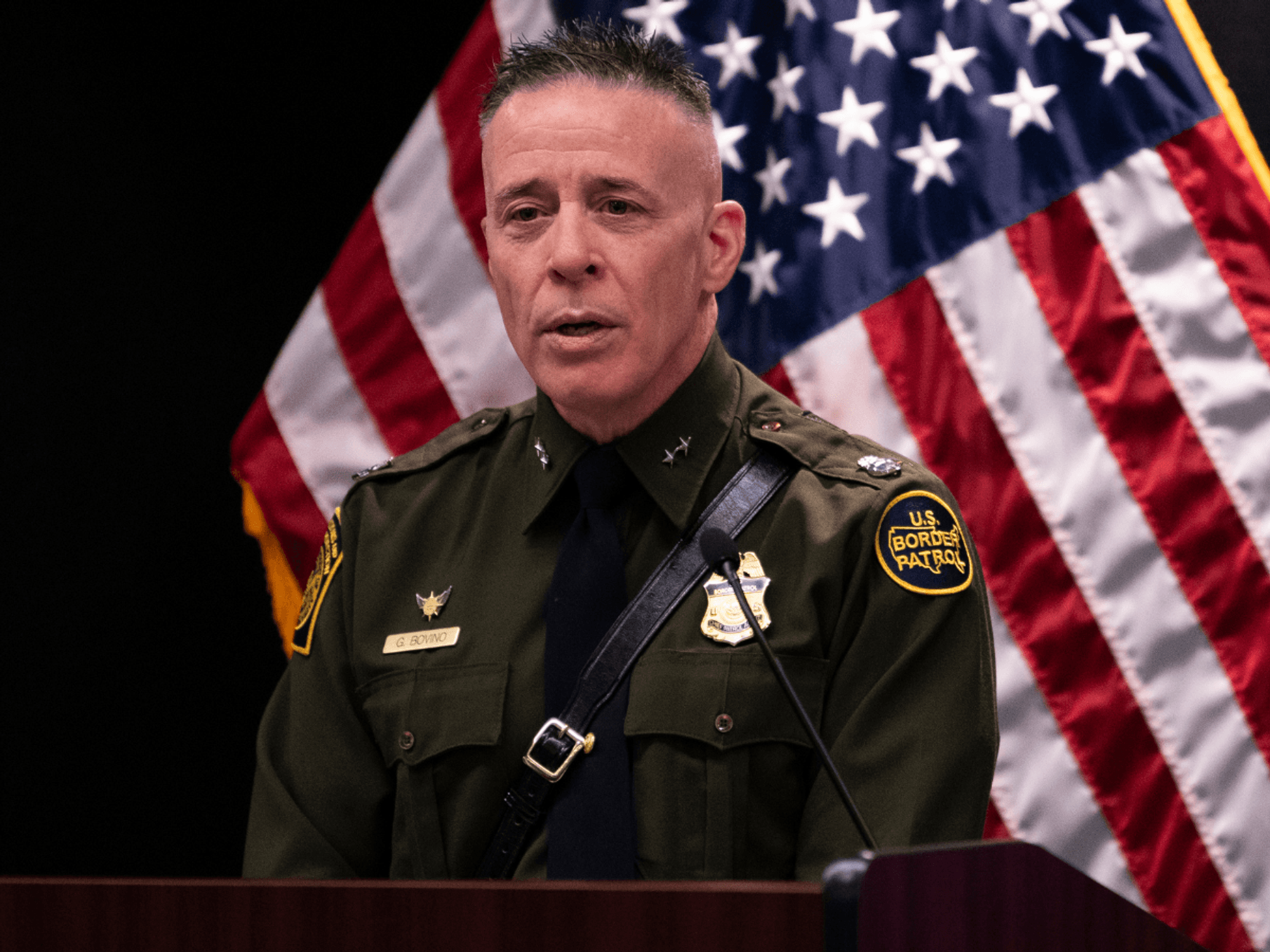

Halifax and Virgin Money launch sub-1% mortgage deal on new homes – but scheme slammed as ‘dangerous’

Mortgage rates have risen substantially in the last year with lenders, including Halifax and Virgin Money, launching new products to ease the costs on homebuyers

Don't Miss

Most Read

Latest

A mortgage product which could see homeowners pay one per cent interest on repayments initially has been slammed as “dangerous” by brokers.

