, have reportedly considered accessing their own retirement funds due to these concerns.

MEMEBRSHIP:

- EXPOSED: Keir Starmer humiliated on eve of Donald Trump visit as bombshell letter threatens 'surrender' deal

- I fired Peter Mandelson during a fractious phone call. I warned him to be on guard - Nigel Nelson

- What our new Home Secretary said about the English flag makes her unfit to police our borders - Adam Brooks

- Keir Starmer faces fresh crisis as two connecting storm clouds could soon tear Labour apart at the seams

- POLL OF THE DAY: Would an emergency general election restore public faith in government? VOTE NOW

A Treasury spokesperson stated: "We do not comment on speculation around changes to future tax outside of fiscal events. We continue to incentivise pensions savings for their intended purpose of funding retirement instead of them being openly used as a vehicle to transfer wealth."

Investment strategist Neil Wilson from Saxo UK reported heightened client anxiety about potential "stealth taxes" affecting pension regulations.

LATEST DEVELOPMENTS:

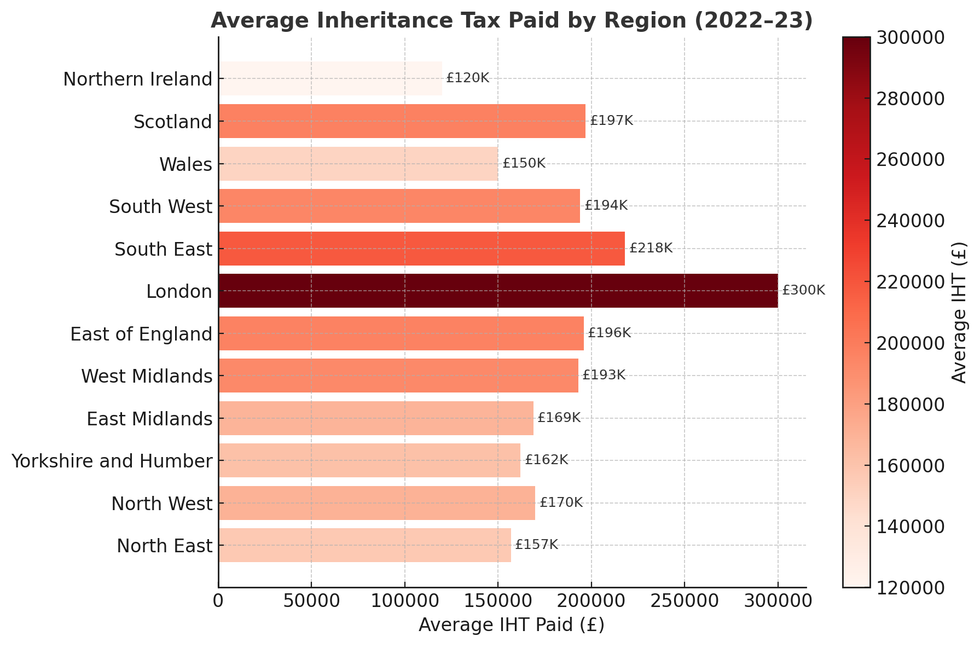

How much is London paying in inheritance tax compared to the rest of the country | GETTY

How much is London paying in inheritance tax compared to the rest of the country | GETTY He noted particular worries about "cuts to the tax-free lump sum, further inheritance tax reforms, or higher capital gains tax (CGT)".

Mr Wilson emphasised that "the first thing is to avoid making hasty withdrawals," warning that large withdrawals could push savers into higher tax brackets and deplete retirement funds prematurely.

Quilter's financial adviser Ian Futcher highlighted cases of investor remorse, noting that many who withdrew funds before the previous Budget later regretted their decision.

He cautioned that premature withdrawals could result in "large lump sums not protected in tax wrappers with no idea what to do with them".

More From GB News