Homeowners in North East could see mortgage costs rise by extra £639 – how much will your region pay?

Some 1.5 million households are coming to an end of their fixed rate mortgage this year with many hoping to secure the “cheapest deal” possible

Don't Miss

Most Read

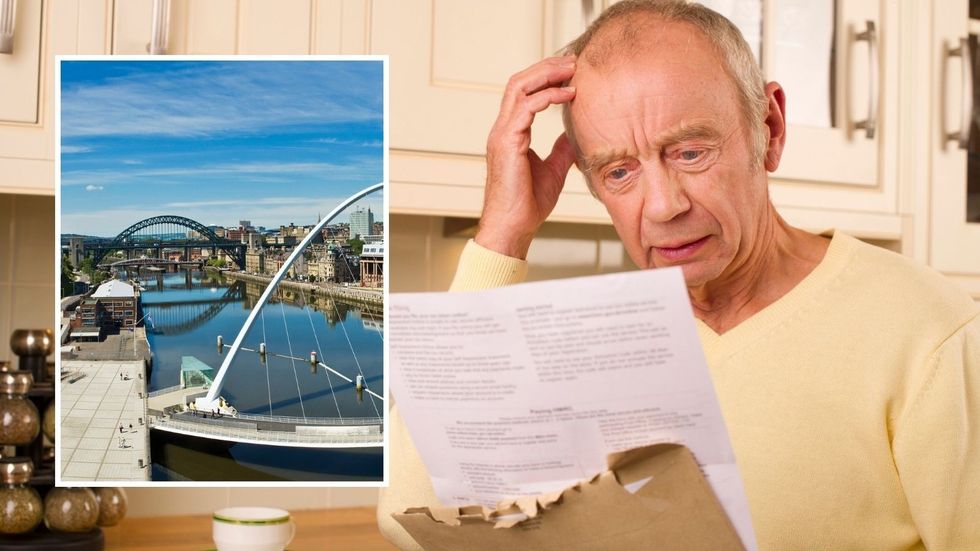

Britons are at risk of paying substantially more in mortgage costs despite falling interest rates. with households in the North East of England forking over an extra £639.

Homeowners are being reminded to get financial advice to make sure they “get the cheapest deal” when negotiating the end of their fixed rate deal.

Average mortgage rates for two-year and five-year fixed rate products have dropped for six consecutive months but experts are warning the “best rate isn’t a straightforward choice”.

This is because cheapest mortgage cost is up to £639 more expensive than the cheapest fee-free mortgage offer.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

Mortgage repayments could be raised higher if homeowners get a 'cheaper deal'

|GETTY

Research carried out by TotallyMoney found that the lowest fixed-rate deal at 4.63 per cent plus £999 fee would cost £375 more than the lowest fee-free offer over two years.

This figure accounts for the average UK property price with a 75 per cent loan-to-value (LTV) mortgage attached.

Notably, average prices in the UK are at their lowest in the North East. However, the discrepancy in cost between the cheapest mortgage cost and the cheapest fee-free mortgage offer is £639 regardless.

In comparison, residents in London could save £81 over two years on the average property priced at £505,000 if they choose the cheapest mortgage cost over the cheapest fee-free offering.

Around 1.5 million fixed rate mortgage deals are expected to come to an end later this year, which means households will be preparing to negotiate a new deal with their lender or be placed on a variable rate.

This comes as the number of homeowners in mortgage arrears has increased by seven per cent with hiked interest rates pushing repayments up.

Andrew Hagger, the founder of Moneycomms, urged customers “don’t go in blind” to negotiations with lenders to avoid paying more in mortgage repayments.

He said: “The mortgage market is a potential minefield for would-be borrowers, with thousands of products and different rate and fee combinations — if you don’t use the services of an independent broker, you can easily come unstuck.

“The best ‘rate only’ or rate plus fee combination isn’t a straightforward choice and you’ll need an expert number cruncher to make sure you get the cheapest deal for your circumstances.

“Your mortgage is the biggest financial transaction that you’re likely to make in your lifetime, so don’t go in blind otherwise you could end up paying way more than you need to in repayments.”

