Nationwide Building Society cuts mortgage rates to 'market-leading' low - full list here

How likely is the Bank of England to cut interest rates again? |

GB NEWS

Lenders, including Nationwide, are slashing mortgage rates in a win for customers

Don't Miss

Most Read

Latest

Nationwide Building Society has confirmed plans to slash mortgage rates to a "market-leading low" in a win for prospective homebuyers across the country.

On top of the ongoing property crisis, many Britons have struggled to get on the ladder to interest rates attached to mortgage products reaching record highs.

This is primarily due to the Bank of England's decision to raise the base rate in its efforts to reign in inflation, however the cost of borrowing has fallen to four per cent in recent months.

With analysts pricing in a potential rate reduction from the central bank's Monetary Policy Committee (MPC) later this year, Nationwide is taking action to offer sub-four per cent deals to customers.

Nationwide is slashing mortgages rates

|GETTY / NATIONWIDE

Carlo Pileggi, the building society's head of Mortgage Products, broke down why homebuyers should consider Nationwide's latest offering as soon as the cuts are implemented tomorrow, November 5.

He shared: "We’re making rate cuts across the majority of our fixed rate mortgage range with a number of sub-four per cent products and a market-leading rate for home movers.

"These changes will put Nationwide firmly on the radar for all borrower types as we aim to position the country’s largest building society as one of the most competitively priced lenders in the market."

This latest move from the lender comes after it enhanced its Interest Only offering as it aims to give homeowners more flexibility.

Thanks to this move, Interest Only lending will be extended to all buyer types up to 75 per cent Loan-to-Value (LTV) or up to 85 per cent if it’s a part interest only, part capital repayment application.

Mr Pileggi added: "These changes, along with robust criteria, mean we will be able to increase the support we can provide borrowers looking for more flexibility, while ensuring Nationwide continues to lend responsibly.

"As the country’s second largest lender, it is natural that we continue to look at the products we offer, including those we make available through brokers, to ensure we can help them meet as many of their clients’ needs as possible."

The Bank of England is preparing to give its latest base rate update on Thursday, November 6.LATEST DEVELOPMENTS

Here is a full list of the upcoming cuts to mortgage rates from Nationwide Building Society, per product type:

Existing and new customers moving home products

These mortgages will see reductions of up to 0.24 per cent across two, three, five and 10-year fixed rate products up to 95 per cent LTV, including:

Two-year fixed rate at 60 per cent LTV with a £1,499 fee is 3.64 per cent (reduced by 0.16 per cent)

Three-year fixed rate at 60 per cent LTV with a £999 fee is 3.75 per cent (reduced by 0.24 per cent)

Five-year fixed rate at 60 per cent LTV with a £999 fee is 3.89 per cent (reduced by 0.10 per cent)

Two-year fixed rate at 85 per cent LTV with a £999 fee is 3.99 per cent (reduced by 0.13 per cent).

Remortgage

These mortgages will see reductions of up to 0.25 per cent across two, three, five and 10-year fixed rate products up to 95 per cent LTV, including:

Two-year fixed rate at 60 per cent LTV with a £1,499 fee is 3.79 per cent (reduced by 0.15 per cent)

Two-year fixed rate at 80 per cent LTV with a £999 fee is 4.19 per cent (reduced by 0.25 per cent)

Five-year fixed rate at 60 per cent LTV with a £999 fee is 3.89 per cent (reduced by 0.15 per cent).

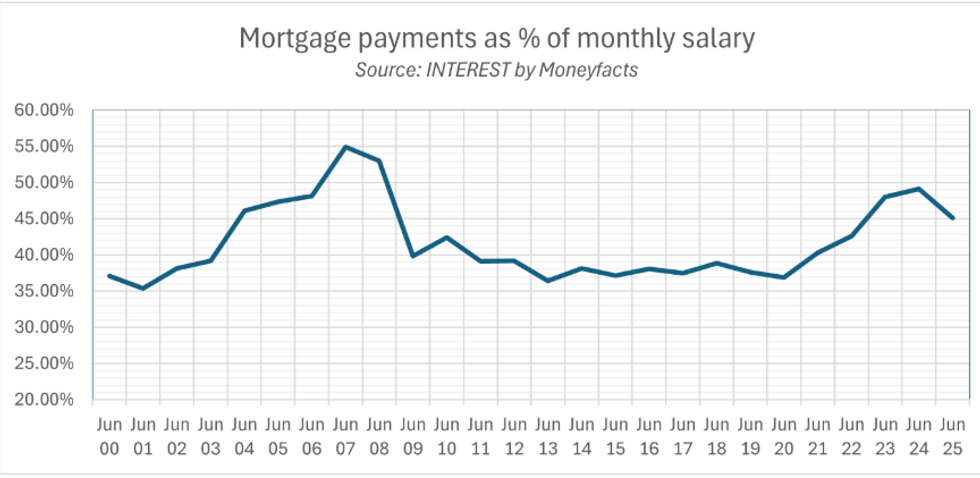

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTS

Analysis shows mortgage repayments now swallow nearly half of average earnings | INTEREST BY MONEYFACTSSwitcher

These mortgages will see reductions of up to 0.25 per cent across two, three, five and 10-year fixed rate products up to 95 per cent LTV, including:

Two-year fixed rate at 60 per cent LTV with a £999 fee is 3.79 per cent (reduced by 0.10 per cent)

Five-year fixed rate at 60 per cent LTV with a £999 fee is 3.84 per cent (reduced by 0.10 per cent)

Two-year fixed rate at 90 per cent LTV with no fee is 4.79 per cent (reduced by 0.25 per cent).

First-time buyers

These mortgages will see reductions of up to 0.17 per cent across two, three, five and 10-year fixed rate products up to 95 per cent LTV, including:

Two-year fixed rate at 60 per cent LTV with a £1,499 fee1 is 3.89 per cent (reduced by 0.10 per cent)

Two-year fixed rate at 75 per cent LTV with a £999 fee is 3.99 per cent (reduced by 0.10 per cent)

Two-year fixed rate at 85 per cent LTV with no fee is 4.34 per cent (reduced by 0.17 per cent)

Five-year fixed rate at 90 per cent LTV with a £999 fee is 4.35 per cent (reduced by 0.10 per cent).

More From GB News