Pension disaster as nearly 15 MILLION Britons failing to save for retirement, DWP reveals

Analysts are sounding the alarm over the lack of pension savings among the British public

Don't Miss

Most Read

Nearly 15 million working-age adults across Britain are failing to save enough for their retirement, according to damning new Department for Work and Pensions (DWP) analysis.

The figures reveal that 43 per cent of the working population, which is the equivalent to 14.6 million people, are not putting away sufficient funds to maintain their standard of living in later life.

Perhaps most striking is that this shortfall extends well beyond those on modest incomes. Among the highest earners taking home more than £67,000 annually, almost half are still projected to face a pension gap when they stop working.

The data underscores a retirement savings crisis that cuts across income brackets, leaving millions potentially facing financial hardship in their later years. Financial advisors say there are three crucial elements that determine whether someone will enjoy a secure retirement.

Some 15 million Britons are failing to save enough in their pension for retirement

|GETTY

Rob Mansfield, an independent financial advisor at Tonbridge-based Rootes Wealth Management, outlined the essential considerations while speaking to Newspage.

He shared: "Don't ignore them, it's your future. You've got three main levers to consider. How much do you need to put in, how aggressive the investments are and when you take retirement."

He emphasised that mastering these factors gives savers the strongest foundation for their later years.

"Get those three right and you give yourself the best chance of a comfortable retirement. If you don't understand the statements or if it feels like it's written in a different language, seek help, either from your scheme or from a financial advisor," Mr Mansfield added.

DWP figures suggest Britons are not saving enough for retirement

| PADespite widespread awareness of the need to address pension planning, most people in Britain continue to delay taking action.

Research from PensionBee found that while over half of respondents had given considerable thought to their retirement savings in 2025, just 17 per cent anticipated actually reviewing or boosting their contributions over the following year.

The survey of 1,000 UK adults revealed a significant disconnect between knowing and doing.

Although 52 per cent expected to make pension changes in 2026, only a fifth had concrete plans, with nearly a third yet to take any steps.

Every day financial concerns appear to be crowding out longer-term priorities. A third of respondents acknowledged that pension review simply was not a current priority, with building short-term savings, specific purchases, and managing daily expenses ranking as the top three financial goals.

Debt reduction also features prominently in people's financial thinking, with over a third making it a priority and nearly a quarter saying they would direct any spare funds towards paying down what they owe.

Meanwhile, just 14 per cent plan to focus on improving their pension, demonstrating how retirement planning consistently loses out to more pressing concerns.

Scott Gallacher, director at Leicester-based Rowley Turton, stressed the importance of acting now.

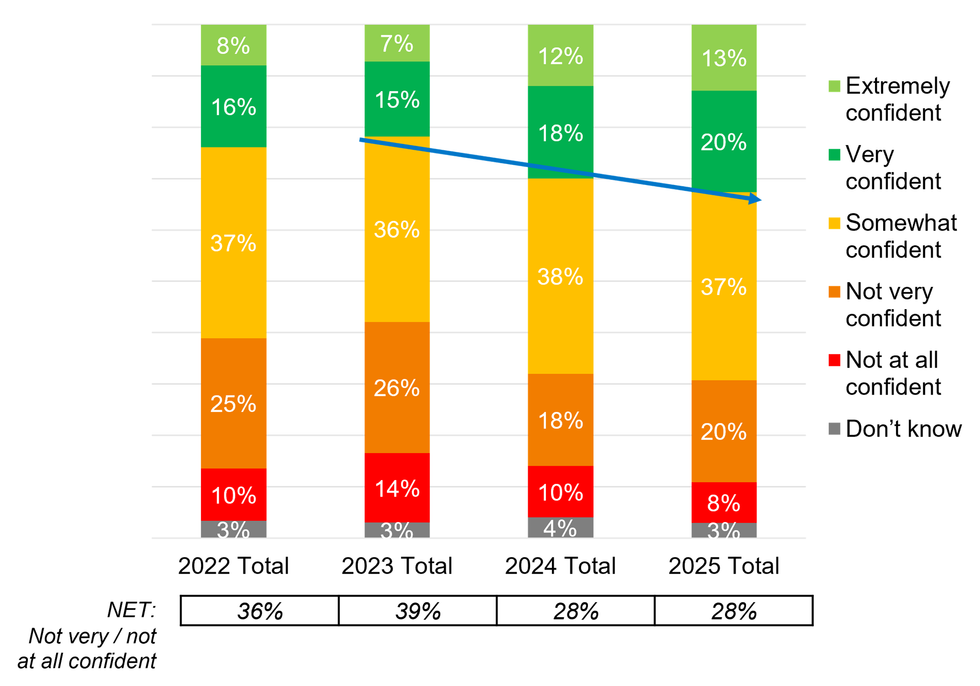

How confident are Britons about their pension savings? | AEGON

How confident are Britons about their pension savings? | AEGON "With personal allowances and income tax bands frozen, pension contributions are more important than ever in 2026, particularly for keeping people out of higher-rate tax or, worse still, the 60 per cent tax trap caused by the tapering of the personal allowance above £100,000," he said.

Samuel Mather-Holgate, managing director at Swindon-based Mather and Murray Financial, urged savers to begin as early as possible, noting that longer investment periods mean working fewer years while retiring with greater wealth.

Lisa Picardo, the chief business officer UK at PensionBee, commented: “The UK is facing a retirement savings crisis, with four-in-10, or nearly 15 million people, undersaving for retirement.

"For many, the immediate pressure of high living costs makes it difficult to prioritise the future over today’s needs, but others are left behind by structural gaps in the system. Without urgent action tomorrow’s retirees are on track to be poorer than today’s."

More From GB News