Pension system 'health check' calls grow as Britain faces 'retirement under-savings crisis'

Retirement analysts are concerned about a looming pension system crisis

Don't Miss

Most Read

A leading think tank and major investment firm are urging the government to embed complimentary pension "health checks" within the forthcoming pensions dashboards to help address Britain's growing retirement savings shortfall.

The Social Market Foundation, working alongside M&G, has proposed that savers accessing their pension information through dashboards should automatically receive the option of a free, tailored guidance session.

Pensions dashboards, which are already in development, will enable individuals to view all their retirement savings in a single location, providing clarity for those with multiple pots accumulated across different employers throughout their careers.

However, the SMF, a cross-party policy organisation, has warned that simply providing information will prove insufficient to resolve widespread disengagement and poor understanding of pension matters among British workers.

A leading think tank has called for pension 'health checks' to be carried out to avoid a looming retirement savings crisis

|GETTY

Research commissioned by M&G and analysed by the SMF reveals concerning gaps in pension knowledge among British workers.

An Opinium survey of 3,000 people conducted in December found that two-fifths of full-time employees with pensions have no idea how much their employer puts into their retirement fund.

The same research showed that over 43 per cent of full-time workers with pensions have never adjusted their own contribution rates.

Many employees also remain with pension savings scattered across numerous providers, the survey indicated. While bringing these pots together can sometimes reduce fees, the report noted that consolidation requires careful consideration as certain schemes may offer specific advantages.

