Pension disaster as retirees overcharged £100k on savings withdrawals by HMRC - are you eligible for refund?

Good Morning Britain guests clash in debate on pensioner support |

GB NEWS

Thousands of retirees could be entitled to a refund after being overtaxed on pension savings withdrawals, analysts warn

Don't Miss

Most Read

Pensioners have been wrongfully overcharged more than £100,000 when making withdrawals from their pension savings, according to shocking new HM Revenue and Customs (HMRC) figures.

British retirees have successfully reclaimed substantial sums from the tax authority after pension tax errors, with several individuals receiving repayments exceeding this lump sum.

Approximately 2,400 pensioners secured refunds above £10,000 during the 2023-24 tax year as a result of this error, with Britons being called to check if they are eligible for a payment.

The figures, obtained by Royal London via a Freedom of Information (FoI) request, expose widespread overtaxation affecting those accessing their retirement savings.

**ARE YOU READING THIS ON OUR APP? DOWNLOAD NOW FOR THE BEST GB NEWS EXPERIENCE**

Have you been overtaxed on pension withdrawals?

|GETTY

Notably, the most substantial 25 repayments averaged £106,900. Refunds stem from HMRC's emergency tax procedures applied to pension withdrawals, which have resulted in systematic overcharging since pension freedoms were introduced in 2015.

The latest HMRC data demonstrates a sharp rise in pension tax reclaim activity. Approximately 60,000 savers sought refunds during 2023-24, marking a 20 per cent increase from the previous year's 50,000 claims.

Over the period, the typical repayment reached £3,342, representing a £280 increase compared to 2022-23. Among those affected, around 11,700 retirees recovered amounts exceeding £5,000

The emergency tax mechanism assumes any pension withdrawal represents monthly income for the remainder of the tax year, resulting in excessive deductions for one-off withdrawals.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

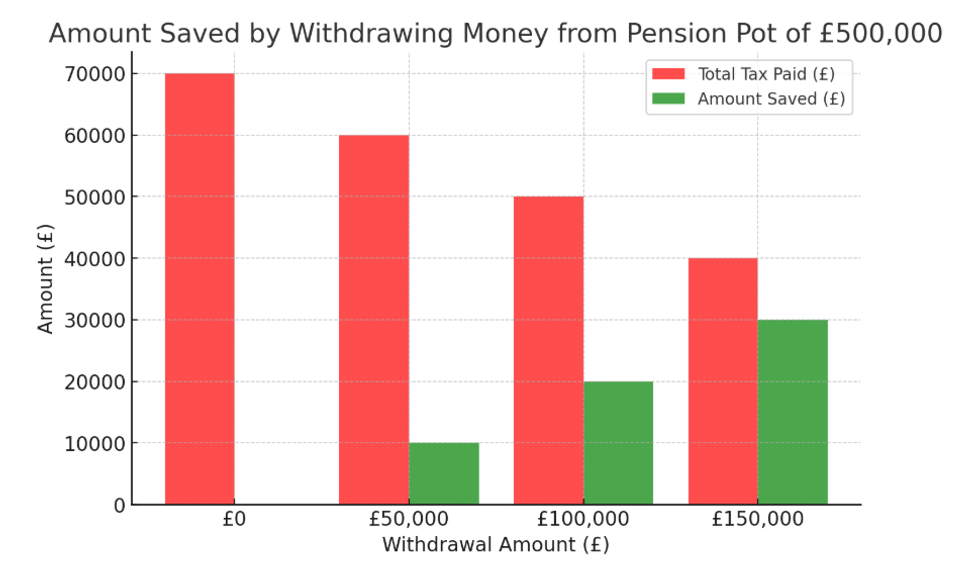

How much you could save by withdrawing money from your pension | GBN

How much you could save by withdrawing money from your pension | GBNClare Moffat, pension expert at Royal London, said: "Not only do these taxes usually come as a massive shock, the unexpected tax amount can also scupper people's carefully laid plans."

While pension freedoms allow over-55s to access 25 per cent tax-free, the remaining portion faces income tax. HMRC's emergency coding frequently miscalculates liability for those making single withdrawals.

Despite HMRC's April reforms promising faster refunds through automatic tax code updates, Moffat noted this "doesn't mean people won't still be charged the higher rate in the first place".

Concerns are mounting that forthcoming inheritance tax (IHT) reforms could exacerbate the overtaxation issue, which are due to come into effect in April 2027 under Government plans.

MEMBERSHIP:

- MAPPED: Full list of local authorities housing hotel migrants - how many are in YOUR area?

- REVEALED: The 32 seats that could parachute Nigel Farage into No10 as General Election petition hits 800k

- Think Reform has gone soft? Farage's migration blueprint will leave you eating your words - Ann Widdecombe

- REVEALED: Panic stations for Keir Starmer as migrant hotel fury sparks ballot box revenge in 20 seats

- Lucy Connolly's release is a step in the right direction, but the screws are turning – Matthew Goodwin

In last year's Autumn Budget, Chancellor Rachel Reeves unveiled major changes to the levy with pension pots and agricultural assets to now become liable for IHT which have provoked backlash.

IHT is imposed on the estates of individuals who have passed away at a rate of 40 per cent if the combined total value of their estates exceeds the £325,000 threshold.

LATEST DEVELOPMENTS:

The Chancellor has been under fire over her inheritance tax reform

| PAMoffat warned that the Government's decision to apply inheritance tax to unused pension funds from 2027 means "more and more people are considering dipping into their pension pots while they are alive" to make substantial gifts to family members.

The tax and pensions expert cautioned: "A rise in large lump-sum withdrawals will likely mean an even greater spike in emergency taxes on those withdrawals."

Since pension freedoms began in 2015, HMRC has refunded approximately £1.4 billion to overtaxed pensioners. An HMRC spokesman stated: "Ultimately, nobody overpays tax as a result of taking advantage of pension flexibility."

"We will repay anyone who pays too much because they’re on an emergency tax code and individuals can claim a repayment much earlier if they wish."

More From GB News