Mortgage affordability hits breaking point as Britons face 50-YEAR loans as repayments take up half their income

UK housing crisis Soaring rent and mortgage |

GBNEWS

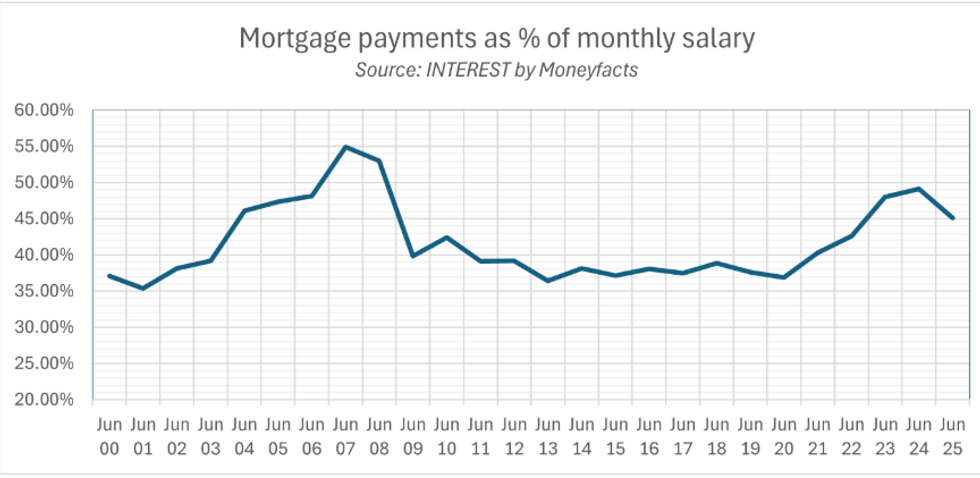

Analysis shows mortgage repayments now swallow nearly half of average earnings

Don't Miss

Most Read

Monthly mortgage repayments are eating into pay packets at levels not seen since the financial crash.

Experts are warning that some borrowers may need mortgages stretching half a century just to make them affordable.

An average earner putting down the required deposit and taking out a mortgage in the past couple of years would now see close to half of their gross salary eaten up by repayments, according to exclusive analysis from INTEREST by Moneyfacts. This marks the toughest burden since the 2008 financial crisis.

Figures underline the scale of the challenge. In June 2000, the average repayment was £499, or 37.09 per cent of monthly earnings. By June 2007, just before the crash, repayments hit £995, swallowing 54.92 per cent of pay.

After the global downturn, lower interest rates brought relief, with repayments dropping to £756 in June 2009, 39.86 per cent of wages. But costs have since surged again.

By June 2024, households were paying £1,470 a month, almost half their gross income at 49.11 per cent - the highest since 2008. A slight fall in rates eased payments to £1,416 in June 2025, yet this still represented 45.11 per cent of average earnings.

Financial experts warn that standard borrowers must now extend their mortgage terms to 50 years simply to reduce monthly payments to 35 per cent of their gross income.

Adam French, Head of News at Moneyfacts, stated: "Affordability may have eased a touch over the past 12 months, but buying a home in 2025 is still too much of a financial stretch for many.

"Putting aside the not inconsiderable tasks of affording rapidly rising rent costs and saving a sizeable deposit, monthly mortgage repayments are eating up almost half of gross earnings – the toughest burden since the 2008 financial crisis.

"Years of ultra-low borrowing costs, Government incentives and a lack of housing supply have driven house prices far ahead of wages, leaving many buyers caught between high prices, expensive borrowing and strict lending rules.

"It all means that a typical borrower today will need to take a mortgage over a 50-year term to keep their repayments to a more affordable 35 per cent of gross monthly income,"

Experts warn that standard borrowers must now extend their mortgage terms to 50 years simply to reduce monthly payments

| GETTYThe scale of Britain’s housing affordability crisis is clear when property prices are set against wage growth over the past 25 years. Analysis shows that mortgage costs are now weighing more heavily on household budgets than at any point since the financial crash.

For an average earner able to put down the required deposit in recent years, nearly half of their gross salary would be swallowed by monthly repayments.

In 2000, the typical UK house price was £78,000, around five times the average wage of £15,800. By 2025, the average property price has soared to £269,000, more than seven times the average wage of £37,600.

Over that period, wages have risen by 237 per cent, but house prices have rocketed by 345 per cent - leaving affordability stretched to breaking point.

Analysis shows mortgage repayments now swallow nearly half of average earnings

|INTEREST BY MONEYFACTS

If wages had kept pace with house prices, the average salary today would be more than £54,000.

Instead, property price inflation has far outstripped not only earnings but also the cost of everyday essentials. By the same measure, a loaf of bread would now cost £2.28 and a dozen eggs £4.73.

Even locking into one of today’s lowest two-year fixed mortgage deals at around 4.20 per cent would only ease the pressure slightly, cutting repayments by around £100 a month compared with June’s average rate of 5.12 per cent.

But the relief is limited. Even at this lower rate, repayments would still swallow about 38 per cent of gross income, a level last seen in 2018.

The property market remains at risk of swinging too far in either direction, with the outlook depending heavily on future interest rates, inflation and wage growth.

Economists are warning mortgage rates will not be 'reduced significantly' with current inflation figures

| GETTYFrench warned: "There remains an acute risk that the market could overcorrect or overheat depending on the future path of interest rates, inflation and wage growth despite a recent softening of house price growth.

"We now need a period of stability where modest house price growth allows incomes to catch up so the market can return to more sustainable levels that benefit homeowners, homebuyers and the wider economy.

"In the meantime, it may mean holding rates where they are until inflation is in check is what is needed to nip another boom-and-bust cycle in the bud."

Ultimately, despite a slight easing in rates this year, the figures show that affordability remains stretched close to crisis levels.

Until wages catch up with runaway house prices, buyers will continue to face the choice of longer loan terms or higher repayments that consume a large share of their income.

More From GB News