Bank of England issues update for anyone with a mortgage as Rachel Reeves eyes 'distressing' new property tax

Falling mortgage rates bring relief, but tax fears leave homeowners on edge ahead of the Budget

Don't Miss

Most Read

Latest

The Bank of England has issued an update for homeowners across the UK.

It comes as speculation grows that Chancellor Rachel Reeves may target property taxes in next month’s Budget.

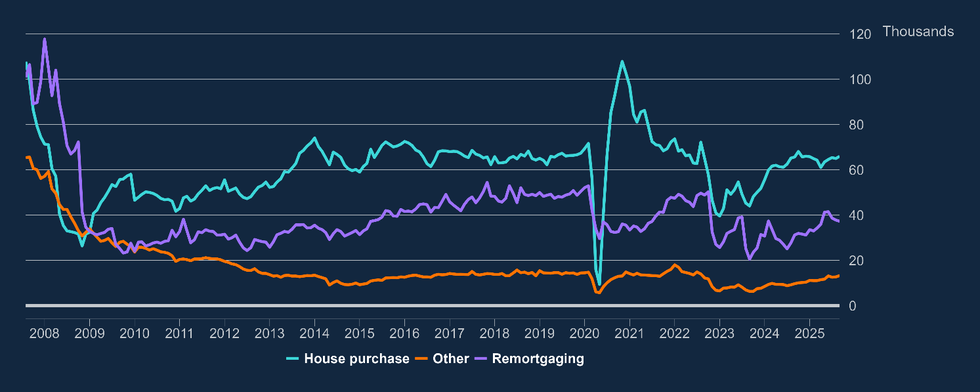

The Bank of England’s latest Money and Credit report for September shows the mortgage market is holding up, even as borrowers face continued uncertainty.

The latest figures have shown that mortgage costs for new borrowers fell to their most affordable level in almost three years in September.

The average effective interest rate on new mortgages fell to 4.19 per cent, the lowest level since January 2023.

Rates have been steadily declining since March, when borrowing costs began to ease.

The data also showed a small rise in mortgage approvals, with 65,900 new home loans agreed in September, up by 1,000 from the previous month. However, remortgage approvals with different lenders dipped slightly to 37,200.

While new borrowers are benefiting from lower rates, many homeowners coming to the end of fixed-rate deals taken out before December 2021 still face sharp increases in their monthly payments when they remortgage.

Alice Haine, Personal Finance Analyst at Bestinvest by Evelyn Partners said: "UK mortgage approvals rose in September, showing signs of resilience in the housing market despite buyer activity taking a hit amid growing speculation that Chancellor Rachel Reeves will target property taxes in her Autumn Budget on November 26.

"While new borrowers may benefit from lower rates, homeowners coming off historic low fixed-rate deals, secured before interest rates began rising in December 2021, still face a jump in monthly repayments unless they've cleared a sizeable chunk of their mortgage balance."

Ms Haine suggested that homeowners with limited equity could use any extra savings to pay down their mortgage and help offset higher costs.

Others, she said, might benefit from gradually increasing their monthly repayments ahead of remortgaging to make the transition to higher rates smoother.

Despite concerns about possible tax changes in the upcoming Budget, the housing market has shown surprising resilience.

The average rate on existing mortgages remained steady at 3.89 per cent in September, highlighting the gap between older, lower-cost deals and today’s higher borrowing rates. Net mortgage borrowing rose to £5.5billion in September, up from £4.3billion in August, meaning homeowners collectively owed £1.2billion more than the previous month, the biggest increase since March 2025.

Rachel Springall, Finance Expert at Moneyfactscompare.co.uk commented: "Regardless, there will be borrowers sitting on the fence until the Budget, and others stuck due to a short supply of affordable housing.

LATEST DEVELOPMENTS

The Bank of England’s latest Money and Credit report for September shows the mortgage market is holding up, even as borrowers face continued uncertainty

| GETTY"Depending on the area of the UK, house prices may be stretching borrowers searching for a new deal, so it’s important to try to increase their deposit or build up more equity in their home to make up the difference."

Rachel Reeves is reportedly preparing to introduce what critics have called a "dangerous" new tax targeting middle-class homeowners. The Chancellor is said to be considering a mansion tax on properties worth over £2million to help fill a £30billion gap in the public finances.

Under the plans, homeowners would pay an annual charge of one per cent on the portion of their property’s value above £2million. For example, someone owning a £3million home could face a yearly bill of £10,000.

Ms Haine warned that such a tax could be "prove impractical and costly to enforce." Sarah Coles, from wealth manager Hargreaves Lansdown, said talk of a mansion tax could cause real worry for older people, describing it as "distressing" for many retired homeowners.

Additional measures being discussed include capital gains tax on high-value primary residences, council tax restructuring and National Insurance contributions on landlords' rental income.

The uncertainty has led buyers to negotiate harder to keep purchases affordable, while sellers are increasingly realising that realistic, competitive pricing is key to securing a sale.

Ms Haine said the current caution in the market could help slow house price growth for now, especially at the higher end, which may improve affordability for some buyers.

Ms Springall added: "Over recent weeks, borrowers may be pleased to see mortgage rates have been on the downward trend, and it looks promising for more fixed rate cuts to continue due to swap rate moves (which lenders watch very closely to re-price their loans).

"Now is a great time for anyone looking for a new deal to seek advice from a broker to assess the latest options."

Rachel Reeves is facing a larger-than-expected hole in the public finances | GETTY

Rachel Reeves is facing a larger-than-expected hole in the public finances | GETTYThe end of the stamp duty relief scheme in spring, which returned thresholds to lower levels, had already pushed up costs for purchasers.

Estate agents are now reporting a drop in buyer interest and, in some cases, sales falling through as uncertainty continues to weigh on the market.

Ms Haine observed that the combination of existing stamp duty changes and potential new measures has created a climate where "buyers and sellers pause moving plans and wait to see what unfolds."

The slowdown in the housing market reflects growing nervousness over what changes the Chancellor might make to property taxes.