Thousands of pensioners may be entitled to tax-free £299 boost – payment due for 8 million people this month

The cost of living payment worth £299 is being paid to those eligible this month

|GETTY

Pensioners on a low income could be entitled to nearly £300 to help with the increased cost of living

Don't Miss

Most Read

Latest

Hundreds of thousands of pensioners are at risk of missing out on a one-off tax-free payment worth £299.

The payment, which is the third instalment of this financial year’s £900 cost of living payment, is being paid to eight million people this month.

The Department for Work and Pensions (DWP) said millions would begin getting the sum between yesterday and February 22.

However, hundreds of thousands of pensioners who may be entitled to the support are set to miss out.

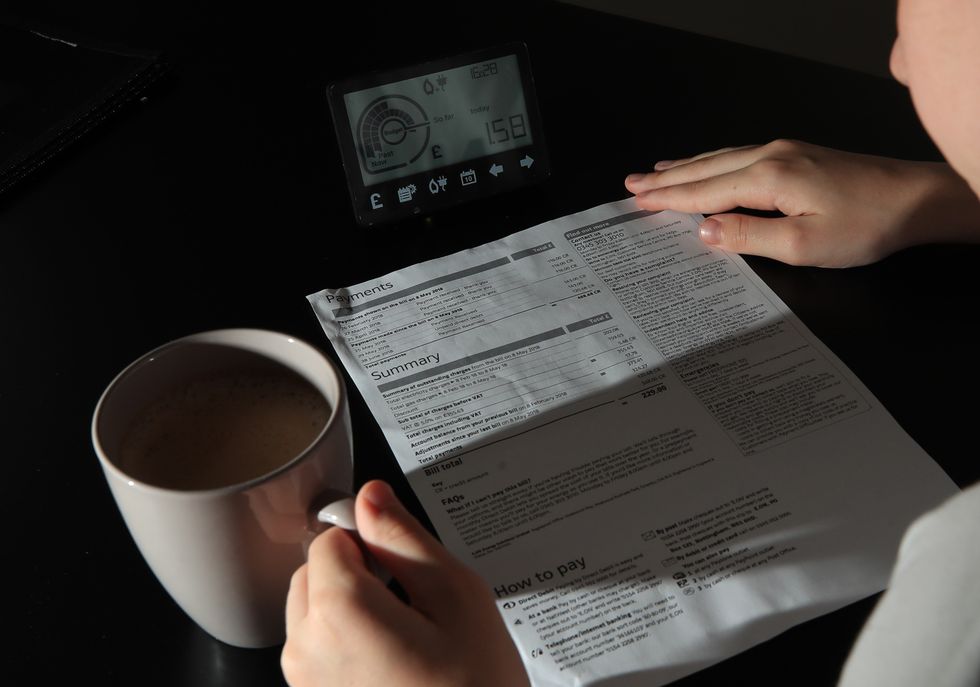

The £299 cost of living payment is intended to help those on a low income with the increased cost of living

|PA

That’s because despite being eligible for the top-up benefit Pension Credit, 880,000 households aren’t claiming it, the latest Government figures show.

To qualify for the cost of living payment, a person must have been eligible for and got one of the following benefits in a qualifying period.

- Universal Credit

- Income-based Jobseekers Allowance

- Income-related Employment and Support Allowance

- Income Support

- Working Tax Credit

- Child Tax Credit

- Pension Credit

They must have been entitled to it between November 13 and December 12, 2023, or entitled to a payment for an assessment period which ended between these dates.

To qualify via tax credits, the recipient must have got a payment of tax credits for any day in the aforementioned period.

People can become retrospectively entitled to a cost of living payment, and as Pension Credit can be backdated by up to three months, it may be low income pensioners can still get the money if they act sharpish.

The deadline for claiming Pension Credit if a person thinks they would have been entitled to it between November 13 and December 12, will therefore fall on March 12.

The DWP says households who qualify retrospectively, or believe they were entitled to the payment but didn’t get it, should report this via gov.uk from February 23.

LATEST DEVELOPMENTS:

People can check to see if they may be entitled to Pension Credit online, such as by using the Government’s Pension Credit calculator tool.

There are also a number of free and independent benefit calculators available on the internet, to help people check they are getting all of the support they are entitled to.

How to claim Pension Credit

Pension Credit can be claimed online via the Gov.uk website.

It's also possible to apply by phone, and a friend or family member can call on the claimant's behalf if they cannot use the phone.

It's also possible to apply by post. Voluntary organisations like Citizens Advice or Age UK may be able to help with the claim form.