Own New, which is funded by housebuilders, has launched a new Rate Reducer scheme in partnership with Virgin Money and Halifax.

Homebuyers could sign up for mortgages with only a one per cent interest rate attached on new build properties.

Initial repayments on the home are cut due to lenders investing homebuilder incentive budgets into the mortgage upfront, which are usually five per cent of the property purchase price.

Do you have a money story you’d like to share? Get in touch by emailing money@gbnews.uk.

High street lenders are offering a new mortgage deal which has been slammed as "dangerous"

|GETTY

According to Own New’s founder Eliot Darcy, the Rate Reducer product will “make homeownership open to more people” thanks to housebuilders and high street lenders collaborating together.

An example given by Virgin Money showcased how a property worth £300,000 would be offered cheaper if it is a new home.

The introductory two-year mortgage interest rate of 4.79 per cent with a £995 fee at 65 per cent loan-to-value (LTV) will be cut to 0.99 per cent at 60 per cent LTV with a £495 fee, Virgin Money claims.

However, this new offering has been criticised by brokers as being a potentially “dangerous scheme” for buyers.

Speaking to Newspage, Stephen Perkins, managing director at Yellow Brick Mortgages, warned that house prices will likely rise which will offset any benefits on a low mortgage rate.

He explained: “This is a dangerous scheme in that buyers will get used to the lower payments and when that initial product ends they will be faced with a large increase in their payments.

“The slightly quicker reduction of the capital balance will unlikely put them in a lower loan-to-value banding to offset that increase.

“Ultimately, though, like the Help to Buy scheme that preceded it, this scheme will see developers just increasing their house prices leaving the potential buyers no better off at all, whilst also sacrificing the other incentives they would have been able to secure.”

LATEST DEVELOPMENTS:

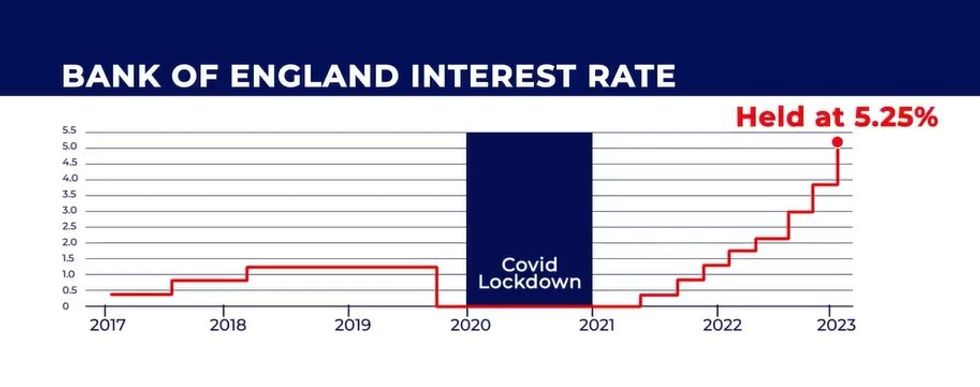

The Bank of England base rate is at a 15-year high of 5.25 per cent | GB NEWS

The Bank of England base rate is at a 15-year high of 5.25 per cent | GB NEWSResponding to criticism of the scheme, Mr Darcy claimed that brokers were “misunderstood” over the Rate Reducer’s perceived shortcomings.

Own New’s founder said: “This has been designed to prevent future affordability issues for customers, with stringent stress testing in place.

“Specially trained brokers guide them through the process and it is impossible to access this scheme without proof that the higher payment level is within affordability levels.

“The scheme is open to all brokers in the country. We would be happy to speak with the brokers quoted by Newspage to explain it more fully as some seem to have misunderstood the criteria.”