State pension triple lock 'is staying' despite concerns over DWP payment's future, Labour minister confirms

Economist Neil Record questions Reform UK’s plans to overhaul council pension funds. |

GB NEWS

State pension payment rates are guaranteed to rise every year by at least 2.5 per cent

Don't Miss

Most Read

The Labour Government has committed to maintaining the state pension triple lock for the duration of the parliament despite growing concerns over its rising cost on the public purse.

Thanks to the payment uprate mechanism, state pension payment rates are hiked annually by whichever is highest: inflation, average earnings growth, or 2.5 per cent.

Pensions minister Torsten Bell has pledged to keep the triple lock in place over the next four years in a boon for Britain's pensioners.

Analysts anticipate retirees will receive approximately £551 more per year when the state pension rises next April.

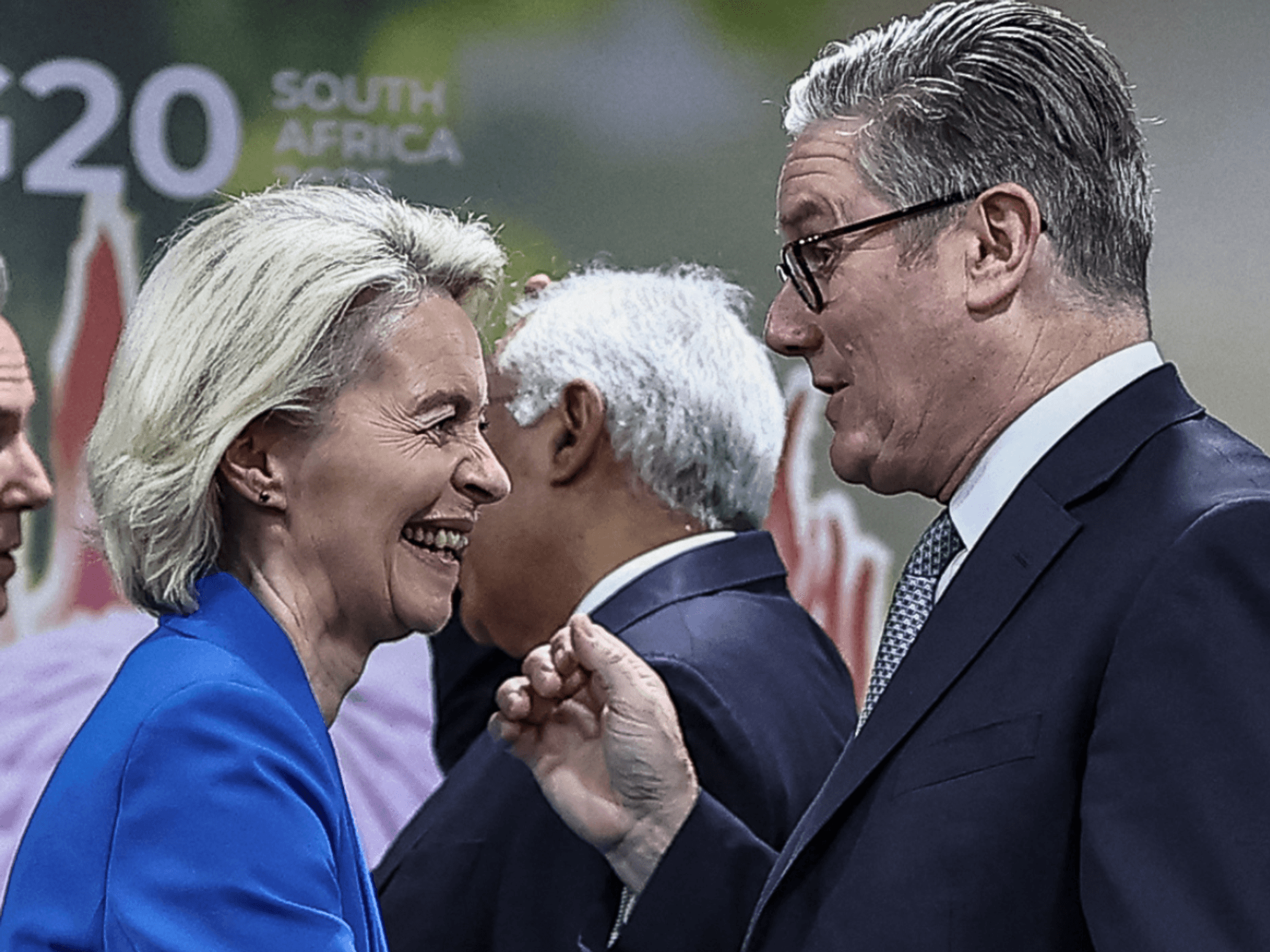

Labour's Pension minister has promised to keep the state pension triple lock in place

|GETTY

Defending the Government's manifesto commitment at a London event earlier this week, Mr Bell said: "I always say that if you want to know what the Government is doing, then you can read the manifesto, because it tells you, which is that the triple lock is staying for the course throughout this parliament."

The Treasury secretary emphasised that state pensions form a crucial foundation for the bottom two-thirds of retirees' income.

"We're aiming to deliver adequate retirements for the vast majority of the population, and the state pension for the bottom two thirds is a very material part of their retirement income, it's a bedrock," he added.

The increase is expected to be around five per cent, lifting the annual amount from £11,973 to £12,572, based on wage growth figures.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

How much will the state pension triple lock cost the British taxpayer? | OBR

How much will the state pension triple lock cost the British taxpayer? | OBR The full new state pension currently stands at £230.25 weekly for those who reached pension age after April 2016.

Financial pressures continue to mount as state pension expenditure reached £114.1billion last year, based on figures from the Office for National Statistics (ONS).