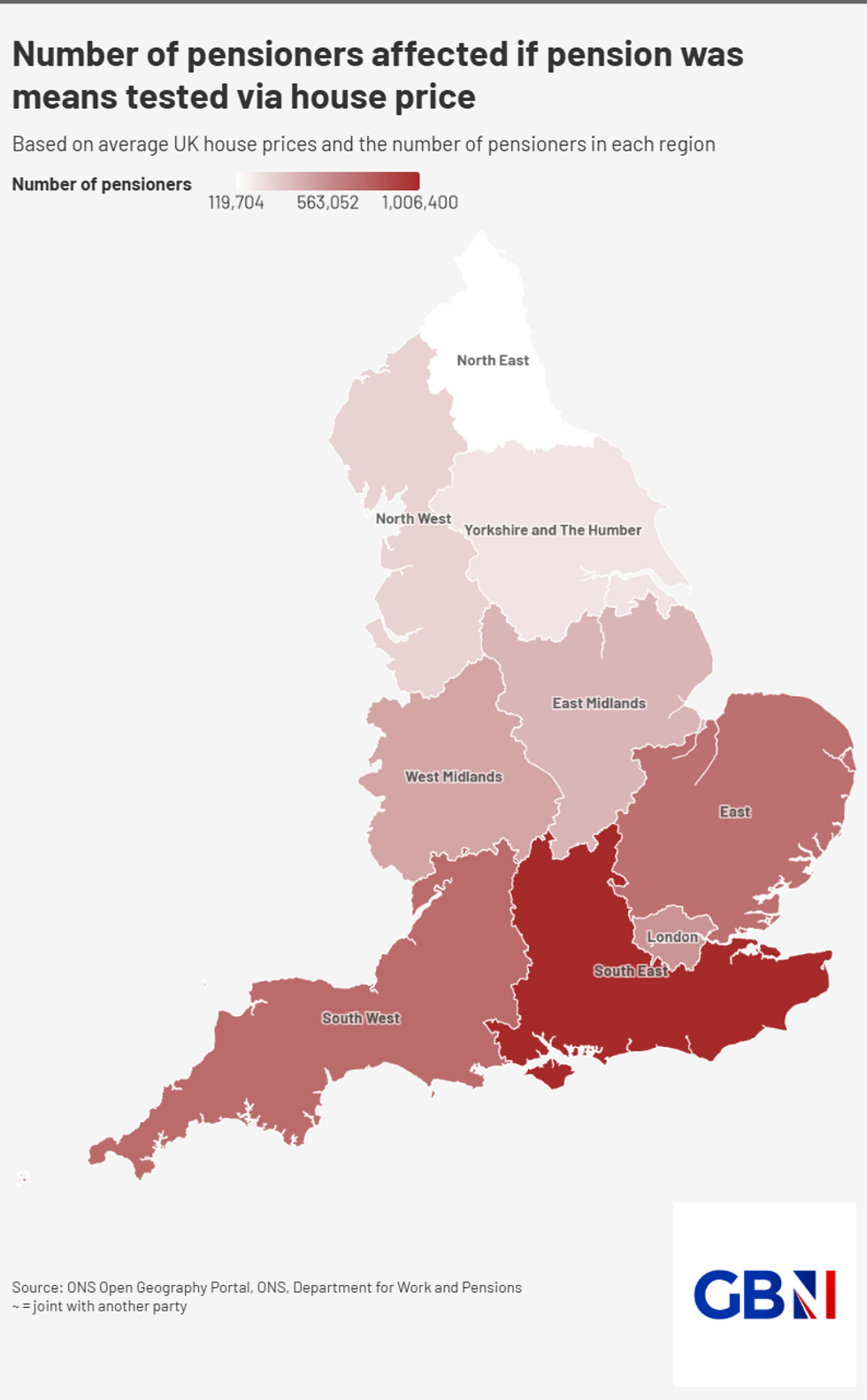

Number of pensioners affected if pension was means tested via house price | GBN

Number of pensioners affected if pension was means tested via house price | GBNThe shift from defined benefit schemes, which guarantee retirement income based on salary, towards defined contribution pensions has placed greater risk on individual savers.

The report argued that inadequate pension savings pose risks extending beyond individual savers, potentially creating substantial additional burdens on the welfare state as Britain's population ages and state pension obligations grow.

Richard Hyde, senior SMF researcher, said: "Pensions dashboards are a welcome step forward, but information on its own won't fix the problem. Millions of people are still under-saving for retirement and many barely engage with their pensions at all."

He added: "Without follow-up support, there's a real risk people see worrying figures and don't know what to do next. A pensions dashboard health check offering additional personalised guidance could help turn awareness into action."

Anusha Mittal, managing director of individual life and savings at M&G, said: "The data and research is clear we are facing into a retirement and savings crisis, fuelled by low levels of engagement and underpinned by low financial confidence."

Ms Mittal emphasised that "collective action is now necessary" and that dashboards must be "supercharged by regular pension health checks, which provide practical and accessible guidance".

The Money and Pensions Service indicated it is already exploring ways to connect dashboard users with its free guidance offerings.

Zoe Burns-Shore, executive director for customer delivery, said: "As part of our development and testing of the MoneyHelper pensions dashboard, we are exploring how we can direct people to the free and impartial guidance we offer at MoneyHelper to help them make the most of their pension."

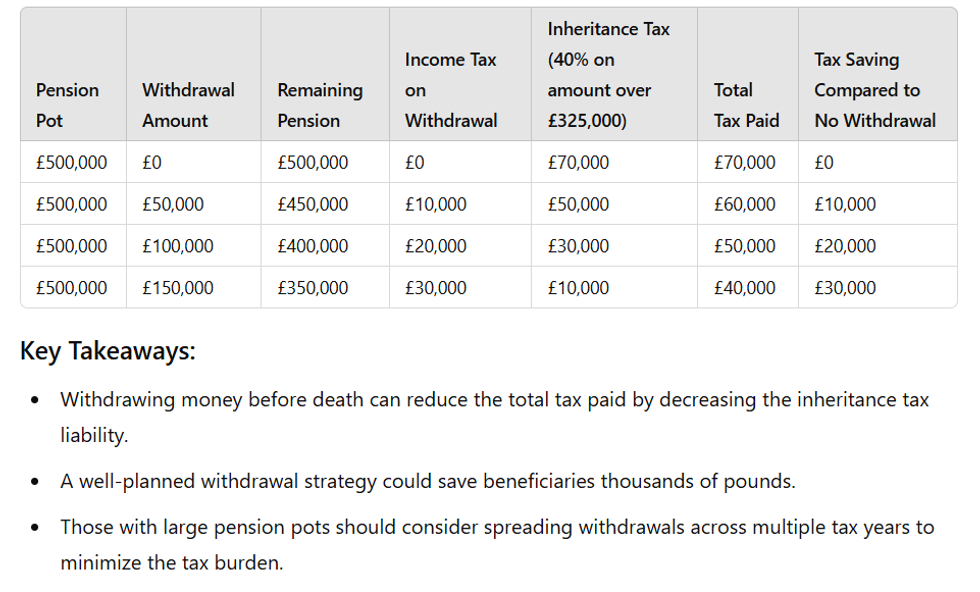

How much you could save by withdrawing money from your pension | GBN

How much you could save by withdrawing money from your pension | GBNHelen Morrissey, head of retirement analysis at Hargreaves Lansdown, highlighted the scale of the challenge, noting that data from HL's Savings and Resilience Barometer shows merely 43 per cent of households are currently on course for sufficient retirement income.

She shared: "The UK is certainly at risk of undersaving for retirement, the latest data from HL’s Savings and Resilience Barometer shows just 43 per cent of households are on track for an adequate retirement income.

"A key challenge is that people have pension pots spread across different providers and don’t have an idea of how much they have in total. Dashboards will help here but the further issue is that people don’t know what kind of income that pension pot will actually give them in retirement.

"Health checks could really help people in understanding this and you can also get some clarity by making use of some of the online tools that are available. Putting your details into an online pension calculator, like HL’s for instance, can help you to see what you are on track to save and what income that could give you."