LATEST DEVELOPMENTS:

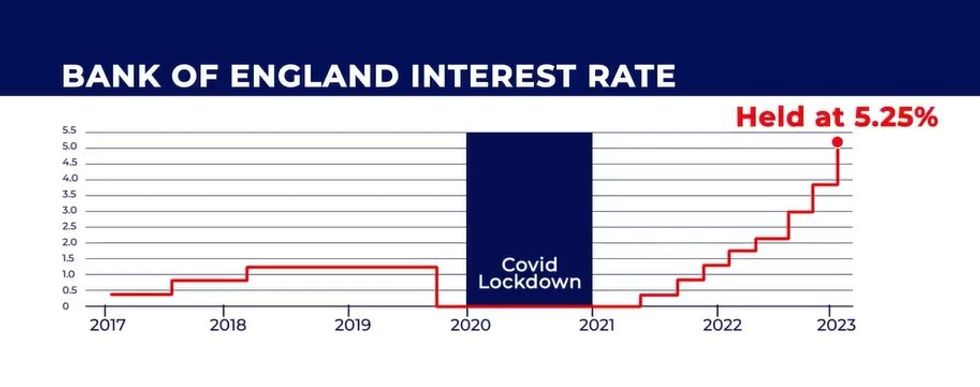

The Bank of England base rate is at a 15-year high of 5.25 per cent | GB NEWS

The Bank of England base rate is at a 15-year high of 5.25 per cent | GB NEWSHere is a breakdown of the how much each region in the UK are at risk of paying if they choose the cheapest mortgage cost rather than the cheapest fee-free mortgage offer cost, according to Moneycomms.

Region: UK

Average property price: £284,95075 per cent LTV: £213,713

Cheapest mortgage cost: £29,895

Cheapest fee-free mortgage offer cost: £29,520

Difference over two year: +£375

Region: England

Average property price: £301,613

75 per cent LTV: £226,210

Cheapest mortgage cost: £31,575

Cheapest fee-free mortgage offer cost: £31,248

Difference over two years: +£327

Region: Scotland

Average property price: £194,006

75 per cent LTV:

Cheapest mortgage cost:

Cheapest fee-free mortgage offer cost:

Difference over two year: +£591

Region: Wales

Average property price: £212,866

75 per cent LTV: £159,650

Cheapest mortgage cost: £22,575

Cheapest fee-free mortgage offer cost:

Difference over two years: +£519

Region: Northern Ireland

Average property price: £179,530

75 per cent LTV: £134,648

Cheapest mortgage cost: £19,191

Cheapest fee-free mortgage offer cost: £18,600

Difference over two years: +£591

Region: North East

Average property price: £159,871

75 per cent LTV: £119,903

Cheapest mortgage cost: £17,199

Cheapest fee-free mortgage offer cost: £16,560

Difference over two years: +£639

Region: North West

Average property price: £213,333

75 per cent LTV: £160,000

Cheapest mortgage cost: £22,623

Cheapest fee-free mortgage offer cost: £22,104

Difference over two years: +£519

Region: Yorks & Humber

Average property price: £209,526

75 per cent LTV: £157,145

Cheapest mortgage cost: £22,239

Cheapest fee-free mortgage offer cost: £21,696

Difference over two years: +£543

Region: East Midlands

Average property price: £243,577

75 per cent LTV: £182,683

Cheapest mortgage cost: £25,695

Cheapest fee-free mortgage offer cost: £25,224

Difference over two years: +£471

Region: West Midlands

Average property price: £243,655

75 per cent LTV: £182,741

Cheapest mortgage cost: £25,695

Cheapest fee-free mortgage offer cost: £25,224

Difference over two years: +£471

Region: East

Average property price: £346,659

75 per cent LTV: £259,994

Cheapest mortgage cost: £36,135

Cheapest fee-free mortgage offer cost: £35,904

Difference over two years: +£231

Region: London

Average property price: £505,283

75 per cent LTV: £378,962

Cheapest mortgage cost: £52,239

Cheapest fee-free mortgage offer cost: £52,320

Difference over two years: -£81

Region: South East

Average property price: £385,844

75 per cent LTV: £289,383

Cheapest mortgage cost: £40,119

Cheapest fee-free mortgage offer cost: £39,960

Difference over two years: +£159

Region: South West

Average property price: £319,221

75 per cent LTV: £239,416

Cheapest mortgage cost: £33,375

Cheapest fee-free mortgage offer cost: £33,072

Difference over two years: +£303.