The Office for Budget Responsibility (OBR) forecasts this figure will climb to £149.3billion by the end of the decade.

Earlier this year, the fiscal watchdog cautioned that the triple lock has already exceeded initial cost projections by approximately threefold, attributing this to unpredictable inflation patterns and sluggish wage growth.

MEMBERSHIP:

- EXPOSED: Keir Starmer humiliated on eve of Donald Trump visit as bombshell letter threatens 'surrender' deal

- I fired Peter Mandelson during a fractious phone call. I warned him to be on guard - Nigel Nelson

- What our new Home Secretary said about the English flag makes her unfit to police our borders - Adam Brooks

- Keir Starmer faces fresh crisis as two connecting storm clouds could soon tear Labour apart at the seams

- POLL OF THE DAY: Would an emergency general election restore public faith in government? VOTE NOW

By 2029-30, maintaining the policy is expected to require an additional £15.5billion compared to linking increases solely to earnings.

Demographic shifts compound these challenges, with state pension spending currently representing five per cent of GDP and projected to reach 7.7 per cent by the early 2070s.

Despite the triple lock benefiting the vast majority of older Britons, approximately 453,000 British pensioners residing overseas will not benefit from this increase.

Campaign groups have highlighted that those living in nations without reciprocal social security arrangements, such as Canada and Australia, face frozen pension rates.

LATEST DEVELOPMENTS:

What has the impact of the state pension triple lock been on the public's finances | OBR

What has the impact of the state pension triple lock been on the public's finances | OBR These expatriate pensioners receive payments fixed at the amount they first drew when emigrating from the UK.

Despite having made full National Insurance contributions during their working lives in Britain, they remain ineligible for triple lock adjustments

.A DWP spokesman said: “People move abroad for many reasons and we provide clear information on how this can impact their finances in retirement."

"The policy on the uprating of the UK state pension for recipients living overseas is a longstanding one of more than 70 years and we continue to uprate state pensions overseas where there is a legal requirement to do so."

More From GB News