Pension hack could boost your retirement savings by £26k 'at the cost of a Netflix subscription'

Nigel Farage explodes at 'direct attack on thrift' as Rachel Reeves mulls tax on pensioners |

GB NEWS

Researching is highlighting the pension benefits younger workers can benefit from if they opt to cut subscription services from their budget

Don't Miss

Most Read

Young workers could accumulate an additional £26,000 for their retirement by making monthly pension contributions comparable to a Netflix subscription fee, according to fresh research from Standard Life.

The financial services company's analysis reveals that Generation Z employees who marginally increase their pension payments during the current Pension Engagement Season could substantially improve their financial prospects in later life.

The study demonstrates that workers beginning their careers at 22 years old with a £25,000 salary could transform their retirement savings through minimal adjustments to their contribution rates, without significantly impacting their current lifestyle or spending habits.

Notably, the power of compound investment growth means modest monthly increases can deliver substantial returns over several decades, Standard Life's research indicates.

Cutting subscription service spending could lead to big pension savings, research suggests

|GETTY / PA

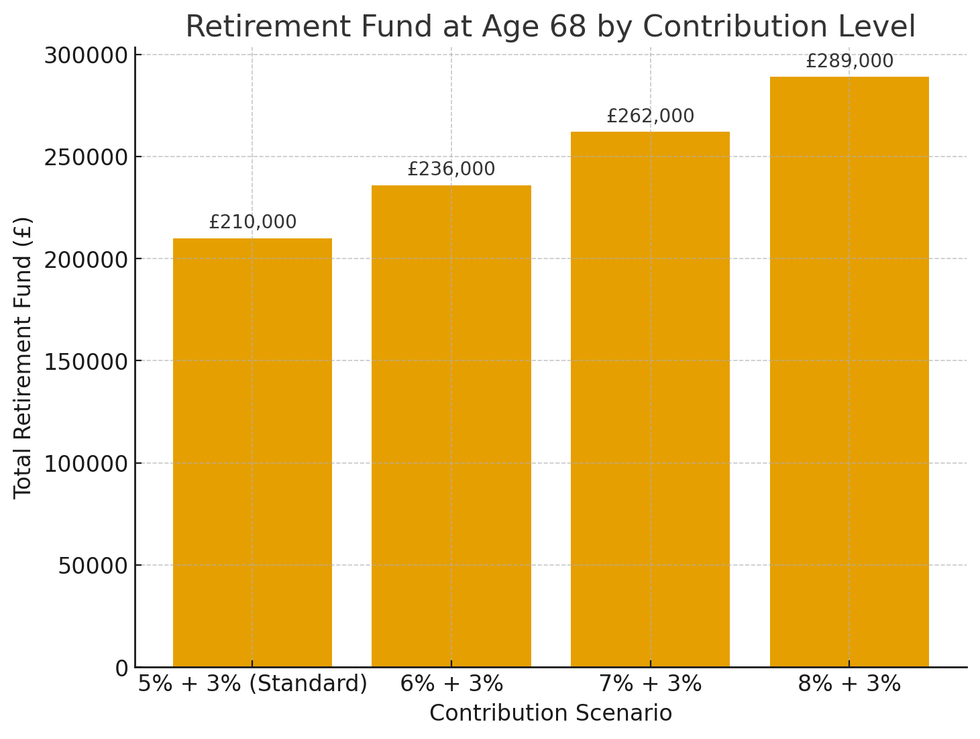

An employee contributing the standard auto-enrolment rates of five per cent from their salary plus three per cent from their employer would accumulate approximately £210,000 by retirement age 68, assuming they begin working at 22 with a starting salary of £25,000.

By raising their personal contribution to six per cent, requiring just £21 extra in their first year of employment, the same worker could retire with £236,000, adjusted for inflation.

This represents a £26,000 increase achieved through monthly payments roughly equivalent to £18.99, the price of Netflix's premium tier.

Workers who can allocate slightly larger amounts see even more dramatic results, the analysis shows.

Scrapping a streaming service subscription could result in significant long-term savings, new research has found

| PARaising contributions to seven per cent would require an extra £42 in year one , comparable to the UK's average gym membership fee of £47.24 monthly ,yet would generate a retirement fund of £262,000.

According to Standard Life's research, this represents a £52,000 increase over standard contributions.

Those able to redirect funds equivalent to Britain's typical monthly takeaway expenditure of £60 could achieve the most substantial gains.

An eight per cent contribution rate, costing an additional £63 in the first year, would create a retirement pot worth £289,000, which is £79,000 above the baseline figure.

Mike Ambery, the retirement Savings Director at Standard Life, emphasised that younger savers needn't sacrifice all enjoyment.

He shared: “While retirement may feel a long way off for younger savers, small and consistent contributions can have a powerful impact over time. You don’t need to give up all the things you enjoy – it’s about finding the balance between living for today and planning for tomorrow that works best for you.

"Redirecting a modest amount each month – even something as relatively small as the cost of a streaming subscription – could add tens of thousands to your pension by the time you retire.

"And for those able to contribute a little more, such as reallocating part of their gym or takeaway budget, the long-term benefits could be even greater.

LATEST DEVELOPMENTS:

How much can you save towards your pension by making a small sacrifice?

|CHAT GPT / STANDARD LIFE

"It’s very important to treat yourself now and then, but Pension Engagement Season is a timely opportunity to reflect in your longer-term financial priorities and consider whether small adjustments could help you build a more secure financial future.

"You don't need to give up all the things you enjoy - it's about finding the balance between living for today and planning for tomorrow that works best for you."

He recommends investigating whether employers offer contribution matching schemes, describing these as "essentially free money for your future self". Salary sacrifice arrangements could reduce National Insurance payments whilst boosting retirement funds, Mr Ambery noted.

He also suggests directing salary increases towards pensions and taking advantage of tax relief, where basic-rate taxpayers effectively pay £80 for every £100 contributed.

More From GB News