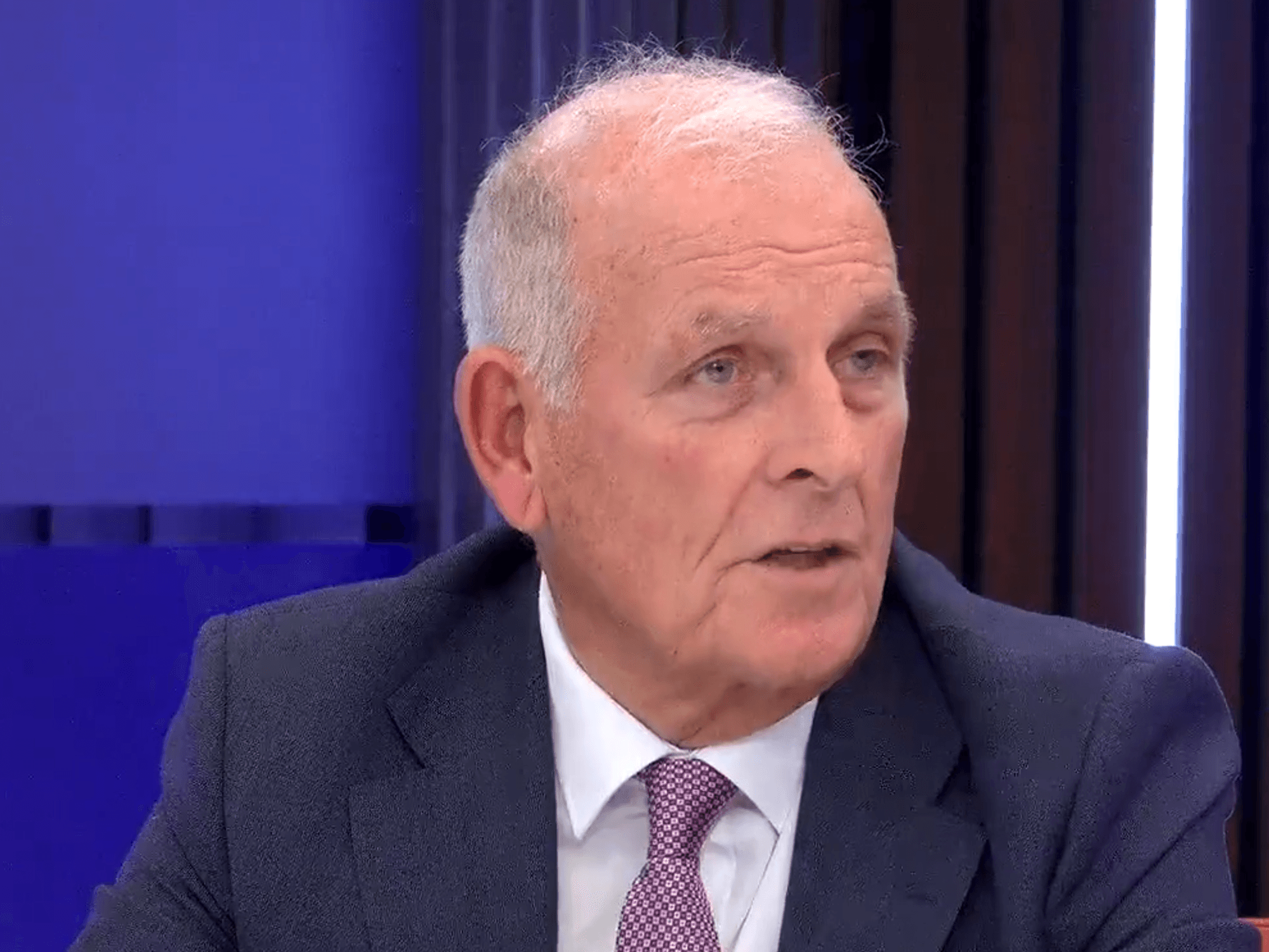

Rachel Reeves under fire as small firms hit by tax 'cliff edges'

GB News

Small firms are already feeling the pressure

Don't Miss

Most Read

The Chancellor has unveiled plans to overhaul property tax rules that penalise smaller firms expanding beyond their first premises.

Rachel Reeves announced a Treasury review of business rates regulations that impose sharp financial penalties on companies opening additional sites.

The government will scrutinise rules that strip firms of small business rates relief once they acquire a second property, unless strict conditions are met.

The reforms form part of Labour's wider commitment to reassess the entire business rates framework in response to long-running calls from industry.

A Treasury report published on Thursday set out proposals to tackle these abrupt tax increases and encourage investment.

The current system creates what officials call "cliff edges" in taxation, where businesses face sudden and steep cost increases when expanding.

Under existing regulations, companies lose their full small business rates relief entitlement as soon as they open a second site.

This immediate withdrawal of support has discouraged many small firms from pursuing growth opportunities.

The current system creates what officials call "cliff edges" in taxation, where businesses face sudden and steep cost increases when expanding.

|PA/GB News

Treasury officials said the review would explore ways to reduce these barriers and create a fairer, more gradual system.

Ministers acknowledge that the rules actively deter expansion, leaving entrepreneurs reluctant to risk heavy tax penalties.

The government wants to replace the current structure with one that supports, rather than punishes, business development.

Ms Reeves said: "Our economy isn't broken, but it does feel stuck. That's why growth is our number one mission."

Business leaders are speaking out about the rumoured tax hike from Labour | PA/GETTY

Business leaders are speaking out about the rumoured tax hike from Labour | PA/GETTY The Chancellor stressed her focus on revitalising high streets and backing small businesses.

She said: "We want to see thriving high streets and small businesses investing in their future, not held back by outdated rules or strangled by red tape."

She added: "Tax reforms such as tackling cliff-edges in business rates and making reliefs fairer are vital to driving growth."

Ms Reeves concluded: "We want to help small businesses expand to new premises and build an economy that works for, and rewards, working people."

"Until we get clarity on these changes, which isn't expected until the Budget, many local investments in jobs and stores are being held back," she said.

The British Retail Consortium welcomed the review while warning of wider problems in the system.

Chief executive Helen Dickinson described current business rates as "outdated, overly complex and economically damaging."

The sector is awaiting detail on permanent rate reductions for retail, hospitality and leisure businesses.

Ms Dickinson said: "Currently, retailers account for 5 per cent of the economy yet pay over 20 per cent of the total business rates bill, which is why such reforms are desperately needed."

She warned that uncertainty is continuing to hold back local investment.

The squeeze on SMEs look set to continue

| PA/GettyRetailers argue that the current system unfairly targets their sector.

Despite generating just 5 per cent of Britain’s economy, they shoulder more than a fifth of the nation’s total business rates.

This imbalance has long been a source of frustration for high street businesses already under pressure from online competition.

Industry leaders say the disparity is damaging investment and job creation in towns and cities.

The Chancellor’s proposed reforms offer the prospect of relief to a sector that has faced years of disproportionate taxation.