Women warned making big pension mistake in divorce could mean poorer retirement

Divorce rates are plummeting but those going through proceedings could see their pension income hit

Don't Miss

Most Read

Women are being warned about the danger of “failing to consider pension savings” when going through a divorce.

A big pension mistake is often “overlooked” by those going through divorce proceedings according to expert.

Experts are urging people to ringfence their retirement if they are going through divorce proceedings due to the impact it could have on pension income.

This warning comes shortly after the publication of new Government figures which found divorce in England and Wales has decreased by 29.5 per cent from 2021 to 2022.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

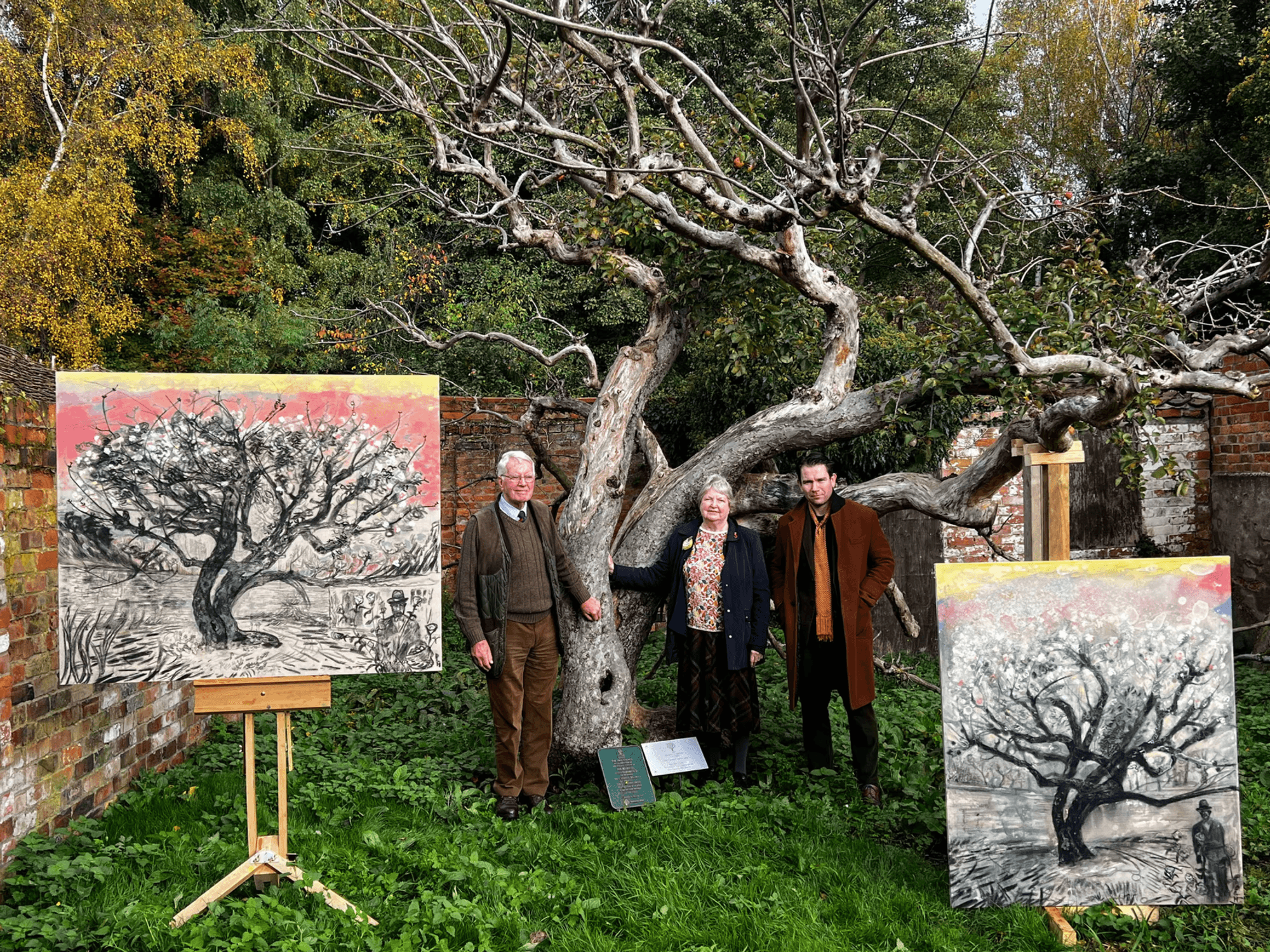

Pension savings could be hit when going through a divorce

|GETTY

Legal analysts from Charles Russell Speechlys noted the drop in the divorce rate could be contributed partially to the “financial challenges related to the cost of living crisis”.

Clare Moffat, a pensions and legal expert at Royal London, noted that a couple’s finances would already be adversely affected outside of the rise in the cost of living, with pensions being in the firing line.

She explained: “The sharp fall in divorces granted in 2022 may have been affected by the new Divorce, Dissolution and Separation Act, which introduced changes including allowing couples to end a partnership jointly, and the removal of grounds for divorce.

“Because separation is an emotionally and financially traumatic time, many aspects of a couple’s finances can be overlooked, particularly pensions.

“However, failing to consider pension savings when splitting assets during a break-up could have an enormous impact on the future financial resilience of individuals.”

Earlier this month, NOW: Pensions published its report into the gender pension gap between men and women.

The provider found that women are on average £136,000 poorer in retirement than their male counterparts.

Furthermore, if women were hoping to successfully fill the gap, they will need to work an extra 19 years to make up the difference.

LATEST DEVELOPMENTS:

Britons are increasingly concerned about their retirement income amid the cost of living crisis

| PARoyal London’s pension expert cited the disparity between the sexes when it comes to women have “lower pension pots”.

“The impact on retirement plans of a relationship ending can be particularly difficult for women who, partly due to career breaks and lower average salaries, typically build up lower pension pots,” Ms Moffat explained.

“Taking financial and legal advice on divorce is crucial. For those who aren’t married or in a civil partnership, taking legal advice at the beginning of a relationship could be important too.”

In 2022, 78,759 divorced were granted in England and Wales between men and women which is the lowest number since 1971.

This number rose to 80,507 when taking into account divorced between same sex couples, a drop from the 113,505 separations reported in 2021.